Downtown Denver Pavilions Acquisition Overview

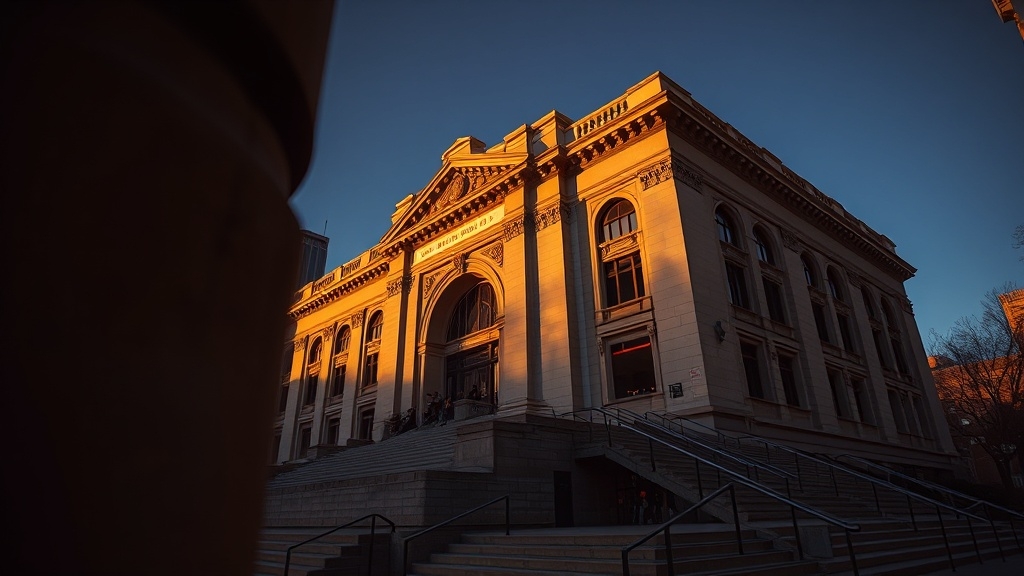

The Denver Downtown Development Authority (DDA) is steering a new path for revitalizing Downtown Denver. The acquisition of the Denver Pavilions is a pivotal step in this new strategy.

With a $37 million investment to purchase the mall, the DDA addresses the urgent need for retail revitalization. This is especially critical in an urban area affected by pandemic challenges and ongoing construction. The purchase includes connected parking lots for $23 million to unify the property, which is part of the overall strategy to enhance the site’s accessibility and appeal.

An additional $8 million is allocated for property enhancements, bringing the total investment to $45 million. The acquisition covers 350,000 square feet spanning two city blocks. Ultra-luxury real estate trends suggest that even mid-tier properties are pushing into luxury brackets, influencing broader market pricing.

The target is to significantly boost occupancy and economic activity. This strategic move aims to transform the declining retail center into a thriving mixed-use development.

The focus is on reimagining retail spaces as community hubs rather than just consumer outlets. By doing so, it sets the stage for a dynamic urban future.

City Leadership’s Role and Vision

City leadership is stepping firmly forward to steer through the complexities of Downtown Denver’s revival. Mayor Mike Johnston and the Downtown Development Authority (DDA) are employing leadership strategies that focus on strategic investments to revitalize the Denver Pavilions. The acquisition involves a retail destination covering over 350K square feet, with plans for reimagining the Pavilions with strategic improvements. This initiative aims to regain control of the area after significant decline. They are using the Union Station revitalization as a model for success.

Central to the vision is community engagement. Emphasizing the importance of local businesses to maintain economic diversity and avoid dominance by national chains. The leadership’s approach extends beyond retail. They are eyeing potential developments in housing, hotels, and mixed-use projects to bolster downtown’s residential and commercial appeal. Long-term strategic planning will create a coherent transformation. This transformation will be aligned with the Downtown Area Plan.

Redevelopment Prospects and Community Impact

Amid the ambitious plans to transform Denver’s 16th Street corridor, the potential for profound community impact takes center stage.

The redevelopment benefits are clear as major investments promise to reshape the area. These investments aim to enhance community engagement and urban living conditions.

The $176 million project not only revives infrastructure, but also aims to decrease retail vacancy rates. There is a focused effort to invigorate business activity.

Housing initiatives propose to offer more affordable, mixed-income residences. This aims to nurture a vibrant, diverse community.

Investments in small businesses and cultural spaces are designed to stimulate entrepreneurship. Such efforts also enrich the local cultural terrain.

The acquisition of the Park Hill Golf Course for parkland expands recreational spaces. This underscores the city’s dedication to sustainable urban development.

The sustained demand for multi-family housing continues to solidify its status as a resilient asset class amidst economic uncertainties.

It highlights a commitment to community well-being.

Financial Considerations and Market Context

Harnessing targeted financial strategies, Denver’s efforts to transform its downtown center around securing fiscal resources while monitoring market trends. Through public financing via the Downtown Development Authority, the city allocated $37 million for acquiring Denver Pavilions.

This approach avoids investment risks typically associated with private investors. The funding comes from tax increment financing, designed to mitigate pandemic-impacted market conditions.

Declining retail traffic, foreclosure risks, and safety concerns prompted the purchase. Denver hopes to leverage financial control in favor of local entities over national chains. The aim is to enhance downtown redevelopment.

With persistently high mortgage rates over 6%, the market includes increased rental demands preventing homeownership, which further complicates revitalization efforts.

By securing these funds, the city hopes to support revitalization efforts. Market conditions, affected by the pandemic, have resulted in decreased property values.

Prioritizing municipal investment over private, the city limits associated financial risks. This strategy anticipates downtown stabilization and economic growth.

Future redevelopment plans may include transferring ownership to local stakeholders. Such moves aim for phased risk management and continued revitalization.

Investor Concerns and Reactions

Investors are growing increasingly cautious about Denver City Hall’s bold moves in real estate. Their concerns are centered around several key areas.

Firstly, there’s the issue of hidden costs. The $2.5 million acquisition of a former Goodyear shop raises red flags over unexpected environmental cleanup expenses.

In addition, compliance with green building mandates remains an ambiguous challenge.

Furthermore, the lack of detailed planning causes unease. The unclear strategies for these properties make investors question the financial wisdom of these purchases.

The city’s actions mirror broader trends, such as the Trump administration’s regulatory and land use reforms and how they affect the real estate market.

Public funds are another point of contention. Comparisons to Monopoly-style spending spark fears of irresponsible use of taxpayer money.

This is exacerbated by worries about a lack of a clear return on investment or strategic oversight.

Lastly, there’s concern over market distortion. The city’s acquisitions could create unfair competition against private developers who face greater risks.

All these factors contribute to growing anxiety. This, in turn, impacts market confidence and stability.

Assessment

Investor apprehensions surrounding Denver City Hall’s recent acquisitions highlight a tense intersection of economic foresight and civic ambition.

While city leadership envisions revitalization and community enhancement, financial mysteries persist.

The potential redevelopment of Denver Pavilions contrasts promising urban renewal with concerns about fiscal prudence and transparency.

As stakeholders watch the unfolding saga, this acquisition plays a pivotal role in shaping downtown’s future.

It bears implications for public trust and private investment strategies in the region.

5 Responses

While I understand Denver Citys vision, isnt it the taxpayers wholl bear the brunt? It feels like nothing more than a high-stakes Monopoly game.

Why is Denver City Hall shopping like a millionaire on a spree? Isnt it time they focused more on affordable housing than acquiring pavilions?

Is Denver City Hall buying up the city just to gentrify it? Sure feels like an investor shake-down. What about the little guys? #DenverUnderSiege

Just thinking out loud here, but are we sure Denver City Hall isnt secretly planning to build a monopoly? 🤔 💭 #CityHallMonopoly

Monopoly or just smart city planning? 🏙️💡 Dont jump to conclusions. #DenverProgress