Increasing Wealth After The Pandemic Through Real Estate Investing: The Aftermath

Are you wondering how to increase wealth after the pandemic?

A primary sector for long-term investments has been the real estate sector.

During the first phase of the pandemic in 2020, most investors feared what the lockdown meant for their properties.

Well, a global pandemic seems to be the best thing to have happened to this sector.

However, for a very valid reason, it is interesting to see the market progression in 2020.

While most people started spending more time at home and with their families, they realized they needed a change.

This change involves more sustainable homes, a bigger living area, and moving out to host and live alone.

2018 raked in $14 and $17 trillion, with a mid-point of $16 trillion.

Despite a global pandemic, a recession, and an increase in the unemployment rate, revenue figures increased to a whopping $36.2 trillion in 2020.

Imagine making an investment in real estate in this current market.

Breakdown

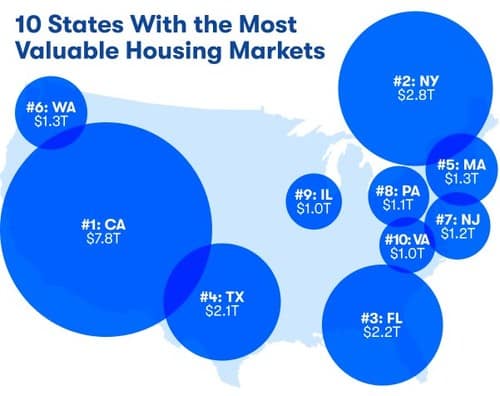

In the United States, there was a $2.5 trillion gain alone, which does not mean Americans enjoy flipping properties more than any other part of the world, although they do.

What it really means is that there’s an awakening for real estate leaving investors smiling at home.

Even better in America, during the pandemic, Americans watched hundreds of shows centered around fixing and flipping properties, interior decoration, and everybody’s favorite – Tidying Up With Marie Kondo.

The stats are very ridiculous because, for the first time since the turn of the century, there is a higher demand for houses than the supply of houses.

Check out the revenue chart below:

Image Credit: PRNewsfoto/Zillow

As developers, you could be charging even higher prices to upgrade service offerings.

These days, home builds are more sustainable because a large portion of people are now more conscious of their carbon footprint.

As housing types are modified, so is the target audience’s evolution.

The New Target Audience

The audience to focus on now is between the ages 18-35. You’d best believe that Gen-Z and Millennials are moving out.

They are morphing into first-time homeowners.

The last set includes families who enjoy flipping properties, are looking to expand, or just want to move.

The general misconception is these houses are being gifted to members of the younger generation. Not necessarily.

They are tech gurus and social media influencers. We all saw Kylie Jenner at 17 years old cut a check for her first home on reality television.

Everyone is working from home, and the dynamics and nature of living are changing. This need is a joy to a realtor and a high currency to investors.

Buying into this market could set you up for life.

Real Estate Brokers

Realtors all over the world are pegging ‘SOLD’ signs on properties all over.

They have clients who need a space and may not necessarily know the specifications of that space.

If they need a loft, what time?

If they need a condo, where?

If they need a penthouse, how high?

It is a realtor’s job to penetrate buyers’ minds and sell them this dream.

A slice of that dream takes you, the investor, to the bank smiling.

No one puts it more formally than Zillow Economist Treh Manhertz in a statement, “While many faced financial hardships because of the pandemic, others fortunate enough to maintain stable income took a step back to contemplate what they wanted their home to be and hopped on Zillow to help find a place that filled their wish list.

Builder confidence, perhaps in reaction to the boosted demand, hit record highs, and more homes are being built as a result.

Add that together and you see why the housing market gained more than in any year since the Great Recession.”

This shows real estate is big business for investors because the human need for habitation is insatiable, but is it still safe to invest in?

What The Future Holds?

Yes, it is still very safe to buy a home, and to be a developer, but even more profitable to be an investor.

Mortgage rates were at an all-time low in 2020, but with the ease of COVID-19, they seem to be going up even though the market factors still have not changed. This means that in 2021, the profitability may double.

A recent survey suggests that more than 1 in 10 Americans (10%) said they moved in the past 12 months, either by choice or circumstance.

This means even households are potential homeowners. So, the question becomes, can the market keep up?

Yes. Right now, the demand does not seem to be easing up. People are still in search of their dream homes.

More demands mean more money.

This means construction companies are charging more than usual and selling more than the norm. By extension, investors are making more money.

The median sales price of new houses sold in April 2021 was about $372,400, which is 20% higher than a year ago.

Every real estate investor is feasting, but how?

ROI in 2021

Search Google for the return of investing in real estate in 2021 and you will yield more than 800 million results. People are curious and anxious.

Those who have already invested are having a field day.

- Demand over supply – We already established this but according to FreddieMac due to housing shortage, the world needs more than 2.5 million extra housing units. More demand, more money. Owning a rental property means your returns are assured.

- Tax advantages – Landlords are legally allowed to make tax deductions through insurance, property tax, HOA fees, interest, and homeowners’ insurance. The market is crazy. Again, owning a rental property or a chain of real estate properties leaves you with a permanent smile.

- Rising home price – The average price of a home is currently $272,446. The price of a home is estimated to increase by 11.4% in the next year. The best advice right now is to own a rental property, as many as possible.

What next for this sector?

The next logical step is not just investing but recognizing the next steps of the market. In terms of architecture, whatever architectural company meets the needs of the growing target audience will control the largest piece of the pie in the market share.

For now, the biggest need of the target audience is green buildings beyond solar panels.

Not only is real estate a primary sector for investment post-pandemic, but it is also the assurance of profitability.

Real estate investment is tangible, safe, and profitable and will ultimately rule market share on investment ventures.

No related posts.