Key Takeaways

- America’s worsening affordability crisis is fueling a nationwide surge in squatting, putting investors and landlords at serious financial risk.

- Weak property laws and overloaded eviction systems are leaving investors trapped in drawn-out battles with unauthorized occupants.

- Strategic property management and legal readiness are now essential defenses for maintaining portfolio cash flow and preventing major losses.

America’s affordability crisis is spiraling into a nationwide squatter epidemic that is destroying investor portfolios and threatening the future of ownership itself.

How did the U.S. housing market become a battlefield between owners and occupiers?

Why are squatters winning legal protection while investors lose control of their properties?

What can you do right now to defend your investments before it is too late?

-

The shocking data behind America’s 2025 housing affordability collapse.

-

How weak laws and local inaction are fueling the squatter surge.

-

What smart investors are doing to safeguard cash flow and property control.

Here is how this crisis exploded and the critical steps you need to take before your next tenant becomes an unexpected squatter.

When Ownership Meets Occupation: The New War Between Investors and the Desperate

Do you know the growing squatter vigilance to own your property from underneath you?

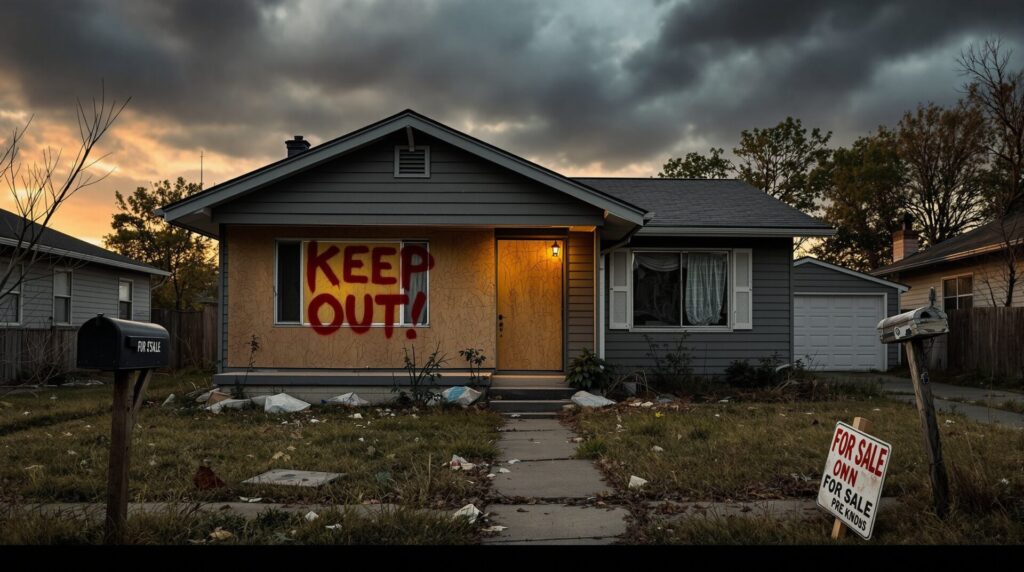

Real estate investors are waking up to a new threat that feels more like a full-scale operation than mere nuisance.

With housing affordability spiraling out of control across the United States, squatters are increasingly seeing unoccupied properties not as abandoned real estate but as accessible opportunity.

Meanwhile, landlords and owners are caught in standoffs that threaten cash flow, property values, and the integrity of entire portfolios.

The Housing Affordability Collapse That Created the Breach

In 2025 the scale of the affordability crisis is staggering. The National Association of Home Builders reports that 74.9% of U.S. households cannot afford a median-priced new home priced around $459,826.

The Harvard Joint Center for Housing Studies found that home prices are up roughly 60% nationwide since 2019 and still rising at an annual rate of about 3.9% in early 2025. (https://jchs.harvard.edu)

The median home value in the U.S. is now approximately $363,932, and average monthly rent is near $1,979.

Mortgage rates remain elevated, above 6 percent in many markets, keeping ownership out of reach for many would-be buyers. (https://fanniemae.com)

The combination of high prices, steep rates, and suppressed wages has left millions of households locked out of the housing market and pushed them toward alternative survival strategies.

The door is opening for squatting and unauthorized occupation.

Investors Are Stacking Up Exposure While the Crisis Deepens

As affordability collapses for average households, investors have stepped up their activity.

In Q2 2025, investors accounted for 33% of all single-family home purchases nationwide, a five-year high. (https://prnewswire.com)

At the same time, the U.S. investor-owned single-family housing stock now numbers around 17.2 million properties, putting roughly one in five single-family homes in the U.S. under investor ownership. (https://thekeys2prosperity.com)

What does this mean for standoffs with squatters?

Investor-owned properties often include units that are vacant, lightly managed, or held for future lease or flip.

They represent prime targets for occupancy without authorization, especially in markets where the local economy, enforcement, or policing of property rights is weak.

The Squatter Threat: Unseen, Unbudgeted, Unruly

For owners and landlords the risk scenarios are increasingly alarming:

-

Properties sit vacant while the market waits for values to appreciate or repairs to be completed. That vacancy invites unauthorized entry.

-

Local governments under budget stress and tenant-friendly laws slow eviction and removal.

-

Squatters armed with minimal financial resources see the logic of occupying inaccessible properties in neighborhoods where ownership is priced out.

-

The culture of desperation spawned by long-term wage stagnation and rising housing costs undercuts conventional deterrence.

While hard national data on squatting is limited, investor sources report a sharp uptick in “unlawful occupancy” incidents in markets with high vacancy, weak enforcement, and affordability stress.

These standoffs drain legal budgets, increase vacancy time, reduce NOI (net operating income), and threaten cap rate assumptions.

Rising Court Battles Over Property Control Reveal the Hidden Scale of America’s Squatter Surge

The surge in unlawful occupancy and eviction-related cases over the past two decades reveals how deeply the affordability crisis has destabilized property control in the United States.

While direct nationwide data on squatter court cases is limited, eviction and adverse possession filings provide a clear picture of growing tension between property owners and occupants.

The following table highlights the most reliable proxy data available from 2000 to 2025, exposing the scale and acceleration of this silent legal war:

| Year or period | Metric | Value | Geography | Why this is a useful proxy | Source |

|---|---|---|---|---|---|

| 2000 to 2016 | Eviction filings, cumulative | 58,000,000 filings total across the period | United States | Establishes long-run scale of court actions to remove occupants. | Eviction Lab |

| 2000 to 2016 | Avg eviction filing rate | Roughly 1 filing per 17 renter households per year | United States | Normalizes filings to renter population, indicating steady legal displacement pressure. | Eviction Lab |

| 2020 | Eviction filings vs normal | About 65 percent below average, 1.55 million fewer cases than typical | United States, modeled from tracked sites | Pandemic moratoria and aid sharply reduced filings, showing policy sensitivity of occupancy disputes. | Eviction Lab |

| 2021 | Eviction filings vs normal | Ended the year more than one third below normal | Eviction Lab tracked sites | Filings remained suppressed post-moratoria most of the year, then began rising. | Eviction Lab |

| 2022 | Eviction filings, annual | Nearly 970,000 cases across ETS sites, up 78.6 percent vs 2021 | 32 tracked cities | Strong rebound in court activity related to removals of occupants. | Eviction Lab |

| 2023 to 2024 | Filing levels in many locations | Many sites trending at or above pre-pandemic averages under new baseline methodology | Multiple counties and cities | Indicates renewed or elevated pressure to remove occupants via courts. | Eviction Lab |

| 2024 | City example, Phoenix AZ | 86,946 filings, filing rate 14.3 percent, a record | Phoenix, AZ | Illustrates extreme local pressure where affordability is tight and investor activity is high. | Eviction Lab |

| 2024 to 2025 | National tracked trend | ETS dashboard shows monthly filings across all locations with counts and vs baseline views | Eviction Lab tracked sites | Best current, frequently updated view of post-pandemic filing momentum. | Eviction Lab |

| 2010 context | Comparison benchmark | Roughly one million foreclosures completed at crisis peak, comparable to annual tenant evictions | United States | Context for magnitude of removals relative to other property displacement. | Eviction Lab |

| 2024 | Federal crime reporting coverage | Over 14 million offenses reported in UCR for 2024 with wide agency coverage via NIBRS | United States | Confirms robust national reporting infrastructure that can be used to study trespass-type offenses alongside housing data. | Federal Bureau of Investigation |

| 1960 to 2015 | Adverse possession mentions in case law | About 5,046 cases referenced in Westlaw, ~92 per year on average | United States | Long-run signal that title disputes from occupation persist in courts, though much rarer than eviction filings. | Center For Rural Affairs |

Notes for use

• Eviction filings are the closest national, time-series legal metric of forced removal of occupants from property. They do not equal “squatter” cases, but they measure the volume of court actions to regain possession and track policy and affordability shifts very well. Eviction Lab

• Pandemic-era policy sharply reduced filings in 2020 and 2021, then filings rebounded in 2022 and in many places have been running at or above pre-pandemic averages through 2024 and into 2025. Eviction Lab+3Eviction Lab+3Eviction Lab+3

• City examples like Phoenix help ground the national story with concrete counts where affordability stress and court throughput are high. Eviction Lab

Legal and Regulatory Weaknesses: The Perfect Storm for Unauthorized Occupation

Property owners are confronted with a fragmented regulatory environment.

Some states allow adverse possession claims under certain conditions, and eviction timelines for unauthorized occupants vary widely by jurisdiction.

Local code enforcement and policing often prioritize other issues over squatting.

At the same time, land-use restrictions and a shortage of affordable supply, estimated at 3 to 4 million units, prevent faster market relief.

Investors therefore face a double bind. Less affordable housing means more potential squatters, and weaker enforcement means more time and money to restore control.

The result is an increased risk of extended property downtime and unexpected legal cost overruns.

Regions and Markets on High Alert

Certain metro areas present glaring red flags:

-

Coastal and large urban counties where typical homeownership expenses consume over 70 percent of average local wages, including Los Angeles, Orange County, and San Diego. (https://attomdata.com)

-

Sun Belt markets and legacy industrial towns where investors are active and vacancy rates are creeping up.

-

States like California where investor-owned homes are concentrated. Nearly 19 percent of homes in California are investor-owned, boosting the inventory of high-risk properties. (theguardian.com)

Any investor portfolio with exposure in these markets must treat squatting risk as a real factor.

Real Investor Stories: When the Siege Begins

Consider the investor who bought a single-family rental, left it vacant pending repairs, and returned months later to find unauthorized occupants claiming tenancy.

Legal removal dragged for six months, rental income vanished, and damage added thousands more in cost. That scenario is increasingly common.

Beyond lost rent, these standoffs erode investor confidence, inflate management costs, and force premature exits from properties.

The cap rates that looked safe on acquisition now include a hidden component of squatter-risk premium.

Cash Flow, Cap Rates, and Portfolio Risk: The Fallout

From a portfolio perspective, the implications are serious:

-

Extended vacancy plus damage reduces NOI and pushes down internal rate of return (IRR).

-

Unbudgeted legal and remediation costs shrink cash flow margins and squeeze profits for small-scale investors.

-

Market perception shifts. If the risk of unauthorized occupancy becomes more widely recognized, cap rates may widen or value compression may begin in affected markets.

-

Insurance gaps. Many standard landlord policies may not cover deliberate unauthorized occupancy or “squatter damage,” leaving losses uninsured.

The Investor Protection Playbook

Investors must shift into defensive posture now:

-

Audit your portfolio for vacancy risk. Identify properties that are unoccupied, under-managed, or in enforcement-weak jurisdictions.

-

Implement active property management. Rapid marketing, secure physical access, frequent inspections, and minimal vacancy are essential.

-

Review lease and occupancy agreements. Ensure unauthorized occupancy triggers swift remedy and that the property is held to strict vacancy criteria.

-

Legal readiness. Keep counsel on standby in states with known squatting issues and understand the timeframes and costs for removal.

-

Insurance review. Check for exclusions related to unauthorized occupants and ensure policies cover damage outside of standard vandalism.

-

Portfolio diversification. Reduce concentration in high-risk markets and spread exposure across geographies with stronger property rights protections and enforcement.

The Larger Implication for the Real Estate Industry

This emerging squatter exposure represents a systemic risk for investors and the broader market.

As affordability pressures mount and investor ownership climbs, a mismatch between property rights enforcement and economic desperation creates a latent threat environment.

If left unchecked, this may depress valuations, widen yields, and shift investor sentiment toward markets with safer regulatory frameworks.

The Siege Must Be Prepared For

In 2025 the affordability crisis is no longer just about buyers being priced out. It is now about properties being seized by default and portfolios being placed at risk.

Real estate investors must recognize that the rise of squatting is not a fringe issue.

It is a direct consequence of housing unaffordability, weak enforcement, and high investor exposure.

Act now to fortify your assets and adjust your risk models for the new reality.