Key Takeaways

- The US-Venezuela conflict acts as a multiplier on property ownership costs rather than a direct price driver.

- Insurance, energy, and construction inputs transmit geopolitical risk into monthly expenses.

- Investors who underwrite ownership costs instead of headline prices are better positioned for the next phase of the market.

The US Venezuela conflict is not a foreign policy story for real estate investors. It is an ownership cost story hiding in plain sight.

What if the rising cost of owning property in the United States has less to do with local housing policy and more to do with global risk moving through insurance markets, energy prices, and construction supply chains?

Most owners blame inflation.

Others blame the Federal Reserve. Few realize how geopolitical tension in the Americas quietly multiplies the expenses that make ownership harder every single year.

Here is what this article breaks down, step by step:

- How Caribbean shipping risk and insurance repricing flow directly into homeowners insurance premiums.

- Why energy volatility tied to Venezuela keeps mortgage rates, maintenance, and utilities elevated.

- Which US housing markets are most exposed, and why the pressure shows up unevenly.

Once you see how these hidden forces connect, the recent jump in ownership costs stops looking random and starts looking structural.

Foreign Conflict Can Become Domestic Ownership Cost Without Noticing

The statement “US Venezuela Conflict Quietly Raising Property Ownership Cost” does not describe a new tax, a sudden law, or a line item added to a mortgage statement.

It describes something far less visible and far more persistent.

It describes how geopolitical risk in the Western Hemisphere becomes embedded inside the everyday expenses that define whether property ownership is affordable or not in the United States.

As of late December 2025, tensions between the United States and Venezuela have moved beyond diplomatic signaling and into sustained economic and logistical friction.

Sanctions, naval posturing, shipping insurance changes, and oil market volatility are no longer hypothetical.

They are active forces shaping costs across global supply chains. The effect on US housing is indirect, but the economic logic connecting these events is well established.

This article does not argue that Venezuela is single-handedly driving US housing inflation.

It explains how the conflict functions as a multiplier.

It raises the cost of insurance, construction materials, energy, and borrowing, and those inputs flow directly into the total cost of owning property.

The effect is quiet because it hides inside broader inflation metrics and operational expenses that homeowners and investors already struggle to track.

Understanding this mechanism matters because the next phase of the US housing market will not be decided by headline prices alone. It will be decided by ownership math. Monthly carrying costs.

Replacement cost assumptions. Insurance renewals. Maintenance budgets. Debt service. This is where global risk now shows up.

The Verdict: True in Function, Indirect in Cause

There is no government index labeled “Venezuela Risk Premium on US Housing.”

There does not need to be one. Economic systems transmit risk through inputs, not labels.

The US-Venezuela conflict does not directly tax homeowners. It does not rewrite mortgage contracts.

What it does is increase the cost of the things that make ownership possible.

Insurance.

Materials.

Energy.

Debt.

Each of these components is sensitive to geopolitical instability in the Americas.

The claim that the conflict is “quietly raising the cost of owning property” is accurate in function and indirect in cause.

The costs do not appear overnight.

They accumulate.

They arrive through renewals, repricing, and revised assumptions.

They are blamed on inflation, on insurers, on contractors, on the Federal Reserve. The underlying driver remains unseen by most consumers.

This distinction matters. Investors who misread the source of cost pressure misjudge its durability. Temporary price spikes fade. Structural input inflation does not.

Insurance Markets Absorbing Caribbean Risk

The Caribbean Corridor as a Cost Transmission Channel

The most direct factual link between the US-Venezuela conflict and US housing costs runs through the Caribbean Sea.

A significant portion of construction materials, aggregates, cement, and refined petroleum products bound for the United States pass through Caribbean shipping lanes. These routes sit adjacent to Venezuelan territorial waters and regional naval activity.

As of late 2025, heightened tensions in the region have led maritime insurers to apply war risk premiums to vessels transiting these corridors. These premiums are not political statements. They are actuarial responses to elevated perceived risk.

When insurers raise rates on ships, shipping companies pass those costs forward. Importers pass them again. Eventually, they arrive at US ports embedded in material prices.

This mechanism is documented, repeatable, and historically consistent. Shipping insurance is one of the first markets to react to regional instability. It does not wait for open conflict. It prices risk.

Replacement Cost Inflation and Homeowners Insurance

For property owners, the consequence of higher material prices is not limited to new construction. It flows directly into replacement cost estimates. Insurance carriers determine premiums based on what it would cost to rebuild a structure at current prices.

When cement, lumber, asphalt, and petroleum-based products rise in price, replacement cost estimates rise with them.

Homeowners insurance premiums follow.

This happens quietly.

A policy renewal arrives with a higher annual premium. The explanation references replacement cost updates, regional risk, or reinsurance adjustments. The geopolitical source of the cost increase remains invisible to the policyholder.

In markets already under insurance stress, this effect compounds. South Florida is the clearest example. Hurricane exposure already pushed premiums higher.

Caribbean shipping risk adds another layer. The result is insurance super-inflation that raises monthly ownership costs even for fully paid-off homes.

Energy Volatility Feeding Housing Costs

Venezuela’s Role in Global Oil Markets

Venezuela holds the largest proven oil reserves in the world, dominated by heavy crude. While the United States does not rely directly on Venezuelan oil imports, global oil markets do not function in isolation. Disruptions, sanctions, or blockades affecting Venezuelan supply alter global pricing expectations.

Heavy crude matters. It is a key input for asphalt, roofing products, industrial fuels, and many petrochemicals. When access to heavy crude tightens, refiners must source alternatives at higher cost. Those costs ripple through energy markets.

As of late 2025, oil markets have priced in sustained volatility linked to geopolitical risk in the Americas. Volatility does not need to result in permanent shortages to affect housing. It only needs to keep prices unstable enough to feed inflation metrics.

Interest Rates and Debt Service Pressure

Energy prices are a core component of inflation. When energy remains volatile, central banks face pressure to keep policy rates higher for longer. This dynamic affects housing through borrowing costs.

For new buyers, elevated mortgage rates increase monthly payments. For existing owners, adjustable-rate mortgages and home equity lines of credit reprice upward. For investors, debt service coverage ratios tighten.

The connection between the US-Venezuela conflict and mortgage rates is indirect but real. Energy volatility influences inflation expectations. Inflation expectations influence monetary policy. Monetary policy determines borrowing costs.

This chain does not appear on a loan estimate. It appears in the difference between a manageable payment and an unworkable one.

Maintenance and Operational Costs

Energy prices also affect the cost of maintaining property. Tradespeople rely on fuel. Delivery trucks rely on diesel. Petroleum-based products are embedded in roofing, siding, piping, flooring, and coatings.

When energy remains expensive, maintenance costs remain elevated. This is especially relevant for older housing stock and rental properties where deferred maintenance becomes unavoidable. Owners face higher operating expenses regardless of whether property values rise.

Migration Pressure and Fiscal Spillover

Migration as an Analytical Vector

Migration is the most debated component of the Venezuela effect on US housing. It is also the most localized. Continued instability in Venezuela has contributed to sustained migration flows into the United States, often concentrated in specific metros.

Markets such as Miami, Houston, New York City, and Chicago have absorbed significant numbers of Venezuelan migrants. The immediate housing impact is increased demand for rental units, particularly at the lower end of the market.

In isolation, rising demand benefits property owners through higher rents and occupancy. The cost impact emerges through fiscal channels.

Municipal Strain and Property Taxes

Rapid population growth strains municipal services. Schools, emergency services, shelters, and public infrastructure require funding. Cities facing sudden demand often respond through budget adjustments that eventually reach property owners.

Property taxes do not rise immediately. They rise after budget cycles, assessments, and political processes play out. This delay contributes to the “quiet” nature of the cost increase. Owners experience higher tax bills years after the initial migration surge.

In sanctuary cities and major metros, this dynamic is already visible. Temporary spending measures evolve into structural obligations. Property taxes and fees follow.

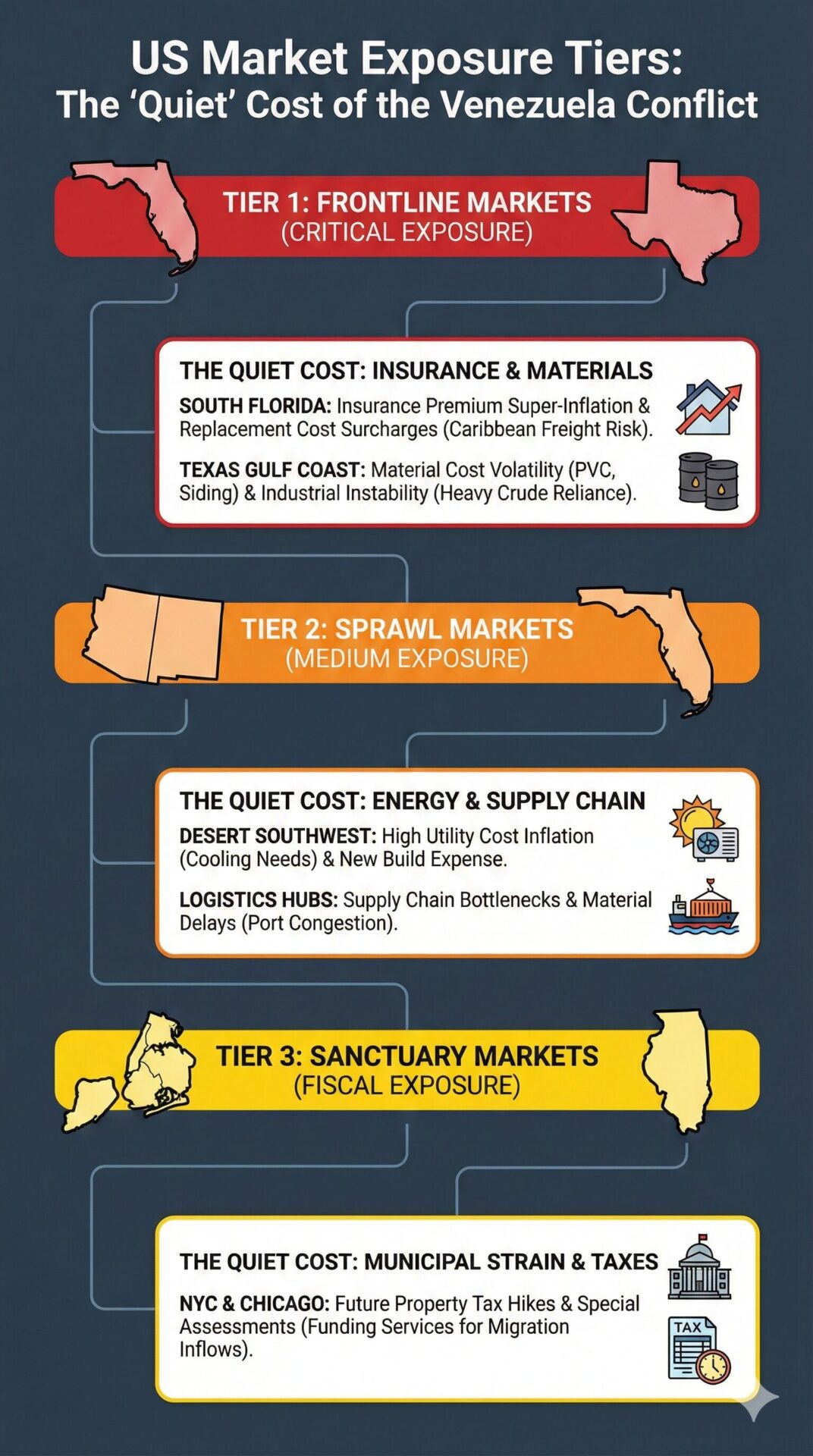

Visualizing How Geopolitical Risk Transmits into Local Insurance, Energy, and Tax Burdens by Region

The financial pressure from the US-Venezuela conflict does not hit every US housing market equally. This framework categorizes regions based on their primary exposure vector—from immediate insurance and material spikes in frontline markets like South Florida to delayed fiscal strain in sanctuary metros like NYC. Investors should use this map to identify whether their portfolios face immediate operational cost increases or long-term tax risks.

Market Exposure Tiers Across the United States

Tier 1: Frontline Markets with High Exposure

South Florida

South Florida faces the most concentrated exposure to the US-Venezuela conflict. It sits at the intersection of Caribbean shipping, insurance vulnerability, and migration inflows.

Insurance premiums in the region have already risen sharply due to climate risk. Replacement cost inflation driven by material prices adds further pressure. Migration demand keeps rental markets tight, supporting values but straining municipal services.

The result is rising ownership costs that do not depend on home price appreciation. Even stable or declining prices do not offset higher insurance and tax burdens.

Texas Gulf Coast

The Texas Gulf Coast is exposed through energy and industrial channels. Refineries in the region are configured to process heavy crude.

Disruptions in heavy crude supply create volatility in refining margins and employment.

Petroleum-based building products become more expensive.

Asphalt, PVC, vinyl siding, and roofing materials see price swings. New construction costs rise unexpectedly, slowing development and supporting existing home prices.

Owners face higher maintenance and renovation costs even as demand fluctuates.

Tier 2: Sprawl Markets with Medium Exposure

Desert Southwest

Markets such as Phoenix and Las Vegas are sensitive to energy inflation. Cooling costs represent a significant portion of ownership expenses. When energy prices remain high, utility bills rise.

These markets also rely heavily on new construction. Petroleum-derived materials are embedded in roads, roofs, plumbing, and infrastructure. When oil prices rise, development costs increase.

Builders respond by keeping prices elevated or delaying projects.

Ownership costs rise through utilities and construction even when demand softens.

Logistics Hubs

Cities such as Jacksonville, Savannah, and Charleston function as alternative ports when Caribbean lanes face congestion or increased inspection.

While this activity creates jobs, it also creates supply chain bottlenecks.

Delayed shipments of lumber, steel, and aggregates stall construction projects. Inventory remains constrained. Prices stay elevated.

Owners benefit from supply scarcity while paying more for materials and services.

Tier 3: Sanctuary Markets with Fiscal Exposure

New York City and Chicago

Large metros absorbing migration face fiscal exposure rather than supply chain exposure. Short-term spending on shelter and services creates long-term budget gaps.

Property owners ultimately fund these gaps. Taxes and fees rise. The effect is delayed and quiet. It does not correlate directly with property values.

For investors, this means underwriting must account for future tax risk, not just current assessments.

Market Exposure Tiers Across the United States

| Market Region | Exposure Level | Primary Exposure Vector | Quiet Ownership Cost Impact |

|---|---|---|---|

| South Florida | High | Shipping disruption, insurance repricing, migration inflow | Accelerated homeowners insurance premium increases, higher replacement cost estimates, elevated risk of future property tax adjustments |

| Texas Gulf Coast | High | Energy volatility, petroleum-based materials | Volatile construction and renovation costs, higher pricing for asphalt, roofing, PVC, and industrial maintenance |

| Phoenix and Las Vegas | Medium | Energy inflation, construction dependency | Rising utility expenses, sustained new construction pricing despite softer demand |

| Logistics Hubs | Medium | Supply chain rerouting and congestion | Project delays, material delivery surcharges, constrained housing inventory |

| New York City and Chicago | Fiscal | Migration-driven municipal strain | Long-term risk of higher property taxes, special assessments, and service-related fees |

Data Notes and Methodology

- Exposure levels are categorized based on observed economic sensitivity to insurance markets, energy pricing, construction supply chains, and municipal fiscal strain as of late December 2025.

- Shipping and insurance impacts are derived from documented maritime war risk premium practices and regional shipping lane exposure in the Caribbean corridor.

- Energy-related exposure reflects oil price volatility effects on inflation, construction inputs, utilities, and borrowing costs rather than direct fuel consumption alone.

- Migration-related fiscal exposure is based on public budget disclosures, emergency spending reports, and municipal service strain trends in major US cities.

- This table represents an analytical framework, not a predictive guarantee. It identifies cost pressure pathways rather than exact dollar impacts and should be used for underwriting and risk evaluation purposes only.

Building Materials Under Pressure

Heavy Crude Dependent Materials

Asphalt shingles, roofing products, vinyl siding, PVC piping, and many paints are derived from heavy crude or petrochemical processes.

When heavy crude supply tightens or becomes more expensive, manufacturers raise prices incrementally.

Roofing products are particularly sensitive. Price increases often appear monthly rather than annually. Owners planning renovations face higher costs simply by waiting.

PVC and vinyl products experience resin volatility. Quotes carry short validity periods. Contractors build risk premiums into bids.

Caribbean Logistics Dependent Materials

Cement and concrete are heavy, low-margin products. Shipping costs represent a meaningful portion of their final price. War risk premiums and fuel surcharges increase landed costs.

Foundation work, driveways, and additions become more expensive. Builders add contingency buffers. Owners pay more without seeing a direct explanation.

Tile and stone imports also face logistics exposure. Affordable, investor-grade materials often route through affected hubs. Delays and surcharges become common.

Diesel-Driven Universal Costs

Lumber and drywall are not oil-based, but they are fuel-intensive to transport. When diesel prices rise, delivery costs rise. Big-box retailers adjust pricing quietly through shelf updates and delivery fees.

Owners experience higher costs without clear attribution.

Strategic Implications for Investors

Underwriting Ownership Costs

The US-Venezuela conflict reinforces a broader shift in real estate analysis. Price is no longer the primary variable. Ownership cost is.

Investors must stress test insurance renewals, utility expenses, maintenance budgets, and tax trajectories. Deals that pencil on purchase price alone fail under operating reality.

Renovation Timing and Material Strategy

Locking material pricing early reduces exposure to volatility. Delayed renovations carry cost risk. Substituting materials less sensitive to oil markets can stabilize budgets.

Fiber cement siding may compete with vinyl. Alternative roofing materials may offer cost predictability. Flexibility matters.

Asset Selection and Market Choice

Existing assets benefit from supply friction. New construction faces unpredictable input costs. Markets with layered exposure require higher risk premiums.

Capital is flowing toward stability. Stability now includes predictable operating costs, not just tenant demand.

Assessment

The US Venezuela conflict is not a headline housing story. It is a structural cost story.

It does not raise property prices directly. It raises the cost of owning property by increasing insurance premiums, sustaining energy inflation, complicating construction logistics, and straining municipal budgets in migration hubs.

These costs are quiet.

They are embedded.

They arrive through renewals, repricing, and revised assumptions.

Homeowners blame inflation. Investors blame insurers. The underlying driver remains largely unseen.

This makes the effect more durable, not less. Structural input inflation persists until risk dissipates. As of late 2025, geopolitical risk in the Americas remains elevated.

For property owners and investors, the implication is clear.

Ownership math must account for global risk, even when that risk originates outside US borders.