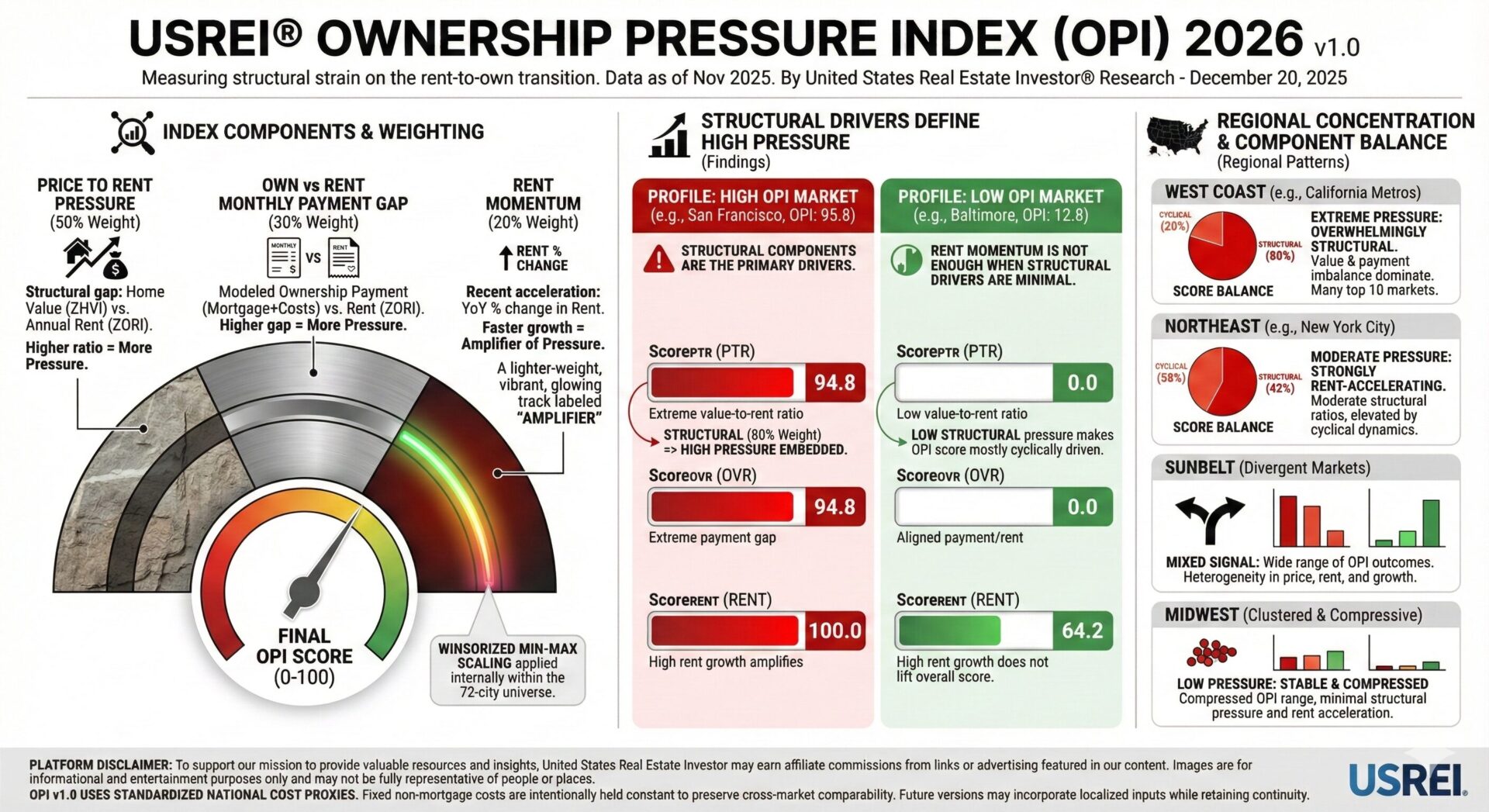

USREI® Ownership Pressure Index (OPI) 2026 v1.0 provided by United States Real Estate Investor® Research

Disclaimer on National Cost Proxies Used in OPI v1.0: USREI® Ownership Pressure Index v1.0 uses standardized national proxies for property taxes and homeowners insurance rather than localized state, county, or city-specific figures. This approach was intentionally chosen to preserve consistent, city-level comparability across all included markets and to ensure a complete, reproducible dataset without introducing uneven data availability or definition drift. By holding non-mortgage ownership costs constant in v1.0, the index isolates price, rent, financing, and rent momentum pressures as the primary drivers of ownership strain. Future versions of the index may incorporate localized tax and insurance inputs while retaining the same core formulas, scoring logic, and weighting structure to maintain continuity across releases.

Key Takeaways

- Ownership Pressure Is Structurally Concentrated at the Top of the Ranking: OPI 2026 v1.0 shows that the highest-ranked markets are defined by extreme structural imbalance rather than by rent growth alone. Cities at the top of the index consistently post Price to Rent Pressure and Own vs Rent Monthly Payment Gap scores near the upper normalization bound, often above 90. This indicates that, under fixed underwriting assumptions, both value-to-rent ratios and modeled ownership payments relative to rent are materially elevated compared to the rest of the city universe.

- Rent Growth Alone Does Not Produce High Ownership Pressure: Markets with elevated Rent Momentum scores do not rank highly unless structural components are also elevated. Several cities post Rent Momentum scores above 40 or even above 60 while remaining in the lower third of the OPI ranking because their Price to Rent Pressure and Own vs Rent Monthly Payment Gap scores remain low. The data shows that rent acceleration acts as an amplifier, not a primary driver, within the v1.0 weighting framework.

- Relative Rank Reflects Component Balance More Than Absolute Price Levels: OPI scores are driven by the normalized balance of components within the 72-city universe, not by absolute home prices or rent levels. Lower-cost markets can rank higher than more expensive markets if their value-to-rent and payment-to-rent relationships are more compressed, while higher-priced markets can rank lower if structural ratios are aligned. The index, therefore, reflects relative ownership pressure as defined by component interaction, not nominal affordability or price scale.

What the USREI Ownership Pressure Index (OPI) 2026 Measures

The USREI® Ownership Pressure Index (OPI) 2026 v1.0 quantifies the structural difficulty of transitioning from renting to owning a single-family home at the city level under a fixed, nationally standardized underwriting framework.

The index measures ownership pressure using three normalized components derived from Zillow city-level data: Price to Rent Pressure, Own vs Rent Monthly Payment Gap, and Rent Momentum. Each component is calculated using the same assumptions across all markets and then combined into a single 0 to 100 score, where higher values indicate greater ownership pressure.

OPI does not measure price growth, affordability in isolation, or investor returns. Instead, it measures the relationship between asset values and local rents, the modeled monthly cost of ownership relative to rent, and recent rent acceleration.

For example, San Francisco ranks first overall with an OPI score of 95.8, driven by extreme Price to Rent Pressure at 94.8, an equally elevated Own vs Rent Monthly Payment Gap of 94.8, and the highest Rent Momentum score in the dataset at 100.0.

At the opposite end, Fort Wayne posts an OPI score of 5.3, reflecting low price-to-rent ratios, minimal ownership payment gaps, and flat rent momentum within the same standardized framework.

All scores are calculated using Zillow Home Value Index city-level typical home values, and Zillow Observed Rent Index city-level typical rents as of November 2025. Ownership costs are modeled using a fixed 20 percent down payment, a 30-year fixed mortgage, and nationalized proxies for property tax, insurance, and maintenance.

This design isolates market structure rather than local policy, income variation, or financing access differences.

Why Ownership Pressure Matters Heading Into 2026

The OPI 2026 results show that ownership pressure is not evenly distributed across U.S. housing markets. The highest pressure scores are concentrated in coastal California and select technology and supply-constrained metros, while many Midwestern and interior Southern markets register materially lower pressure despite rising rents.

This divergence reflects differences in price-to-rent alignment and ownership payment gaps rather than short-term volatility.

Several large metros demonstrate moderate overall OPI scores that mask different underlying drivers. New York City ranks 15th with an OPI of 61.3, combining mid-range price to rent pressure at 55.7 with one of the highest Rent Momentum scores in the dataset at 83.6.

Chicago ranks 23rd with an OPI of 39.9, where balanced price-to-rent ratios and ownership payment gaps coincide with moderate rent momentum. In contrast, cities such as Detroit and Baltimore post low Price to Rent and Own vs Rent scores of 0.0 but elevated Rent Momentum scores above 60, producing mid-teens overall OPI readings driven almost entirely by renter side pressure.

By holding underwriting assumptions constant and scoring all cities within the same normalization bands, OPI 2026 isolates where ownership strain is structurally embedded versus where it is emerging through rent dynamics alone.

The index establishes a comparable baseline for understanding how ownership pressure is distributed nationally as the market enters 2026, without embedding forecasts, behavioral assumptions, or policy expectations into the results.

Place yourself ahead of the game with United States Real Estate Investor® Research.

Index Purpose

Defining Ownership Pressure in Practical Terms

Ownership pressure, as defined in OPI 2026 v1.0, is the combined effect of (1) how far home values sit above local rent levels, (2) how large the modeled monthly ownership payment is relative to rent under fixed underwriting assumptions, and (3) how quickly rents are changing year over year.

This definition is operationalized through three component scores that are each normalized to a 0 to 100 scale across the included city universe and then weighted into the final OPI score.

The index treats ownership pressure as a composite condition that can be high for different reasons. In OPI 2026 v1.0, each city’s final score is built from:

- Price to Rent Pressure (50% weight): ZHVI divided by annualized ZORI (12 × ZORI), scored so higher ratios produce higher pressure scores.

- Own vs Rent Monthly Payment Gap (30% weight): a modeled Owner Monthly payment (mortgage plus fixed proxies for tax, insurance, and maintenance) divided by ZORI, scored so higher ownership-to-rent ratios produce higher pressure scores.

- Rent Momentum (20% weight): year over year percent change in ZORI, scored so faster rent growth produces higher pressure scores.

Because each component is normalized within the same market set, the OPI score is designed for cross market comparison under a consistent framework, not for estimating household specific outcomes.

Who the Index Is Built For

OPI 2026 v1.0 is built for readers who need a standardized, city to city view of ownership pressure that is anchored to the same data definitions and the same underwriting assumptions in every market. The intended use is comparative: identifying where ownership pressure is concentrated and how the components differ across markets.

In practical terms, the index is structured to support:

- City level comparison across a fixed universe: the output is a ranked list from highest pressure to lowest pressure using a single scoring system.

- Component level attribution: each city includes pre scored component values (Score_PTR, Score_OVR, Score_RentYoY) so the OPI score can be read as a weighted combination rather than a black box.

- Consistent underwriting and cost treatment: all markets use the same down payment, term, interest rate, and nationalized cost proxies to prevent assumption drift across cities.

How OPI Differs From Affordability and Price Indexes

OPI is not a price index and does not report a single series such as median sales price, listing price, or percent change over time. It also does not function as an income based affordability metric, because v1.0 does not incorporate household income, debt ratios, or credit constraints.

Instead, OPI measures pressure using ratios and growth rates that connect values to rents and model a standardized ownership payment relative to rent.

The distinction is visible in how the index is constructed:

- A price index would track values over time. OPI uses the value level (ZHVI) to compute two ownership pressure ratios, then normalizes them.

- An affordability index typically compares payments to income. OPI compares modeled ownership payments to rent (Own vs Rent Monthly Payment Gap) and compares values to annual rent (Price to Rent Pressure).

- A rent index would track rent levels or rent changes. OPI includes rent growth only as one component (Rent Momentum at 20% weight), and only after normalization within the same city set.

To make the scoring comparable, each component is winsorized to the 5th and 95th percentile within the included market universe and then min max scaled to 0 to 100. The final OPI score is the weighted average of the three component scores, preserving a consistent interpretation across all ranked cities.

Methodology Summary

Data Sources and Market Coverage

OPI 2026 v1.0 is built from two city-level series for each included market, both anchored to the same month for comparability:

- ZHVI (home value anchor): Zillow Home Value Index, City geography, all homes, middle tier, smoothed, seasonally adjusted, as of 2025-11-30.

- ZORI (rent anchor): Zillow Observed Rent Index, City geography, all homes, smoothed, as of 2025-11-30.

The published v1.0 output includes 72 ranked cities with pre-scored component values and final OPI scores. The scoring universe for normalization is the included 72-city set, meaning all percentile bands and 0 to 100 scaling are computed within this universe only.

Core Assumptions Locked for v1.0

OPI 2026 v1.0 applies one standardized ownership cost and financing structure to every city so results reflect market structure rather than assumption drift. The following assumptions are fixed across all included markets:

- Down payment: 20%

- Loan term: 30 years (360 months)

- Fixed interest rate: 6.50%

- Loan amount: 0.80 × ZHVI

Non-mortgage ownership costs are nationalized proxies applied uniformly to ZHVI:

- Property tax proxy: 1.10% of ZHVI per year

- Homeowners insurance proxy: 0.60% of ZHVI per year

- Maintenance proxy: 1.00% of ZHVI per year

These fixed inputs are used only to compute the Own vs Rent Monthly Payment Gap component and are not used to estimate local tax burdens or insurance pricing differences between cities.

Component Structure and Weighting

OPI 2026 v1.0 is a weighted composite of three component scores. Each component is calculated from ZHVI and ZORI-based formulas, then normalized to a 0 to 100 score within the 72-city universe.

The table below shows the three components, their purpose, the raw metric used, and their weights in the final score.

Table 1. OPI v1.0 components and weights

| Component | What it measures | Raw metric definition | Weight |

|---|---|---|---|

| Price to Rent Pressure | Structural gap between home values and rents | Price-to-rent ratio = ZHVI / (12 × ZORI) | 50% |

| Own vs Rent Monthly Payment Gap | Modeled ownership payment relative to rent | Owner-vs-rent ratio = Owner Monthly / ZORI | 30% |

| Rent Momentum | Recent rent acceleration | Rent YoY = (ZORIt / ZORI(t-12)) − 1 | 20% |

For the Own vs Rent Monthly Payment Gap component, Owner Monthly is computed as:

- Monthly mortgage payment using standard amortization:

- r = 0.065 / 12, n = 360

- Loan = 0.80 × ZHVI

- Mortgage = Loan × r × (1 + r)^n / ((1 + r)^n − 1)

- Monthly tax = (0.011 × ZHVI) / 12

- Monthly insurance = (0.006 × ZHVI) / 12

- Monthly maintenance = (0.01 × ZHVI) / 12

- Owner Monthly = Mortgage + Tax + Insurance + Maintenance

Normalization and Scoring Framework

Each raw component metric is converted to a comparable 0 to 100 score using a fixed two-stage approach inside the 72-city universe:

- Winsorize the raw metric to reduce the influence of extreme values:

- Values below the 5th percentile are set to the 5th percentile.

- Values above the 95th percentile are set to the 95th percentile.

- Min-max scale the winsorized metric to a 0 to 100 score:

- Score = 100 × (clip(x, p05, p95) − p05) / (p95 − p05)

The table below shows the fixed winsorization bands used in v1.0 for each component, calculated from the included 72-city set.

Table 2. OPI v1.0 winsorization bands for normalization

| Raw metric | p05 | p95 |

|---|---|---|

| Price-to-rent ratio (ZHVI / (12 × ZORI)) | 10.496 | 29.180 |

| Owner-vs-rent ratio (Owner Monthly / ZORI) | 0.920 | 2.558 |

| Rent YoY ((ZORIt / ZORI(t-12)) − 1) | -0.0166 | 0.0583 |

After component scoring, the final index value is computed as:

- OPI = (0.50 × Score_PTR) + (0.30 × Score_OwnVsRent) + (0.20 × Score_RentYoY)

How to Interpret the 0 to 100 Scale

OPI scores are relative within the included 72-city universe and are designed to be read as a pressure ranking system:

- Higher OPI scores indicate higher ownership pressure, driven by one or more of:

- Elevated Price to Rent Pressure (higher price-to-rent ratio after normalization)

- Elevated Own vs Rent Monthly Payment Gap (higher modeled ownership payment relative to rent after normalization)

- Elevated Rent Momentum (faster rent growth after normalization)

- Lower OPI scores indicate lower ownership pressure, reflected by lower normalized values across the same three components.

Because each component is normalized within the same 72-city set using fixed percentile bands, OPI is interpretable as a cross-market comparison tool where:

- The component scores show which pressure channel is dominant in a city.

- The weighted average (OPI) summarizes the combined pressure level under the fixed v1.0 assumptions.

This USREI® infographic from December 2025 explains the methodology and regional findings of its Ownership Pressure Index (OPI) 2026, which measures structural strain on the rent-to-own transition across U.S. cities

National Findings

Overall Ownership Pressure Landscape in 2026

OPI 2026 v1.0 shows a wide dispersion of ownership pressure across the 72-city universe, with final scores ranging from 95.8 at the high end (San Francisco) to 5.3 at the low end (Fort Wayne). This spread reflects substantial differences in how home values, modeled ownership payments, and rent dynamics interact at the city level under the same underwriting assumptions.

The national distribution is not clustered around a single midpoint. Instead, scores are stratified, with a relatively small group of markets exhibiting extreme ownership pressure driven by elevated Price to Rent Pressure and Own vs Rent Monthly Payment Gap scores, and a larger group of markets registering low to moderate pressure due to comparatively aligned value and rent levels.

Key national score markers include:

- Top decile (highest pressure): OPI scores above approximately 80, dominated by coastal California and select Pacific markets.

- Middle band: OPI scores roughly between 30 and 60, representing a mix of large metros and fast-growing regional cities with mixed component signals.

- Bottom decile (lowest pressure): OPI scores below approximately 15, concentrated in smaller Midwestern and Southern markets with low normalized price and ownership payment ratios.

What the National Distribution of Scores Reveals

When decomposed into components, the national OPI distribution reveals that high overall pressure is typically associated with elevated scores in both structural components, while lower pressure markets often show uniformly low scores across Price to Rent Pressure and Own vs Rent Monthly Payment Gap.

Across the 72-city universe:

- Price to Rent Pressure scores span the full 0 to 100 range, indicating large variation in the relationship between ZHVI levels and annualized ZORI.

- Own vs Rent Monthly Payment Gap scores closely track Price to Rent Pressure in most markets, reflecting the shared dependence on ZHVI and ZORI under fixed financing assumptions.

- Rent Momentum scores show greater dispersion independent of the other two components, with some low price markets posting high rent growth and some high price markets posting moderate or low rent growth.

This pattern produces distinct score profiles:

- High OPI markets typically show:

- Price to Rent Pressure scores above 90

- Own vs Rent Monthly Payment Gap scores above 90

- Rent Momentum that is often positive but not always extreme

- Low OPI markets typically show:

- Price to Rent Pressure scores near the lower bound

- Own vs Rent Monthly Payment Gap scores near the lower bound

- Rent Momentum that may vary without materially changing overall pressure

Structural Versus Cyclical Pressure Signals

OPI 2026 v1.0 differentiates between structural ownership pressure and rent-driven pressure through its component weighting. Structural pressure is primarily captured by the Price to Rent Pressure (50%) and Own vs Rent Monthly Payment Gap (30%), while near-term cyclical pressure is captured by Rent Momentum (20%).

The national results show three dominant patterns:

- Structurally constrained markets

- High Price to Rent Pressure and Own vs Rent scores

- Rent Momentum may be moderate or high

- Result: very high OPI scores driven by value and payment structure

- Rent-accelerating but structurally light markets

- Low Price to Rent Pressure and Own vs Rent scores

- High Rent Momentum scores

- Result: low to mid-range OPI scores, as rent growth alone cannot outweigh low structural pressure

- Balanced markets

- Mid-range scores across all three components

- Result: OPI scores clustered in the middle of the national ranking

The table below illustrates how these patterns appear in the national rankings by showing representative score ranges across pressure tiers.

Table. National ownership pressure tiers by OPI score range

| Pressure tier | Approximate OPI range | Dominant component pattern |

|---|---|---|

| Extreme | 80+ | Very high Price to Rent and Own vs Rent scores |

| Elevated | 60–79 | High structural scores with moderate to high Rent Momentum |

| Moderate | 30–59 | Mixed component signals |

| Low | 15–29 | Low structural scores, variable Rent Momentum |

| Very Low | Below 15 | Minimal structural pressure |

Nationally, the data shows that ownership pressure in 2026 is primarily a function of structural price-to-rent imbalance and ownership payment gaps, with rent acceleration acting as an amplifying factor rather than a primary driver in most markets.

Highest Pressure Markets

Top Ranked Markets by OPI Score

The highest ownership pressure markets in OPI 2026 v1.0 are concentrated at the top of the ranking due to extreme alignment between elevated home values and comparatively lower rent levels, combined with large modeled ownership payment gaps. These markets post the highest normalized scores in both structural components: Price to Rent Pressure and Own vs Rent Monthly Payment Gap.

The table below lists the top ten markets by OPI score, along with their component scores. This table is included to show how consistently high structural pressure, rather than a single factor, defines the top of the distribution.

Table. Highest ownership pressure markets, OPI 2026 v1.0

| Rank | City | State | Price to Rent Score | Own vs Rent Score | Rent Momentum Score | OPI |

|---|---|---|---|---|---|---|

| 1 | San Francisco | CA | 94.8 | 94.8 | 100.0 | 95.8 |

| 2 | San Jose | CA | 100.0 | 100.0 | 66.7 | 93.3 |

| 3 | Seattle | WA | 100.0 | 100.0 | 66.2 | 93.2 |

| 4 | Irvine | CA | 100.0 | 100.0 | 53.4 | 90.7 |

| 5 | Long Beach | CA | 100.0 | 100.0 | 40.6 | 88.1 |

| 6 | Anaheim | CA | 94.1 | 94.1 | 60.2 | 87.3 |

| 7 | Los Angeles | CA | 91.1 | 91.1 | 46.2 | 84.1 |

| 8 | San Diego | CA | 90.1 | 90.1 | 35.2 | 80.9 |

| 9 | Honolulu | HI | 77.1 | 77.1 | 56.0 | 76.9 |

| 10 | Santa Ana | CA | 72.3 | 72.3 | 76.6 | 73.2 |

Across these top ranked markets, the Price to Rent Pressure and Own vs Rent Monthly Payment Gap scores are tightly clustered near the upper bound of the normalization range. This indicates that, under the fixed underwriting assumptions used in v1.0, the ratio of ZHVI to annualized ZORI and the ratio of modeled ownership payment to rent are both extreme relative to the national city set.

Common Traits of Extreme Pressure Markets

The highest pressure markets share several measurable characteristics visible directly in the component scores:

- Simultaneously elevated structural components

- Price to Rent Pressure scores typically above 90

- Own vs Rent Monthly Payment Gap scores typically above 90

- Secondary contribution from Rent Momentum

- Rent Momentum varies widely, from mid range values in Long Beach to the maximum score in San Francisco

- High rent growth is not required for a market to rank at the top

- Tight coupling between price and payment metrics

- Markets with Price to Rent scores at or near 100 also post Own vs Rent scores at or near 100, reflecting the shared dependence on ZHVI and ZORI under fixed financing inputs

These patterns show that extreme OPI scores are driven primarily by structural value to rent imbalance rather than short term rent acceleration alone.

Coastal and Tech Driven Market Dynamics

Geographically, the highest pressure markets are heavily concentrated in coastal California and Pacific markets with high home value baselines. In these cities, the modeled ownership payment, calculated using a fixed 20 percent down payment and a 6.50 percent 30 year mortgage rate, produces ownership to rent ratios near the upper normalization limit.

Notable observations from the top tier include:

- California dominance

- Eight of the top ten markets are in California

- These markets consistently post Price to Rent and Own vs Rent scores above 90

- Technology centered metros

- San Francisco, San Jose, Seattle, and Irvine all rank in the top four

- Each posts maximum or near maximum scores in the two structural components

- Rent growth as an amplifier, not a driver

- Santa Ana and San Francisco show high Rent Momentum scores

- San Diego and Long Beach rank highly despite moderate Rent Momentum values

Within this group, differences in final OPI scores are primarily explained by variation in Rent Momentum, since the structural components are already near the upper bound. This confirms that, at the extreme end of the ranking, ownership pressure is fundamentally structural in nature rather than cyclical.

Lowest Pressure Markets

Bottom Ranked Markets by OPI Score

The lowest ownership pressure markets in OPI 2026 v1.0 sit at the bottom of the ranking because their normalized structural component scores are near the lower bound of the 72-city universe. In these cities, both the Price to Rent Pressure score and the Own vs Rent Monthly Payment Gap score are low relative to the national set, indicating comparatively aligned ZHVI and ZORI levels under the standardized v1.0 underwriting assumptions.

The table below lists the ten lowest pressure markets by OPI score, along with their three component scores. This table is included to show how low overall OPI values are typically produced by low structural pressure, with Rent Momentum acting as a smaller modifier.

Table. Lowest ownership pressure markets, OPI 2026 v1.0

| Rank (low end) | City | State | Price to Rent Score | Own vs Rent Score | Rent Momentum Score | OPI |

|---|---|---|---|---|---|---|

| 72 | Fort Wayne | IN | 6.6 | 6.6 | 0.0 | 5.3 |

| 71 | El Paso | TX | 8.2 | 8.2 | 0.0 | 6.6 |

| 70 | Corpus Christi | TX | 11.4 | 11.4 | 0.0 | 9.1 |

| 69 | Memphis | TN | 0.0 | 0.0 | 45.0 | 9.0 |

| 68 | Buffalo | NY | 10.1 | 10.1 | 9.5 | 10.0 |

| 67 | Louisville | KY | 12.8 | 12.8 | 0.0 | 10.2 |

| 66 | Cincinnati | OH | 12.7 | 12.7 | 0.0 | 10.2 |

| 65 | New Orleans | LA | 9.0 | 9.0 | 19.4 | 11.1 |

| 64 | Greensboro | NC | 12.1 | 12.1 | 8.7 | 11.4 |

| 63 | Baltimore | MD | 0.0 | 0.0 | 64.2 | 12.8 |

This bottom tier includes markets where Rent Momentum varies from 0.0 to 64.2, yet overall OPI remains low when structural components are minimal. Baltimore, for example, posts a Rent Momentum score of 64.2 but remains in the lowest pressure group because its structural scores are both 0.0. Memphis shows a similar pattern, with Rent Momentum at 45.0 and structural scores at 0.0, yielding a low OPI of 9.0.

Characteristics of Low Pressure Ownership Environments

Within the v1.0 scoring universe, low pressure markets share consistent score characteristics that appear directly in the component outputs:

- Low Price to Rent Pressure

- Price to Rent scores commonly in the single digits to low teens

- Indicates lower ZHVI relative to annualized ZORI compared to the national city set

- Low Own vs Rent Monthly Payment Gap

- Own vs Rent scores closely mirror Price to Rent scores in most of these markets

- Indicates that the modeled ownership payment remains comparatively close to rent under the fixed 20 percent down, 30 year, 6.50 percent mortgage framework and national cost proxies

- Rent Momentum does not dominate the final score

- Even when Rent Momentum is high, its 20 percent weight limits its ability to raise OPI into the mid or upper tiers without accompanying structural pressure

This component structure produces a bottom tier that is primarily defined by low value-to-rent imbalance and low modeled payment-to-rent imbalance.

Income to Price Alignment Observations

In OPI 2026 v1.0, income is not included as an input and therefore no income-based affordability ratios are computed within the index. As a result, the index does not report alignment between household income and home values, nor does it incorporate income variation into scoring.

What the v1.0 data does show is alignment between prices and rents in the lowest pressure markets. That alignment is visible through:

- Low Price to Rent Pressure scores, indicating comparatively low ZHVI relative to annualized ZORI within the 72-city set

- Low Own vs Rent Monthly Payment Gap scores, indicating that modeled ownership payments remain comparatively close to rent under the standardized assumptions

These observations are limited to the variables included in v1.0 and reflect price-to-rent and payment-to-rent relationships only.

Notable Regional Patterns

West Coast Concentration Effects

OPI 2026 v1.0 shows a pronounced concentration of high ownership pressure along the West Coast, driven primarily by extreme structural component scores. California markets dominate the upper tier of the national ranking, with consistently elevated Price to Rent Pressure and Own vs Rent Monthly Payment Gap scores.

Across West Coast markets:

- California cities account for the majority of top 10 and top 20 rankings

- San Francisco, San Jose, Irvine, Long Beach, Anaheim, Los Angeles, San Diego, Santa Ana, and Oakland all rank within the top 11

- Structural components are near upper normalization bounds

- Price to Rent Pressure scores frequently exceed 90

- Own vs Rent Monthly Payment Gap scores closely track these values

- Rent Momentum varies without altering rank materially

- Some markets show high Rent Momentum (San Francisco at 100.0, Santa Ana at 76.6)

- Others show moderate Rent Momentum (San Diego at 35.2, Long Beach at 40.6)

This pattern indicates that West Coast ownership pressure in v1.0 is overwhelmingly structural, with rent growth acting as a secondary modifier rather than a primary driver.

Northeast Rent Driven Pressure

Northeastern markets display a different component balance, where Rent Momentum plays a larger role in overall OPI scores relative to structural components.

Key observations from the Northeast include:

- Elevated Rent Momentum in large metros

- New York City posts a Rent Momentum score of 83.6

- Newark and Jersey City post Rent Momentum scores of 73.0 and 72.5, respectively

- Moderate structural pressure

- Price to Rent Pressure scores in these markets range from the mid 50s to low 60s

- Own vs Rent Monthly Payment Gap scores mirror these mid range levels

- Resulting mid to high OPI scores

- New York City ranks 15th with an OPI of 61.3

- Newark and Jersey City rank 12th and 13th with OPIs of 65.5 and 64.6

This regional pattern shows how strong rent acceleration can elevate overall ownership pressure even when structural value to rent imbalance is less extreme than in West Coast markets.

Sunbelt Divergence Between Price and Rent

Sunbelt markets exhibit significant divergence between structural and cyclical components, producing a wide range of OPI outcomes within the region.

The data reveals three distinct Sunbelt profiles:

- High structural, low rent momentum

- Austin posts Price to Rent and Own vs Rent scores near 40, but Rent Momentum of just 3.3

- Plano and Chandler show similar patterns

- Moderate structural, high rent momentum

- Miami combines mid range structural scores (42.7) with elevated Rent Momentum (62.2)

- Orlando shows balanced mid range scores across components

- Low structural, high rent momentum

- Oklahoma City posts low structural scores (11.4) with Rent Momentum of 33.3

- Memphis posts structural scores of 0.0 with Rent Momentum of 45.0

These divergent component mixes result in Sunbelt OPI rankings that span from the top third of the distribution to the bottom third, despite geographic proximity.

Midwest Stability and Compression

Midwestern markets are clustered tightly toward the lower end of the OPI distribution, reflecting relatively low structural pressure across the region.

Common characteristics across Midwest cities include:

- Consistently low structural scores

- Price to Rent Pressure and Own vs Rent Monthly Payment Gap scores often below 20

- Several markets post structural scores near 0.0

- Rent Momentum variability with limited impact

- Some markets show moderate Rent Momentum, but its 20 percent weight limits its effect on final OPI

- Compressed OPI range

- Cities such as Fort Wayne (5.3), Cincinnati (10.2), Louisville (10.2), and Omaha (16.2) cluster tightly at the low end

This compression indicates that, under the v1.0 framework, Midwest ownership pressure is generally low and relatively uniform compared to the wide dispersion observed in coastal and Sunbelt markets.

2026 Outlook Scenarios Based on OPI Components

How This Section Should Be Read

This section presents forward-looking scenario analysis using the existing OPI 2026 v1.0 component framework. It does not modify any published scores, rankings, assumptions, weights, or normalization bands. All scenarios are conditional and explanatory, describing how ownership pressure would change if specific inputs moved, based on how the index is constructed.

What Would Move Ownership Pressure in 2026

Under OPI v1.0, ownership pressure can only change through movement in one or more of the three components:

- Price to Rent Pressure, driven by changes in ZHVI relative to ZORI

- Own vs Rent Monthly Payment Gap, driven by changes in modeled ownership costs relative to rent

- Rent Momentum, driven by changes in year over year rent growth

Because financing terms and non-mortgage cost proxies are fixed in v1.0, shifts in ownership pressure entering 2026 would primarily reflect changes in prices and rents rather than underwriting structure.

Scenario 1: Mortgage Rates Change While Prices and Rents Hold

In OPI v1.0, the mortgage rate is fixed at 6.50 percent. If rates were to move in reality while prices and rents remained unchanged, the effect would appear exclusively in the Own vs Rent Monthly Payment Gap component in future versions of the index.

Under this scenario:

- Price to Rent Pressure would remain unchanged, since it depends only on ZHVI and ZORI

- Rent Momentum would remain unchanged, assuming rent growth is stable

- Own vs Rent Monthly Payment Gap would shift, because the mortgage payment portion of Owner Monthly would change

The impact would be asymmetric across markets:

- High ZHVI markets would experience larger absolute payment changes

- Markets already near the upper normalization bound would see the greatest upward or downward pressure in their ownership payment ratios

This scenario illustrates why high OPI markets are structurally sensitive to financing conditions, even when prices and rents are flat.

Scenario 2: Rents Accelerate or Cool Relative to Prices

If rents accelerate faster than prices entering 2026, ownership pressure would change through two components simultaneously.

Under rent acceleration:

- Rent Momentum scores would rise directly

- Price to Rent Pressure would decline, because the denominator of the ratio increases

- Own vs Rent Monthly Payment Gap would decline, as rent rises relative to a fixed ownership payment

This creates a counterbalancing effect where:

- Cyclical pressure increases through Rent Momentum

- Structural pressure decreases through both value-to-rent and payment-to-rent ratios

Markets with currently high structural pressure but moderate rent growth would be most sensitive to this scenario. Conversely, if rent growth slows or turns negative, Rent Momentum scores would fall while structural ratios would increase, raising ownership pressure in future readings even without price appreciation.

Scenario 3: Home Values Reprice Faster or Slower Than Rents

Changes in home values relative to rents produce the strongest directional shifts in OPI because they affect both structural components simultaneously.

If home values rise faster than rents:

- Price to Rent Pressure increases directly

- Own vs Rent Monthly Payment Gap increases, as loan size grows relative to rent

- Rent Momentum is unaffected, unless rent growth also changes

If home values fall or stagnate while rents hold:

- Price to Rent Pressure declines

- Own vs Rent Monthly Payment Gap declines

- Rent Momentum may remain positive, producing mixed component signals

This scenario explains why ownership pressure can fall in some markets even when rents remain elevated, provided values re-align downward relative to rent levels.

Where Changes Would Appear First in the Index

Based on the v1.0 weighting structure, changes would register in the following order of sensitivity:

- Price to Rent Pressure Most sensitive to price-rent divergence and the largest weight at 50 percent

- Own vs Rent Monthly Payment Gap Sensitive to both price changes and financing conditions, weighted at 30 percent

- Rent Momentum Sensitive to short-term rent dynamics, weighted at 20 percent

As a result, sustained shifts in ownership pressure entering 2026 would most likely be driven by changes in structural ratios rather than rent growth alone.

What OPI Does Not Capture in Forward-Looking Context

Even in scenario analysis, OPI v1.0 does not incorporate:

- Household income changes

- Credit availability or underwriting tightening

- Policy interventions such as zoning reform or tax changes

- Behavioral responses from buyers or renters

Any future movement in ownership pressure inferred from these scenarios reflects only how prices, rents, and modeled ownership costs interact within the fixed OPI framework.

This section establishes how the index can be used as a lens for understanding potential shifts entering 2026, while preserving the integrity and comparability of the published OPI 2026 v1.0 results.

Assessment

What OPI Signals for Renters

OPI 2026 v1.0 shows that renter conditions vary materially by city depending on whether ownership pressure is driven by structural imbalance, rent acceleration, or both. Renters in high OPI markets are typically operating in environments where rent levels are low relative to home values, but ownership payments are substantially higher than rent under standardized assumptions.

Data patterns relevant to renters include:

- High OPI markets

- Price to Rent Pressure scores above 90 indicate that home values are many multiples of annual rent

- Own vs Rent Monthly Payment Gap scores above 90 indicate that modeled ownership payments far exceed current rent

- Rent Momentum may be high or moderate, but renters face limited ownership substitution regardless

- Low OPI markets

- Low Price to Rent and Own vs Rent scores indicate closer alignment between rent and ownership costs

- Rent Momentum can be elevated without materially changing the ownership pressure environment

In v1.0, Rent Momentum alone does not push markets into high pressure territory unless structural components are already elevated.

What OPI Signals for Buyers

From a buyer perspective, OPI 2026 v1.0 isolates how far ownership costs diverge from prevailing rents when financing assumptions are held constant. Buyers in high ranking markets face large modeled payment gaps that are driven primarily by ZHVI levels rather than by rent behavior.

Key buyer-relevant signals in the data include:

- Structural dominance

- In top ranked markets, Price to Rent Pressure and Own vs Rent scores are both near the upper bound of normalization

- This indicates that ownership payment stress is embedded in the value-to-rent relationship

- Limited offset from rent dynamics

- Markets with moderate Rent Momentum can still rank among the highest pressure markets

- Rent acceleration is not required for high ownership pressure when structural ratios are extreme

Conversely, buyers in low OPI markets operate in environments where ownership payments, as modeled, remain relatively close to rent.

What OPI Signals for Investors

OPI 2026 v1.0 provides a standardized view of how asset prices relate to rents and ownership payments, without incorporating income, leverage optimization, or localized operating assumptions. For investors, the index highlights where value-to-rent relationships are most and least compressed under a consistent framework.

Investor-relevant observations include:

- High OPI markets

- Extremely high Price to Rent scores indicate compressed rent yields relative to values

- Ownership payment gaps are wide even before adding variable operating costs

- Mid-range OPI markets

- Mixed component profiles suggest heterogeneity in price, rent, and growth dynamics

- Low OPI markets

- Low structural scores indicate relatively favorable value-to-rent alignment within the city set

- Rent Momentum variability plays a secondary role in overall pressure

The index does not assess returns, but it does show where rent levels are structurally high or low relative to values.

How Policymakers Should Read the Index

OPI 2026 v1.0 distinguishes between ownership pressure driven by long-term structural imbalance and pressure driven by short-term rent acceleration. This distinction is visible directly in the component scores.

For policy interpretation within the bounds of v1.0:

- Structural pressure

- Identified by high Price to Rent and Own vs Rent scores

- Concentrated in supply constrained, high value markets

- Cyclical pressure

- Identified by high Rent Momentum scores with low structural scores

- More common in lower cost markets experiencing rent acceleration

Because OPI holds financing and non-mortgage cost assumptions constant, differences in scores reflect market structure rather than policy settings, income distribution, or credit availability.

Limitations and Disclaimer

Fixed Assumptions and Their Impact

OPI 2026 v1.0 is built on a deliberately fixed assumption set to ensure cross-market comparability. As a result, the index reflects relative ownership pressure under standardized conditions rather than localized financing or cost realities.

Key limitations arising from fixed assumptions include:

- Uniform financing structure

- All markets use a 20 percent down payment, a 30 year fixed loan term, and a 6.50 percent mortgage rate

- The index does not adjust for local lending practices, buyer credit profiles, or alternative financing structures

- Nationalized non-mortgage cost proxies

- Property tax, insurance, and maintenance are applied as fixed percentages of ZHVI

- City-specific tax regimes, insurance premiums, and maintenance cost variation are not reflected

- Modeled ownership payments

- The Own vs Rent Monthly Payment Gap is a modeled construct designed for comparability

- It does not represent an exact payment quote for any individual property or buyer

These constraints mean that differences in OPI scores reflect relative market structure under identical assumptions, not absolute ownership costs.

Data Scope and City Level Constraints

OPI 2026 v1.0 relies exclusively on city-level ZHVI and ZORI data to maintain consistency across markets. This approach introduces scope-related limitations that affect interpretation.

Data scope constraints include:

- City-level aggregation

- Scores reflect city-wide averages rather than neighborhood-level conditions

- Intra-city variation in prices and rents is not captured

- Typical value and rent measures

- ZHVI represents a typical home value, not a median transaction price

- ZORI represents a typical asking rent, not an executed lease rate

- Fixed market universe

- Normalization bands and scores are calculated within the 72-city set included in v1.0

- Scores are not directly comparable to cities outside this universe without recalculation

Because normalization is internal to the v1.0 city set, changes to the market list would alter percentile bands and component scores.

Intended Use and Non-Advisory Disclaimer

OPI 2026 v1.0 is a comparative research index designed to measure ownership pressure across cities using a standardized methodology. It is not intended to function as a pricing tool, an affordability calculator, or a substitute for market-specific analysis.

Within its intended scope:

- The index explains how home values, rents, modeled ownership payments, and rent growth interact at the city level

- It does not incorporate household income, debt obligations, credit access, or buyer preferences

- It does not project future price movements, rent changes, or policy outcomes

All findings are descriptive and comparative in nature, based solely on the data, assumptions, and methodology defined for OPI 2026 v1.0.