Key Takeaways

- Individual investors own the majority, over 70%, of all U.S. rental properties, while institutional investors account for just 2%.

- Institutional ownership is concentrated in the Southeast and Southwest, particularly in Atlanta, Jacksonville, and Charlotte.

- Despite common fears, institutional investors still represent a small share of the overall housing market, though their influence can drive local rent increases and evictions.

Who really owns America’s rental properties, Wall Street or everyday investors?

Institutional giants may grab the headlines, but do they truly control the market?

The answer will change how you see the housing crisis.

Are institutional investors quietly reshaping your neighborhood without you knowing it?

This report reveals how deep their influence runs and where small investors still reign supreme.

Inside this article, you’ll discover:

- The true percentage of U.S. rental homes owned by institutions vs. individuals

- Why Atlanta, Jacksonville, and Charlotte are institutional hot zones

- How ownership patterns have shifted since the 2007 housing crash

- What these trends mean for evictions, rent prices, and future opportunities

- Why individual landlords remain the hidden power players in housing

Get ready to rethink everything you thought you knew about property ownership in America.

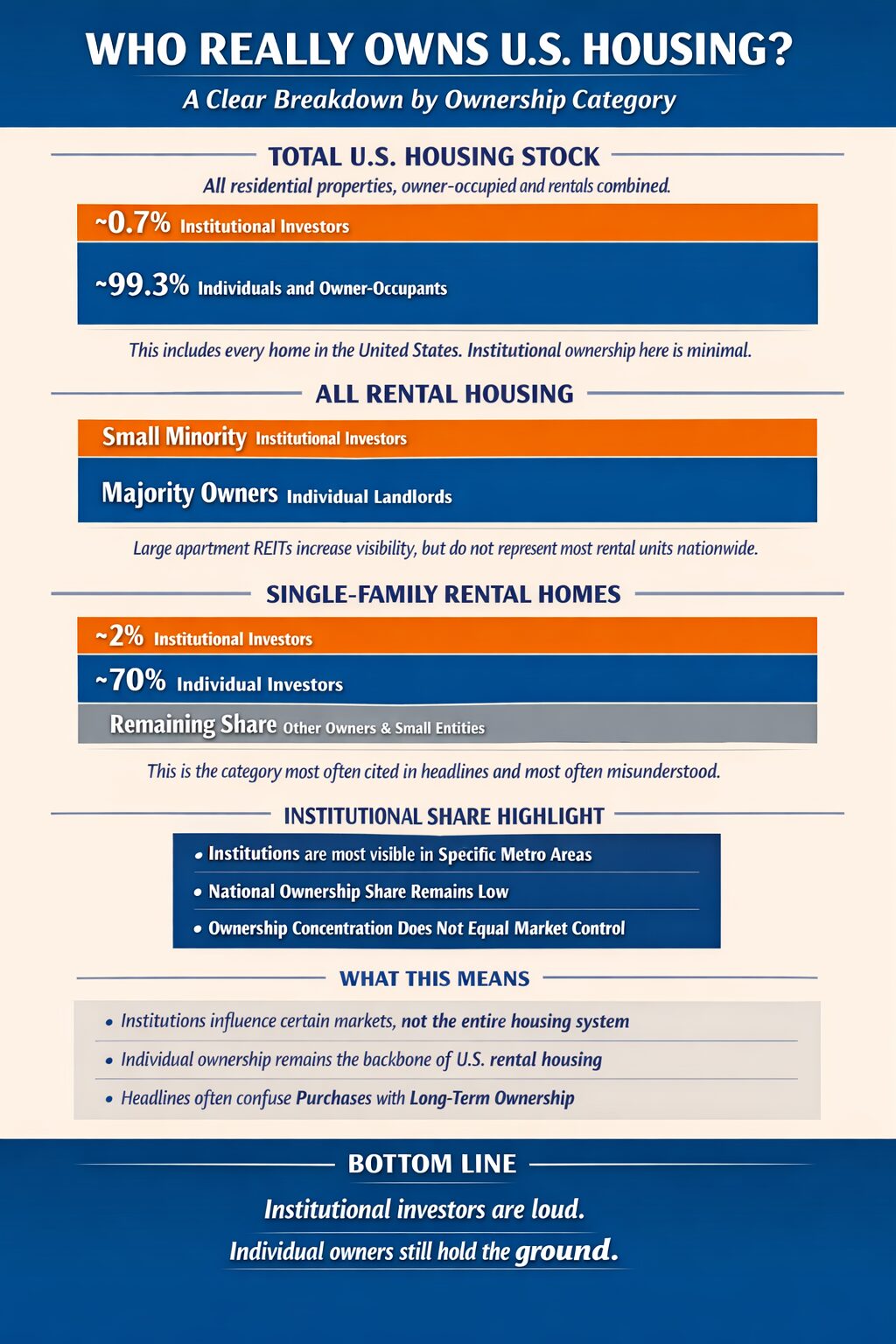

Ownership Distribution of Rental Properties

You’ve likely heard concerns about Wall Street buying up America’s housing, but the reality might surprise you.

While institutional investors have garnered significant media attention, they actually own just 2% of rental properties in the United States, compared to individual investors who control 70.2% of the market.

However, these numbers don’t tell the complete story, as institutional ownership varies dramatically by region and has been steadily increasing since the 2007 financial crisis, raising important questions about the future of housing accessibility and affordability.

This analysis is part of United States Real Estate Investor® ongoing review of U.S. housing data, focused on separating widely repeated narratives from verifiable ownership realities.

Let’s dive deeper into the data…

Understanding Property Ownership Statistics

In the complex terrain of property ownership, institutional investors control a surprisingly small portion of America’s single-family rental homes, owning just 2% of the total rental housing stock.

To put this into perspective, by 2022, only 32 institutional investors collectively owned 450,000 single-family homes across the country, highlighting the relatively modest scale of their holdings in the broader market.

This marked a dramatic shift from pre-2011 when no investor exceeded 1,000 homes in their portfolio.

Research shows that eviction rates increased 33% in neighborhoods where institutional investors acquired properties.

When you look at the ownership dynamics more closely, you’ll find that most rental properties are actually in the hands of small investors who own between 1 to 10 homes.

The overall percentage of investor-owned homes has increased modestly from 9.0% in 2005 to 9.9% today, with institutional investors accounting for just 0.73% of the total U.S. single-family housing stock.

Understanding investor motivations helps explain this distribution – institutional investors typically target newer, larger homes in high-growth metropolitan areas, particularly in the Southeast and Southwest.

You’ll notice their presence is especially concentrated in markets like Atlanta (25%), Jacksonville (21%), and Charlotte (18%), where strong job growth and limited housing supply create attractive investment conditions.

Clarified Breakdown of U.S. Property Ownership by Category

| Ownership Category | What This Category Measures | Institutional Investor Share | Individual Investor Share | Why This Figure Is Often Misunderstood |

|---|---|---|---|---|

| Total U.S. Housing Stock | All residential properties in the United States, including owner-occupied and rentals | ~0.7% | Majority held by owner-occupants and small investors | Media narratives often imply institutional dominance across all housing, which this metric disproves |

| Single-Family Housing Stock | All single-family homes, whether owner-occupied or rented | <1% | Over 99% | Institutional ownership is frequently overstated by conflating purchases with total stock |

| Single-Family Rental Homes | Single-family homes actively used as rental properties | ~2% | ~70% | This is the category most cited in headlines, but it excludes owner-occupied homes |

| All Rental Properties | Single-family rentals, small multifamily, and large apartment buildings | Small minority overall | Majority ownership | Large apartment REITs skew perception despite being a fraction of total rental units |

| Investor Share of Annual Purchases | Portion of home purchases in a given year made by any investor | Peaks near 25% in some years | Majority of investor purchases | Purchase activity is often mistaken for long-term ownership control |

| Institutional Share of Annual Purchases | Homes bought annually by large institutions | Typically 2% to 3% | Not applicable | Short-term buying spikes are misread as permanent market takeover |

Data Notes and Context for Readers

- Percentages vary depending on whether the data measures ownership stock or annual transaction activity.

- Institutional investors are more visible due to scale and branding, not numerical dominance.

- Most U.S. rental housing remains owned by individuals holding between one and ten properties.

- Regional concentration can be high even when national ownership share is low.

This table resolves the core confusion driving public fear narratives while reinforcing the article’s central finding: institutional investors influence specific markets, but they do not own the housing market.

Methodology and Definitions

Ownership percentages vary depending on how housing data is measured and categorized. This article distinguishes between total housing stock, rental housing, and single-family rental homes, which are often conflated in public discussions. Ownership stock reflects long-term control of properties, while purchase activity reflects short-term transaction volume and should not be interpreted as permanent ownership. National ownership shares can differ significantly from city-level concentrations, where institutional investors may hold a larger local presence despite representing a small share nationwide. All figures cited reflect aggregated national research and should be interpreted within these definitions.

Types of Real Estate Investors

Real estate investors come in several distinct categories, each playing a unique role in shaping the property market.

You’ll find that REITs are companies with diverse property portfolios, and their REIT characteristics include providing stable dividend income and long-term appreciation potential.

Private equity firms operate differently, with private equity strategies focused on pooling capital and pursuing value-add opportunities through various financial instruments.

These firms typically participate through limited partnership structures with their investors. The industrial and logistics sectors have seen growing investor interest due to e-commerce expansion and supply chain demands.

Individual investors make up the largest segment of rental property owners, controlling about 70.2% of rental properties in the U.S. These investors typically focus on residential properties for rental income and appreciation.

In contrast, institutional investors like REITs and real estate corporations own a smaller percentage but often target larger commercial properties, particularly in the multifamily and industrial sectors.

Family offices represent another important category, managing wealth for multiple families with a focus on long-term stability.

Each investor type faces distinct challenges, from market dependency for REITs to operational risks for individual property owners.

You’ll notice that while some prefer the liquidity of REITs, others opt for direct property ownership despite its hands-on management requirements.

Market Share By Region

Market share patterns reveal stark geographical differences in institutional investor ownership across the U.S.

While institutional investors own just 2% of single-family rentals nationwide, you’ll find their presence concentrated heavily in specific regions, particularly the Southeast and Southwest.

These areas attract large investors due to strong job growth potential and limited housing supply.

You’ll notice particularly high institutional ownership in several key markets:

- Atlanta leads with 25% institutional ownership

- Jacksonville follows at 21%

- Charlotte shows 18% ownership

- Tampa maintains 15% ownership

- Phoenix rounds out the top markets with significant institutional presence

When you look at investor demographics nationwide, you’ll see that small mom-and-pop investors still dominate the market.

They’re part of the broader 25% of residential transactions attributed to all investors, while institutional buyers peak at just 2.5% of purchases.

Despite viral claims suggesting higher numbers, big investors only control about 0.4% of the market.

However, in those southeastern hotspots, institutional ownership has created notable market impacts.

These large investors can influence local rental rates and property values, often implementing widespread property improvements through economies of scale.

The total number of rental homes has grown to 14.3 million homes across the country, showing significant expansion from previous decades.

Currently, though, institutional buying has slowed considerably due to rising interest rates.

Historical Ownership Trends

Historical ownership trends of single-family rentals have undergone dramatic shifts since the early 2000s. Before 2007, small investors dominated the market, with institutional investors owning less than 1% of single-family rentals.

You’ll find it interesting that investors overall owned about 9% of all homes in America during this period, participating in roughly 12-18% of real estate transactions.

The 2007-2009 financial crisis marked a turning point, sparking widespread institutional buyouts of foreclosed properties.

Large companies like Blackstone began purchasing homes in bulk, leading to extensive rental conversion programs.

By 2015, institutional investors had acquired between 170,000 and 300,000 single-family homes, compared to virtually none before 2011.

From 2015 to 2022, institutional ownership continued growing, with the top five investors accumulating nearly 300,000 homes.

However, you should know that despite this growth, institutional investors still own less than 1% of the total U.S. single-family housing stock.

Recent data from Parcl Labs confirms this trend, showing institutional ownership at 0.73% of all U.S. housing stock.

Small “mom and pop” investors remain the dominant force in the market, while institutional activity concentrates primarily in Sunbelt states like Georgia and Florida.

Impact on Housing Markets

Through extensive market analysis, institutional investors have secured approximately 3.8% of single-family rental properties, while local and smaller investors control 7.3% of institutional-owned rentals.

The institutional influence on housing markets varies greatly by region, with mega investors dominating 78% of institutional-owned properties.

When issues arise with property access, 404 error monitoring helps investors track digital platform problems.

Technological advancements have enabled efficient management of massive property portfolios.

You’ll find the most considerable institutional presence in southeastern markets, where rental dynamics have remarkably shifted.

Here are key impacts you should know about:

- Atlanta leads with 25% institutional ownership, followed by Jacksonville at 21%

- Large investors are more likely to initiate eviction proceedings than smaller landlords

- Institutional buyers can affect local home prices and rental rates, especially in concentrated areas

- They’ve expanded primarily through smaller purchases and mergers in recent years

- Their market share remains relatively small at 2% overall, despite common misconceptions

While institutional investors initially grew through bulk purchases of foreclosed homes, they’ve since diversified their strategies.

You’ll notice their influence most in specific metropolitan areas, though claims about their market dominance are often exaggerated.

The real impact on homeownership opportunities continues to be studied, as data remains limited in many markets.

Frequently Asked Questions

How Do Institutional Investors Select Which Neighborhoods to Target for Acquisitions?

You’ll find institutional investors analyze neighborhood trends and investment criteria, focusing on affluent areas with strong rental demand, good infrastructure, and favorable economic indicators to maximize their returns.

What Financing Methods Do Institutional Investors Use Compared to Individual Buyers?

You’ll find institutional investors use bulk purchases and diverse financing options like private equity, while you’re typically limited to traditional mortgages and personal savings for individual property investment strategies.

Do Institutional Investors Typically Renovate Properties Before Renting Them Out?

Like a butterfly emerging, you’ll find institutional investors regularly transform properties through essential upgrades. They’ll renovate based on tenant preferences, ensuring ideal rental potential and maintaining competitive market standards.

How Do Property Management Strategies Differ Between Institutional and Individual Investors?

You’ll find institutional investors focus on standardized tenant relations and marketing strategies, while individual investors typically maintain more personal connections and rely on smaller-scale, localized approaches to property management.

What Role Do Technology and Data Analytics Play in Institutional Investment Decisions?

You’ll find institutional investors rely heavily on data integration and market forecasting tools, leveraging technology adoption to analyze investor behavior, assess risks, and track performance metrics for smarter investment decisions.

Understanding Rental Property Ownership

It’s easy to think that large corporations are taking over the rental market, but that’s not the full story.

In fact, individual investors hold the reins, owning over 70% of U.S. rental properties.

Institutional investors, on the other hand, account for just 2%.

While concerns about corporate control exist, it’s clear that small-scale landlords are still the heart of America’s rental housing.

You’ll typically find these institutions in a few urban areas, but the vast majority of regions are still managed by individuals.

So, what’s the takeaway?

Individual investors are the true driving force behind rental housing.

And here’s a call to action: If you’re considering becoming a landlord, know that you have the power to shape the market in your community.

Don’t let the fear of big corporate players deter you. Individual ownership is not only possible, it’s the norm.

Institutional investors influence select markets, but individual owners continue to control the vast majority of U.S. housing, confirming that ownership remains decentralized and accessible.

Related Content:

- Global Housing Storm (Holistic Solutions to Million-Dollar Dreams, Desperate Sellers, Rising Rents, and Shifting Wealth)

- The Death and Resurrection of the American Dream (How Real Estate Remains America’s Only Escape Route in 2025)

- 10 Shocking Truths From the 2025 Global Housing Storm (And How Agents and Investors Can Thrive Through It)

5 Responses

Interesting stats, but arent they skewed by the big cities? What about rural areas where institutional investors barely make a dent? #FoodForThought

Interesting stats but arent we overlooking the impact of Airbnb on individual vs. institutional ownership? Thoughts? #RealEstateDebate

Interesting stats, but isnt it scary how few properties individuals own? Is the real estate market now just a playground for big corporations?

Interesting stats, but arent we ignoring the impact of Airbnb? How much property is hoarded for short-term rentals? Would love some insights there.

Airbnbs impact is negligible. Traditional rentals still dominate. Stop scapegoating innovative platforms.