Key Takeaways

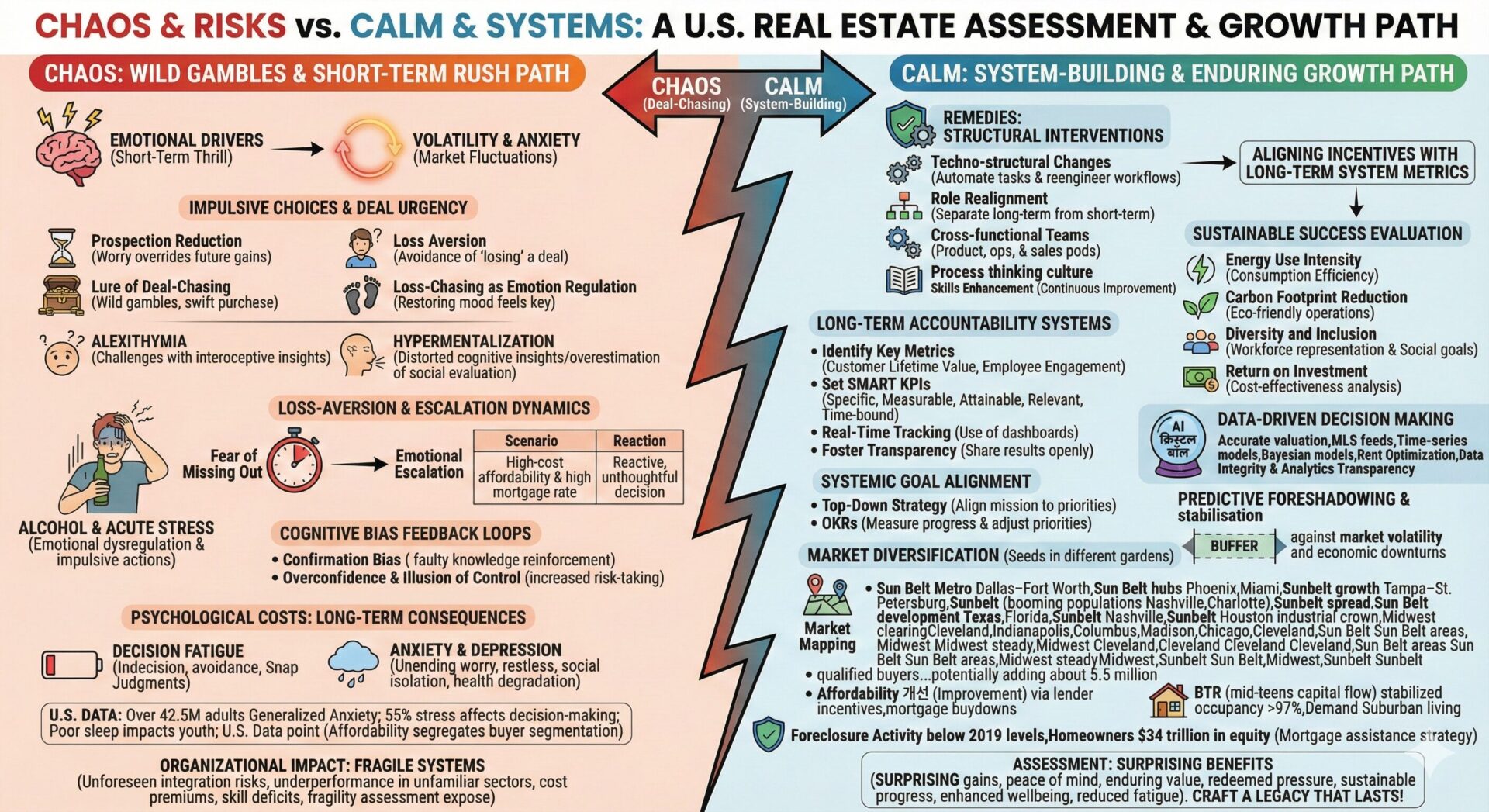

- Real estate success is characterized by consistent, informed decision-making rather than high-risk ventures.

- Backed by data, each choice contributes to a resilient and reliable growth path.

- The satisfaction in real estate comes from the steady and rewarding progress it provides.

The Subtle Art of Real Estate Triumph

In the world of real estate, success often feels like a gentle, uneventful breeze rather than a whirlwind. It’s less about wild gambles and more about consistent, informed choices.

You fine-tune your strategies, savoring the quiet moments of growth. Each decision, backed by data, shapes your steady path to success.

As you chart the U.S. market, you build resilience and reliability. It’s not always flashy, but it’s rewarding in a way that’s deeply satisfying.

Curiosity stirs within you…

The Art of Predictability in Real Estate

Steering the real estate market can feel like guiding a ship through choppy waters, yet mastering the art of predictability transforms the journey. With predictive modeling, you can forecast trends, helping stabilize the ever-volatile market.

Diversification of property types and investments acts as a buffer against market volatility and economic downturns, ensuring a more secure and prosperous future for investors. Think about homes priced realistically: they sell faster, strengthening your bottom line. As market stabilization becomes vital, particularly amid stretched affordability, being able to anticipate shifts empowers you to act strategically.

In 2026, there is a projected 14% increase in existing home sales, driven by lower mortgage rates and rising inventories. Imagine this: well-priced homes standing out, attracting enthusiastic buyers, and speeding up sales. This leaves you less worried about market fluctuations.

When you leverage predictive tools, it’s like having a compass pointing to success. Maneuvering real estate with predictability isn’t just smart—it’s essential for thriving in today’s competitive U.S. market.

Navigating the Calm With Data-Driven Insights

Hey there! If you want to really shine in the real estate market today, it’s all about tapping into predictive analytics.

Why? Because it helps you anticipate changes and get ahead of the curve. By the time 2026 arrives, we’re expecting the market to bounce back.

So, staying in tune with trends and making smart, data-driven choices can open up a world of opportunities for you.

Just imagine positioning yourself at the cutting edge of success, where your strategic decisions leverage a solid housing market and cutting-edge tech.

Ready to dive into more insights? Let’s move on to our next section!

Leveraging Predictive Analytics

How can predictive analytics change the game in real estate, you ask? It’s all about predictive modeling and data enrichment. By combining transaction history, mortgage age, and local mobility rates, you can improve move predictions dramatically.

These models don’t just rely on traditional data; they incorporate life-event indicators and consumer spending patterns, too. This blend boosts your lead conversion rates because you can prioritize them more effectively.

Ensemble approaches, such as using gradient-boosted trees with neural networks, offer deeper insights from diverse datasets in your CRM.

But there’s more—privacy-safe feature engineering protects consumer data while honing accuracy. This means you’re staying compliant without compromising on detail.

Rolling-window retraining, adjusted weekly or monthly, guarantees your models stay relevant as market dynamics shift.

Capitalizing on Market Trends

Even when the market feels calm, understanding trends can help you make bold moves in real estate. Recognize market timing by watching economic indicators like job growth and unemployment. Demand forecasting allows you to predict buyer demographics, influencing your investment strategies.

Analyze inventory and note moderate increases, often foreshadowing price trends. Keep an eye on mortgage trends, such as rate declines—these reveal buyer potential. Look for regional opportunities where local pricing diverges from national trends.

Construction cycles and their completion inform about new supply impact on affordability. By examining these, you align your strategies effectively.

Track different buyer demographics to steer shifts. These insights make real estate feel uneventful because well-informed strategies reduce risks and maximize gains.

Reliable Growth Through Strategic Planning

Imagine yourself on the brink of real estate success, where smart moves are driven by data-savvy decision-making.

Envision prioritizing market diversification, so you can glide through economic shifts with ease and confidence.

By embracing technological integration, you’ll be able to flip challenges into exciting opportunities, setting the stage for growth and a future that’s both stable and prosperous.

Ready to dive deeper? Let’s move on to the next section!

Data-Driven Decision Making

When it comes to real estate, making informed decisions can be your ticket to success. Data integrity and analytics transparency are essential for confident choices.

AI-powered predictive analytics become your crystal ball, offering accurate valuation based on transaction histories and MLS feeds. Time-series models dynamically forecast prices, aiding decisions with new signals. Predictive tools manage risk, spotting trends like vacancy spikes ahead of time.

| AI Insights | Benefits | Actions |

|---|---|---|

| Valuation Accuracy | Decrease appraisal variance | Use ensemble models |

| Dynamic Forecasting | Better hold/sell decisions | Engage Bayesian models |

| Rent Optimization | Stabilized cash flow | Implement ML algorithms |

Integrating AI’s insights helps steer through the ever-changing U.S. market environment with clarity. It’s not just technology; it’s an opportunity for foresight and steady growth.

Prioritize Market Diversification

Diversifying your real estate portfolio is like immersing seeds in different gardens. Market mapping helps you spread holdings across diverse regions.

Think of regional strategies as your guide to steer through demographic shifts. You need to spot growth pockets and adjust your investments.

In the U.S., try blending investments in Sun Belt areas known for booming populations with the steady charm of the Midwest. Balance is key here.

Don’t forget about your investment thresholds. Deciding how much to invest in various asset types keeps your portfolio healthy.

Incorporate a mix of residential, commercial, and industrial properties. Each sector has unique cycles and demand drivers.

Use regional indicators like job growth and migration. Monitor and respond to changes in these regions for reliable growth.

Embrace Technological Integration

While technology may seem intimidating, accepting it’s vital for achieving enduring success in the real estate market.

Technology adoption streamlines operations and boosts efficiency. However, overcoming integration challenges is key.

Many U.S.-based organizations face technical issues or resistance during this shift. Yet, you reveal immense advantages by welcoming AI and PropTech platforms.

Data readiness and strong governance prepare you for success. Clean and organize data to empower AI with accurate insights.

Integrated PropTech platforms transform operations. Smarter, AI-driven decisions enhance tenant experiences and boost returns.

With tools like IoT for smart buildings, anticipate and respond to tenant needs. Visual tools simplify design and leasing.

Understanding Market Trends and Forecasts

Understanding market trends and forecasts in real estate is like having a crystal ball that shows you tomorrow’s opportunities and challenges. With clever market analysis and trend forecasting, you can anticipate shifts and align your strategy for success.

Sales are expected to rise, driven by pent-up demand and slight recovery in supply. Prices may only inch upward, stabilizing after a flat period. Keeping a keen eye on mortgage rates is essential too. They’re projected to decrease slightly, spurring buying activity.

Here’s a breakdown of various forecasts:

| Forecast Type | Projected Change |

|---|---|

| Existing Home Sales | Up to 14% increase |

| Home Prices | 1.2% to 4% rise |

| Mortgage Rates | Avg. around 6% |

| Inventory | Nearly 9% rise |

Seize future opportunities by staying informed.

Affordability and Its Impact on Market Dynamics

As mortgage rates slowly drop, affordability in real estate is set to improve, offering hope to many aspiring homeowners. The gradual decline to low-6% rates brings positive affordability trends, potentially adding about 5.5 million qualified buyers.

With incomes outpacing house prices, you’ll see a 3% annual improvement in affordability.

However, buyer segmentation remains a challenge. Not everyone benefits equally, especially where wage growth stagnates, impacting affordability in high-cost locations.

Creative financing options like lender incentives and mortgage buydowns help bridge gaps, easing monthly payments. Additionally, increased mid-priced homes and movements in real price measures contribute to better affordability.

The Importance of Steady Inventory and Construction

You mightn’t always see it, but having a steady flow of homes available is crucial for a healthy real estate market.

When supply consistency is maintained, it keeps housing affordable.

In 2026, the market is stabilizing, with existing-home inventory rising year-over-year by 8.9%. This provides more opportunities for buyers.

Even though single-family starts decline slightly, builders have over 150,000 completed yet unsold houses.

This contributes to a balanced market despite challenges.

You’re observing a time when housing affordability is improving as more homes become available.

Supply might still be 12% below pre-2020 levels, but improved inventory helps manage price gains.

As the real estate scene evolves, steady inventory and construction guarantee a smoother market where everyone benefits.

Harnessing Economic Fundamentals for Stability

So, to really make the most of economic fundamentals for stability, consider riding the wave of steady job growth.

This growth not only contributes to rising home prices but also helps property values appreciate over time.

Plus, with mortgage delinquencies hitting record lows, thanks to vibrant job markets and increased homeowner equity, the real estate landscape is looking pretty solid.

By tapping into these strong fundamentals, you can pave the way for a stable and promising future.

Ready to dive deeper? Let’s move on to the next article section!

Leveraging Job Growth Stability

While many people worry about the ups and downs of job markets, there’s an inspiring side to job growth stability, especially in the United States. When certain sectors like Education and Healthcare thrive, they bolster housing confidence.

Even though high-income sectors are shrinking, job stability makes a strong foundation for real estate success. By focusing on these expanding sectors, you’re tapping into opportunities that steady the real estate ship during turbulent times.

This consistent job creation sends a positive signal, particularly when tech and professional services decline. Stable employment rates offer a sense of predictability. It lessens fears of housing bubbles or rapid market shifts.

When jobs are steady, markets flourish, and the result is a smoother ride for everyone involved in real estate.

Capitalizing on Low Delinquencies

Although the economy has seen its share of ups and downs, low delinquency rates are a current beacon of hope in the U.S. real estate market.

You can feel secure knowing these rates are at some of the lowest levels ever.

Borrower confidence soars as credit quality remains excellent. Refinancing into lower interest rates means more manageable payments, which aids mortgage assistance efforts.

Homeowners hold over $34 trillion in equity, creating a solid equity management strategy against any delinquencies.

Delinquency rates benefit from a strong job market, minimizing financial distress.

With foreclosure activity below 2019 levels, the market enjoys a cushion of stability.

Even with minor foreclosure upticks, the fundamentals hold strong, truly showcasing the power of a steady economy.

Embracing Emerging Trends in Real Estate

Do you wonder what’s shaping the future of real estate? Emerging markets and sustainable development are at the forefront.

As baby boomers hit their 80s in 2026, the demand for versatile senior housing soars. Think independent-living-lite and wellness-infused spaces.

Meanwhile, migration shifts the spotlight to Sun Belt hubs like Texas and Florida. Here, sprawling development, driven by lower costs, alters rent dynamics.

Young households rise, but there’s a gap in affordable options, nudging builders toward compact homes, townhomes, and rowhouses.

In smaller cities like Raleigh and Richmond, rising renter mobility brings opportunities, attracting young professionals to vibrant communities.

The Role of Technology in Uneventful Success

Hey there! Have you noticed how technology is completely transforming the real estate scene across the U.S.?

It’s not just about fancy gadgets; AI is stepping in as a real game-changer, forecasting market trends and making intuitive decisions on your behalf.

Imagine a world where buying and selling properties is as easy as a single click. Tech is streamlining every part of the process, from property valuation to the ins and outs of buyer-seller negotiations.

And let’s not forget those data-powered strategies that boost accuracy, allow you to manage risk, and seize opportunities with ease.

Exciting stuff, right? Let’s dive deeper into how this evolution is unfolding!

Integrating AI in Operations

When you think about real estate, AI probably isn’t the first thing that comes to mind. Yet integrating AI revolutionizes operational efficiency with predictive tools and automated workflows.

Imagine AI analyzing sensor data to streamline proactive maintenance—no more unexpected failures, just smooth operations.

Intelligent systems boost tenant engagement by using data standardization to fine-tune interactions, while sensor technology guarantees everything functions without a hitch.

Adopting AI means process automation thrives, and properties run like well-oiled machines.

Predictive tools offer invaluable insights, telling you what’s needed before it even crosses your mind. This forward-thinking approach reduces costs and extends asset life.

In the ever-evolving U.S. real estate market, AI integration isn’t just about innovation—it’s the ultimate tool for seamless property management.

Streamlining Transactions With Tech

Adopting AI sets the stage for tech-driven real estate transactions. Imagine buying property with ease. Automated processes simplify it all. Blockchain smart contracts automate deed transfers and payments, slashing transaction costs by up to 30%.

A digital ledger records every step, ensuring security and transparency. You don’t just save money; you dodge complexity. Tokenized properties split into shares, opening the market for small investors in exciting ways.

Explore fractional ownership through digitized paths. Platforms like Pacaso give you co-ownership access, making property investment easier. As these technologies integrate, seamless experiences await.

Integrated platforms unify tools into one, with AI steering the wheel.

It’s innovation that speeds up procedures while ensuring smooth, secure, and successful transactions every time.

Enhancing Data-Driven Decisions

In today’s dynamic real estate market, technology plays a pivotal role in enhancing data-driven decisions, leading to uneventful success.

By leveraging data visualization, you can uncover trends and make informed choices seamlessly. AI-powered predictive analytics flag opportunities early, allowing proactive steps that keep tenant engagement high.

The precision offered by these tools minimizes disruptions and streamlines operations.

| Technology | Purpose | Emotion Evoked |

|---|---|---|

| AI Predictive Analytics | Early Opportunity Detection | Confidence |

| Data Visualization | Trend Identification | Clarity |

| Tenant Engagement | Seamless Interactions | Satisfaction |

With hyper-local market intelligence, you can pinpoint hotspots while real-time risk assessments protect investments. Such insights keep you ahead, empowering confident decisions with ease.

Spotting trends before they blossom guarantees uneventful success in a highly competitive environment.

Identifying Top Markets for Consistent Returns

Picture yourself excitedly exploring the best real estate markets in the U.S., and you’ll quickly see why these top markets stand out for consistent returns.

Dallas–Fort Worth shines with its undeniable institutional momentum. Compare this with Miami, Brooklyn, and Jersey City, where vibrant coastal economies attract savvy investors.

Phoenix and Tampa–St. Petersburg prove irresistible for those eyeing the Sunbelt’s growth corridors. You’ll notice regional shifts as San José and San Francisco regain their tech-centered allure.

But don’t overlook the Midwest: Cleveland, Indianapolis, and Columbus offer affordable opportunities with steady growth.

In the Sunbelt, Nashville and Charlotte thrive on population boosts, while Houston’s industrial crown glows brighter.

Meanwhile, Madison and Chicago improve in rankings, offering promising prospects in the Midwest.

Risk Management Through Diversification

Hey there! When it comes to managing risk in the real estate world, it’s all about keeping a balanced portfolio and not putting all your eggs in one basket.

Think of it like mixing up ingredients in a recipe—combine a little bit of residential with a sprinkle of commercial properties. This way, if one market stumbles, you’ve got the others to keep things steady.

Also, consider spreading your investments across different U.S. regions. It’s like having a safety net that catches you when local market dips try to shake things up.

Now, let’s dive into the next section where we’ll explore even more strategies to keep you ahead of the curve!

Portfolio Asset Allocation

When you’re building a successful real estate portfolio, it’s not just about picking properties—it’s about balance and variety. You need to manage risk through diversification by mixing asset types and locations. This keeps your investments stable. Think of liquidity management and risk assessment as your guide.

| Asset Type | Allocation (%) |

|---|---|

| Residential | 40 |

| Commercial & Industrial | 35 |

| REITs & Crowdfunding | 15 |

Residential properties offer steady income. Commercial spaces promise growth. REITs provide liquidity and adaptability. It’s like painting with different colors to avoid monotony.

You’ve got to diversify: invest in urban and suburban locales. This spreads risk and taps into demand. Use variety for stability, harnessing the strength of each asset class without placing all your eggs in one basket.

Market Exposure Limits

Let’s plunge into setting market exposure limits to manage risk through diversification in your real estate portfolio. By conducting a proper risk assessment, you can adjust your investment strategy to maintain financial stability.

Keep an eye on regulatory compliance, ensuring all guidelines for credit limits are met and focusing on sector diversification.

Asset allocation helps reduce risk; set exposure limits for various real estate sectors to match your risk tolerance. Use performance metrics to regularly assess how your investments are doing. Understanding these can help you respond quickly to market changes.

Managing risk isn’t just about minimizing loss; it’s about making smart, informed choices. Stay within limits, and real estate success will feel steady and rewarding, not turbulent.

Operational Excellence as a Cornerstone

Operational excellence in real estate is like building a strong foundation for success. It’s about using operational frameworks and process standardization to reduce costs. By enhancing skills and aligning teams, you can traverse complexities seamlessly.

Performance metrics alongside vendor management play a key role. Governance structures help align strategy across units, while technology adoption speeds up processes, contributing to cost control and facilities management efficiency.

Here’s a quick snapshot:

| Element | Benefit |

|---|---|

| Operational Frameworks | Streamlined processes |

| Skills Enhancement | Greater team efficiency |

| Vendor Management | Reduced service costs |

| Technology Adoption | Improved work-order throughput |

| Governance Structures | Strategic alignment and execution |

Operational excellence helps you maintain a predictable cash flow, paving the way for sustained growth and resilience in real estate.

The Power of Insight and Agility

Revealing the power of insight and agility in real estate gives you a competitive edge. Insight generation through AI-driven models enhances accuracy in pricing and tenant behavior predictions. You can use these insights to adjust strategies dynamically, improving lease renewal rates by targeting at-risk tenants.

Agile responses, like flexible capital structures, allow you to seize opportunities in transitional assets and distressed markets swiftly. Demand-forecasting tools enable precise timing for acquisitions or dispositions, helping you stay ahead of market moves.

Faster decision-making, bolstered by real-time dashboards, aligns teams and reduces delays. High-frequency data reveals micro-demand shifts, allowing you to refine leasing strategies and preserve asset value.

Leveraging Job Growth for Market Confidence

Though the road to market success can be challenging, leveraging job growth can ignite your market confidence and propel you forward. Focus on areas where employment surges, such as tech and AI hubs—California, Texas, New York, and Florida lead the charge.

You’ll notice job market fluctuations influence where people move, and regional job gains guarantee economic resilience. Increased employment leads to higher rental yields and boosts home sales.

This isn’t just a local trend; foreign investors also spot these opportunities, leading to robust market activity. Seize these moments where labor income rises, making it easier to qualify for mortgages.

Strong job markets stabilize housing, leading to smoother, less volatile prices. Accept the cycle of growth for confidence in your real estate ventures.

The Influence of Global Economic Conditions

As the U.S. economy stands tall, it’s showing an impressive strength that leaves a mark on the global stage. With such economic resilience, global growth is fueled by the U.S., inspiring confidence in market stability.

You’re witnessing a robust investment climate despite ongoing tariff impacts and supply chain challenges.

Let’s break it down:

- Tariff Impacts: Despite these, the U.S. maintains global leadership, showing strategic adaptations in markets.

- Investment Climate: A low-interest-rate environment bolsters optimism in commercial real estate transactions.

- Geopolitical Tensions: The U.S. navigates these tensions, ensuring market stability.

- Property Trends: Asset performance improves as reindustrialization and defense spending drive industrial demand.

Capitalizing on Build-to-Rent Opportunities

Imagine a world where renting feels like owning. In this thriving scene, BTR investment strategies emerge as a powerful tool. You can tap into the mid-teens billion-dollar capital flow by focusing on high-demand areas like Sun Belt metros.

Finding the right property means checking occupancy metrics. Aim for over 97% stabilized occupancy—a key sign of success.

BTR isn’t just another trend. It’s supported by remote work preferences and a shift toward suburban living. Demand climbs among renters wanting home-like amenities without ownership hassles.

Positioning yourself in this market means considering every angle, from competition to tenant retention rates.

With occupancy metrics often surpassing expectations, you’ll find that BTR combines opportunity with stability, offering substantial returns along the way.

The Resilience of Retail and Office Spaces

Retail and office spaces are proving they can bounce back. You’ve witnessed retail resilience with certain markets like Florida and South Carolina recovering quickly, showing strong demand and rising rents.

The office evolution is real, highlighting a shift towards premium spaces with flexible terms and green certifications.

Here’s how they’re adapting:

- Location Matters: Office spaces near vibrant retail areas become off-site amenities, driving demand.

- Smaller, Better Spaces: Companies lean toward renovated, right-sized areas that support fewer total square feet.

- Quality Over Quantity: Tenants focus on amenity-rich, trophy buildings for workspaces.

- Flexible Workspaces: Hybrid work boosts the need for adaptable, technology-enabled environments.

Together, this combo of retail and office transformation ushers in a promising future despite past challenges.

Demographic Trends Shaping Future Demand

Even though the housing market has faced many challenges, it’s clear that changing demographics are reshaping the demand environment in the U.S. You’ve got a complex mix of demographic shifts playing out.

Young adult renters are delaying homebuying due to rental affordability and economic pressures. Aging baby boomers are driving demand for senior living, leaning towards rental homes or multigenerational setups.

Meanwhile, migration patterns, influenced by policy changes, are altering where people choose to live.

This table shows key trends:

| Demographic Group | Dynamic |

|---|---|

| Young Adult Renters | Delaying homebuying |

| Aging Baby Boomers | Increasing demand for senior housing |

| Recent College Graduates | Slower household formations |

| International Migration | Declines affecting population growth |

| Overall Need | Rising demand for rental homes |

Understanding these factors helps you grasp future housing demand trends.

High-Quality Assets for Predictable Outcomes

If you want predictable outcomes in real estate, focus on high-quality assets. These assets, featuring high-end finishes and sustainable materials, guarantee enduring value and appreciation.

Here’s how you can make certain your investments stand out:

- Choose Infill Locations: Seek areas with high barriers to entry. Limited supply in these zones minimizes competition, boosting your asset’s security and value.

- Opt for Affluent Neighborhoods: These areas promise higher rents and steady appreciation, buoyed by proximity to amenities like schools and transit.

- Demand Strong Construction: Prioritize buildings with impeccable construction. High-end finishes and robust materials eliminate future surprises, ensuring durability.

- Embrace Sustainability: Use sustainable materials and energy-saving measures. These choices meet regulations, add value, and appeal to eco-conscious tenants.

The Significance of Strategic Partnerships

Strategic partnerships have become a game-changer for real estate success, providing access to unique skills and markets, adding excitement to the investment journey. You’re not just investing; you’re making smart connections.

Teaming up with local operating partners boosts execution and returns.

Explore this table for insights:

| Category | Trend | Example |

|---|---|---|

| Access to Specialized Knowledge | 24% prioritize joint ventures | Ontario Teachers’ Pension Plan |

| Joint Ventures | Pivot for liquidity, risk | Blackstone-Vanguard alliance |

| Market Expansion | New geography access | Easterly’s tech expertise |

Strategic alliances and market partnerships create opportunities in high-growth areas like senior housing. U.S.-based REITs leverage these partnerships, working with private capital for enhanced scalability.

Assessment

When you do real estate right, it’s like having a steady hand and making smart moves.

You know the saying, “slow and steady wins the race”?

Well, that’s totally the case here.

Focus on those long-term goals and lean into those data-driven insights.

You’ll find peace of mind while others are chasing the next big thrill.

It’s about building your path with care and forming strategic alliances.

Remember, you don’t need fireworks for success to shine.

With patience and understanding, you craft a legacy that lasts.

Now, that’s something to be proud of, isn’t it?