AirBNB vs. AirBNB Rental Arbitrage (Comparison In Short Term Rental Liability & Profitability): AirBNB or AirBNB Arbitrage? Which strategy is best for you?

AirBNB, often referred to as a style of real estate investing, has revolutionized the concept of vacation rentals, offering a platform where property owners can list their spaces for short-term rentals. This business model has opened up a new avenue for earning passive income, particularly for those with properties in high-demand areas or popular tourist destinations.

The role of an AirBNB (VRBO, a similar, well-known platform) host involves managing rental properties, ensuring guest communication, and complying with local laws related to short-term rental regulations.

On the other hand, AirBNB Rental Arbitrage, sometimes known as the easiest way to make money from real estate without buying and owning a property, (ie: the practice of renting a property or multiple properties from AirBNB hosts and then subletting them) is a different approach to the traditional AirBNB business model.

Instead of owning the property, an individual or a company, often referred to as professional hosts, leases a property on a long-term basis from a property owner.

The property is then listed on the AirBNB platform for short-term rentals, often at a higher price than the long-term lease. This difference in price between the long-term lease and the short-term rental income is where the profit lies.

The first step in starting a rental arbitrage business involves market research to identify the best places with a high average nightly rate and a good average occupancy rate.

This could be in major cities like San Francisco or New York, or near attractions like Walt Disney World. It’s also important to understand the local market, including average monthly rent and short-term rental laws.

Due diligence is crucial in this business model. This includes understanding the local regulations, securing a long-term rental contract that allows for subletting as an AirBNB sublet, and ensuring a good team for property management.

It’s also a good idea to have liability insurance and to consider start-up costs such as a security deposit.

How to invest in real estate without owning property (Rental Arbitrage)?

In recent years, AirBNB Arbitrage, a business model that focuses on leveraging other peoples properties through sub-lease agreements instead of utilizing your own property, has become a popular side hustle, offering great potential for generating rental income without owning property.

This idea is similar to almost no liability instead of full liability.

It’s a dynamic pricing model that requires understanding different markets, managing guest communication, and keeping an eye on the average daily rate.

While it might seem like a great way to earn passive income, it’s not without its challenges. Legal issues can arise if the local laws or the long-term rental contract do not allow for an AirBNB sublease.

Also, the cash flow can be unpredictable as it depends on the demand for short-term vacation rentals, which can fluctuate based on the season and other factors.

Moving forward, you will see that being an AirBNB host and running an AirBNB Arbitrage business can be profitable ventures.

The best way to succeed is to do thorough research, understand the risks, and be prepared to put in the necessary work.

Whether you’re a real estate investor looking to leverage your own property or someone looking for a successful AirBNB rental arbitrage business, there’s a great place for you in the world of short-term rentals.

Understanding the AirBNB Business Model

AirBNB provides a rental platform where real estate investors can turn their properties into profitable vacation homes.

This is done by listing the property on the platform and renting it out on a short-term basis to AirBNB guests.

The property can be anything from a single bedroom in a house to entire apartment units, depending on what the investor owns or is willing to invest in.

The profit from AirBNB rentals comes from the difference between the rental income and the costs associated with maintaining and managing the property.

Costs can include mortgage or lease payments, property manager fees, cleaning and maintenance costs, and any fees charged by the platform.

The potential earnings can be substantial, especially for properties in popular tourist destinations or high-demand short-term rental markets like the Bay Area.

Having the Right Short Term Rental (STR) Connections

Real estate agents often play a crucial role in helping investors find the right place to invest in. They can provide valuable insights into the real estate market, including the best practices for maximizing rental income and minimizing costs.

An online course can also be a valuable resource for learning more about the ins and outs of the AirBNB business model.

The profitability of an AirBNB rental business can be affected by several important factors. The location of the property is one of the most critical.

Properties in popular tourist destinations or areas with high demand for short-term rentals can command higher prices and have higher occupancy rates, especially during the peak season.

The quality and condition of the property also matter. Properties that are well-maintained and offer good amenities can attract more guests and command higher prices. A little bit of investment in improving the property can go a long way in increasing its profitability.

Another factor is the ability of the investor or the property manager to manage the rental business effectively. This includes everything from setting the right price to managing bookings, dealing with guests, and handling any issues that arise.

The good news is that there is a wealth of short-term rental data available online that can help investors make informed decisions. A simple Google search can provide a lot of information about the average rental rates, occupancy rates, and other important factors in different markets.

While the AirBNB business model offers much profit potential for real estate investors, it also requires careful planning and management. It’s not just about owning a property and listing it on AirBNB.

It’s about understanding the market, managing the property effectively, and constantly adapting to changes in the market and the platform.

AirBNB Arbitrage is a unique twist on the traditional AirBNB model. Instead of owning a property, the individual or company, often referred to as rental arbitrage hosts, rents a property on a long-term basis and then lists it on AirBNB as a short-term rental. The goal is to rent the property at a higher rate on a short-term basis than what is being paid for the long-term rental.

The costs associated with AirBNB Rental Arbitrage can include long-term lease payments, any fees for breaking the lease if necessary, cleaning and maintenance costs, and the fees charged by the AirBNB platform. The potential earnings come from the difference between the short-term rental income and these costs.

For example, if a rental arbitrage host leases a two-bedroom house in a popular tourist destination for a long-term rental rate of $2000 per month, and then rents it out on AirBNB for an average of $150 per night, the potential earnings can be substantial. If the property is rented for 20 nights in a month, that’s $3000 in rental income, resulting in a profit of $1000 for the month, minus any additional costs.

The profitability of an AirBNB Arbitrage business can be influenced by several factors. The location of the property is crucial. Properties in popular tourist destinations or areas with high demand for short-term rentals can command higher prices and have higher occupancy rates.

The quality and condition of the property also matter. A property that is well-maintained and offers good amenities can attract more guests and command higher prices.

Another important factor is the terms of the long-term lease. The lease should allow for subletting, and the cost of the lease should be low enough to allow for a profit margin when the property is rented out on a short-term basis.

Managing an AirBNB Arbitrage business effectively is also crucial. This includes everything from finding the right property to lease to setting the right price, managing bookings, dealing with guests, and handling any issues that arise.

AirBNB Arbitrage can be a profitable venture for those who understand the market and are willing to put in the work to manage the business effectively. It offers a way to get into the short-term rental business without the need to invest in owning a property.

Comparing AirBNB and AirBNB Rental Arbitrage

When comparing AirBNB and AirBNB Arbitrage, it’s important to consider the differences in profit margins, cash flow, risks, rewards, and the suitability of each model for different types of investors.

In terms of profit margins, both models have the potential to generate significant income. However, the exact amounts can vary greatly depending on a variety of factors, including the location and quality of the property, the demand for short-term rentals in the area, and the effectiveness of the property management.

For cash flow, AirBNB typically provides a more steady and predictable income, as it is based on the long-term rental of a property that the investor owns. On the other hand, the cash flow from AirBNB Arbitrage can be more variable, as it depends on the difference between the long-term lease cost and the income from short-term rentals, which can fluctuate based on demand and seasonality.

In terms of risks and rewards, owning an AirBNB property involves the risks associated with property ownership, such as maintenance costs and property market fluctuations. However, it also offers the potential rewards of property appreciation and a steady rental income.

AirBNB Arbitrage, on the other hand, involves the risks associated with leasing a property, such as the possibility of the lease being terminated or the rent being increased. However, it also offers the potential rewards of a high-profit margin if the property can be rented out at a significantly higher rate on a short-term basis.

As for the suitability of each model, owning an AirBNB property might be more suitable for investors who have the capital to invest in property and who prefer a more steady and predictable income. AirBNB Arbitrage might be more suitable for those who prefer a less capital-intensive investment and who are comfortable with a more variable income.

At this point, you can see both AirBNB and AirBNB Arbitrage offer unique opportunities for real estate investing. The best choice depends on the individual investor’s financial situation, risk tolerance, and investment goals.

quick facts

Airbnb and Airbnb arbitrage offer different approaches to property owners looking to maximize their profits.

The average Airbnb rate in July tends to vary depending on the location and demand, making it a key factor for apartment owners to consider.

While traditional apartment rental listings may provide stable income, they might not match the income potential of Airbnb rentals.

However, property owners must consider additional expenses such as cleaning fees, maintenance costs, and service fees that could affect their overall profitability.

On the other hand, Airbnb arbitrage involves leasing a property solely for the purpose of listing it on Airbnb.

This investment property strategy enables owners to utilize platforms like RealPage Market to identify high-demand locations and optimize Airbnb occupancy.

When this approach is implemented, apartment owners can benefit from increased rental rates and maximize their profits in a competitive rental market.

Case Studies

While specific case studies with mathematical figures are not readily available, we can still discuss hypothetical scenarios based on general knowledge and industry averages.

These examples should provide a good understanding of how successful AirBNB and AirBNB Arbitrage businesses operate and what kind of results they can achieve.

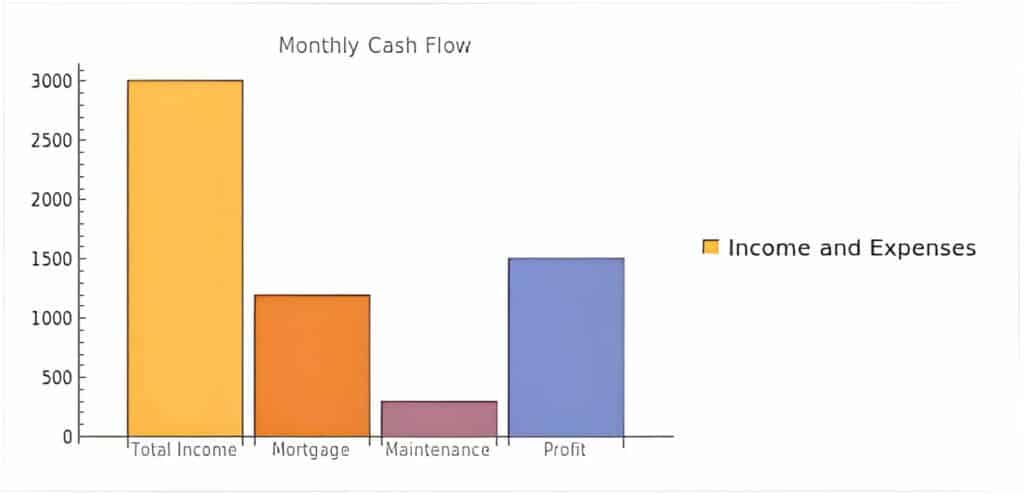

AirBNB Case Study

Consider an investor who purchases a property in a popular tourist destination. Let’s say the property costs $300,000, and the investor puts down 20% ($60,000) and takes out a mortgage for the rest. The monthly mortgage payment is around $1,200, and the investor spends an additional $300 per month on maintenance, utilities, and other costs.

The investor lists the property on AirBNB as a short-term rental and manages to rent it out for an average of 20 days per month at a rate of $150 per night. This results in a monthly rental income of $3,000.

Subtracting the mortgage payment and other costs, the investor makes a monthly profit of $1,500, or $18,000 per year. This represents an annual return on investment of 30% on the initial $60,000 down payment.

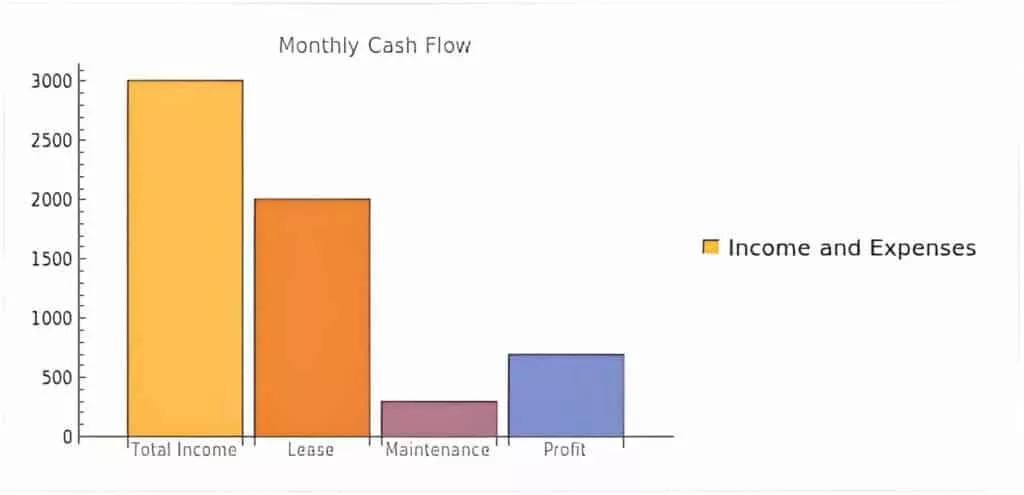

AirBNB Arbitrage Case Study

Now consider a rental arbitrage host who leases a similar property in the same location for a long-term rate of $2,000 per month. The host also spends an additional $300 per month on cleaning, utilities, and other costs.

The host lists the property on AirBNB and manages to rent it out for the same 20 days per month at the same rate of $150 per night, resulting in the same monthly rental income of $3,000.

After subtracting the lease payment and other costs, the host makes a monthly profit of $700, or $8,400 per year. While this is less than the profit made by the property owner, the host did not have to make a large initial investment to purchase the property.

These examples illustrate the potential profitability of both models. The actual results can vary based on many factors, including the cost and quality of the property, the demand for rentals in the area, and the effectiveness of property management.

Making the Right STR Choice

Choosing between AirBNB and AirBNB Arbitrage involves considering several factors.

Firstly, your financial situation is crucial. Purchasing a property for AirBNB requires a significant upfront investment, including the down payment, closing costs, and any necessary renovations.

On the other hand, starting an AirBNB Arbitrage business requires less upfront capital, as you’re not purchasing the property, but you’ll need funds for the security deposit and initial lease payments.

Secondly, consider your risk tolerance. Owning a property comes with risks such as property damage, market fluctuations, and potential vacancies. With AirBNB Arbitrage, the risks include potential lease violations, sudden rent increases, or the property owner deciding to sell.

Thirdly, your time commitment and business skills are important. Both models require time and effort to manage, but AirBNB Arbitrage can be more demanding as you’ll need to manage relationships with both property owners and guests.

Finally, consider your long-term goals. If you’re interested in building equity and potentially earning income from property appreciation, owning an AirBNB property might be the right choice. If you’re more interested in a business that’s potentially scalable with less capital, AirBNB Arbitrage could be a good fit.

To maximize profits in both models, here are some tips:

- Location, Location, Location: Choose a property in a high-demand area for short-term rentals. This could be a popular tourist destination or a city with a vibrant business sector that attracts corporate rentals.

- Quality Matters: Invest in making your property appealing. This could mean tasteful decor, high-speed internet, or comfortable beds. Happy guests leave positive reviews, which can lead to more bookings.

- Pricing Strategy: Set competitive prices. Research what similar properties in your area are charging and consider using dynamic pricing tools that adjust your rates based on demand.

- Excellent Customer Service: Provide excellent service to your guests. Respond quickly to inquiries, resolve issues promptly, and consider going the extra mile with personal touches.

- Understand and Comply with the Rules: Make sure you understand and comply with all local regulations regarding short-term rentals, as well as the terms of your lease if you’re doing AirBNB Arbitrage.

Remember, success in both AirBNB and AirBNB Arbitrage requires research, planning, and hard work. But with the right approach, both can be profitable ventures.

Closing Thoughts

The current real estate and tourism market presents promising opportunities for both traditional AirBNB hosting and AirBNB Rental Arbitrage.

With the rise of the gig economy and the shift towards more flexible accommodation options, short-term rentals are becoming an increasingly popular choice for travelers.

This trend, combined with the potential for significant annual revenue, makes both models attractive options for savvy investors.

AirBNB hosting offers the potential for long-term property appreciation and the ability to generate income from an existing asset.

It’s a good fit for those who already own property or have the capital to invest in real estate.

On the other hand, AirBNB Rental Arbitrage offers a way to enter the short-term rental market without the need for significant upfront capital.

It’s a more flexible model that can be a good fit for those who are willing to put in the effort to manage multiple leases and maintain good relationships with both property owners and guests.

Regardless of the model you choose, the key to success is thorough research and careful planning. Understand the market, know the costs, and be realistic about the potential earnings.

Consider the location of your property, as a good place in a high-demand area can command higher rental rates and have higher occupancy levels.

Also, don’t underestimate the importance of providing a great guest experience. Positive reviews can boost your property’s visibility on the platform, leading to more bookings and higher earnings.

Finally, remember that while both models offer great potential, they also come with risks. It’s important to understand these risks and to have a plan in place to manage them.

With the right approach, both AirBNB hosting and AirBNB Arbitrage can be profitable ventures that offer a unique way to participate in the booming short-term rental market.

So, whether you’re considering purchasing your first property or leasing a long-term rental property for arbitrage, the opportunity is there.

It’s up to you to seize it.

No related posts.