Key Takeaways

- Entertainment-driven housing shows reshaped public perception without improving investor readiness.

- Process-based learning declined as personality and lifestyle narratives took over.

- Investors who separate media perception from ownership mechanics gain a long-term edge.

Netflix did not just change housing TV. It changed how Americans perceived home ownership.

What looked like harmless entertainment quietly replaced process with perception and left millions feeling informed while being unprepared.

If you have watched years of housing shows and still feel unsure about ownership, this most likely explains why.

In this breakdown, you will see:

- How HGTV trained viewers to think in steps

- How Netflix rewired real estate into lifestyle theater

- Why understanding collapsed while visibility exploded

Here is where the real story begins…

The Shift Was Not About TV Channels

From Instruction to Interpretation

For decades, HGTV trained viewers to think about homes as physical systems.

Episodes repeated the same fundamentals again and again: budgets had limits, timelines slipped, materials mattered, and outcomes depended on execution. Viewers absorbed process through familiarity, not spectacle.

That framework changed as Netflix expanded into real estate programming.

Homes were no longer framed primarily as projects to be understood. They became symbols to be interpreted.

The emphasis shifted toward personalities, social dynamics, and lifestyle signaling. The house was no longer the lesson. The house became the backdrop.

This was not a simple format swap. It was a cognitive shift. Real estate stopped being presented as a discipline and started being presented as an identity.

Why This Change Went Largely Unnoticed

The transition happened quietly because it aligned with broader changes in how audiences consume media.

Streaming removed fixed schedules and replaced repetition with immersion. Viewers no longer watched one episode a week and reflected. They watched entire seasons in a sitting and absorbed narrative without pause.

Several forces reinforced this shift:

- Binge viewing compressed time, making complex processes feel immediate.

- Global distribution detached properties from local economics.

- Emotional storytelling replaced mechanical explanation.

The result was familiarity without structure. Viewers felt closer to real estate than ever, yet further from understanding how ownership actually works.

The channel did not change first.

The frame did.

How HGTV Trained a Generation to Think Operationally

The Original HGTV Formula

HGTV’s early success came from repetition, not spectacle. Shows followed nearly identical structures episode after episode, which conditioned viewers to expect a sequence rather than a surprise.

The camera lingered on planning meetings, trade coordination, material selection, and budget tradeoffs. Progress unfolded in stages, not highlights.

That repetition mattered. Viewers learned to associate real estate outcomes with preparation and sequencing. Even when results were optimistic, the path there was visible.

Common elements reinforced this operational mindset:

- Budgets were stated early and referenced often.

- Timelines were discussed before work began.

- Trade delays and material issues were treated as normal friction.

- Decisions had consequences that affected scope and finish.

What Viewers Actually Learned

Without explicitly teaching investing, HGTV still transmitted usable knowledge. Viewers developed an intuitive sense of order and dependency.

Demolition came before framing.

Framing came before finishes.

Cosmetic upgrades could not fix structural problems.

Over time, this created a baseline literacy. Many viewers could not execute projects themselves, but they understood that real estate outcomes were built step by step.

Homes were presented as systems that demanded coordination, not just taste.

This understanding extended beyond renovations. Buying, selling, and improving property felt procedural.

There was a beginning, a middle, and an end.

The Limits of HGTV’s Model

That instructional approach depended on linear television. As audiences aged and cord cutting accelerated, the repetition that once reinforced learning became harder to sustain.

Production costs rose while younger viewers drifted away from scheduled viewing altogether.

The network did not lose relevance because its message failed. It lost relevance because its delivery system eroded.

As viewership declined, fewer people were exposed to process-based real estate thinking at scale.

What remained was familiarity without reinforcement.

When that repetition disappeared, nothing equivalent replaced it. The operational lens faded, creating space for a very different interpretation of what real estate represents.

How Netflix Rewired Real Estate Perception

The Rise of the Docusoap Real Estate Model

When Netflix entered real estate programming, it did not copy HGTV’s instructional format. It replaced it. The focus moved away from how deals work and toward who the people are. Transactions became story arcs.

Listings became stages. Conflict, ambition, and personal identity carried the narrative forward.

In this model, explanation is unnecessary. Viewers are not asked to follow steps. They are asked to follow characters.

Real estate functions as context rather than content. The home exists to support the story, not to teach the process.

This approach proved efficient. Episodes required less technical depth, fewer logistical explanations, and shorter production timelines. Engagement came from emotional continuity rather than operational clarity.

Global Reach Changed the Message

Streaming scale amplified this shift. Real estate, once understood as local and market-specific, was presented to a global audience as a universal aspiration.

A listing in Los Angeles or Manhattan was no longer a regional example. It became a lifestyle symbol consumed equally by viewers thousands of miles away.

Local constraints disappeared from view:

- Financing structures were rarely explained.

- Regional income differences were not addressed.

- Market-specific risks were flattened into visual appeal.

Homes stopped representing assets tied to local economics and started representing status narratives that traveled cleanly across borders.

Engagement Efficiency Over Education

This format delivered high engagement at relatively low cost.

Unscripted real estate shows generated strong viewership without the expense of scripted drama or construction-heavy programming.

Emotional retention replaced informational density.

The tradeoff was subtle but meaningful.

Viewers spent more time watching real estate content than ever before, yet absorbed less about how ownership actually functions.

The genre became easier to consume and harder to learn from.

Real estate did not disappear from the screen. Understanding quietly did.

What Disappeared When Process Left the Screen

The Math That No Longer Appears

As real estate programming shifted toward narrative, the numbers quietly faded out. Financing structures stopped being discussed.

Carrying costs were rarely mentioned. Cash flow, reserves, and downside scenarios disappeared almost entirely.

Viewers still saw prices, but price alone does not explain ownership. Without context, a number becomes a prop.

The absence of math made transactions feel simpler than they are and reduced complex decisions to visual moments.

The Timeline Illusion

Streaming narratives compressed time. Deals appeared to move from listing to closing without friction.

Renovations unfolded cleanly from start to finish. Delays, permitting issues, financing setbacks, and contractor scheduling conflicts were edited out or skipped entirely.

This created a false sense of linear progress. Real estate began to look predictable and contained, even though real-world ownership rarely behaves that way.

Time stopped feeling like a variable and started feeling like an inconvenience that could be edited away.

The Consequence for Viewers

When process vanished, confidence filled the gap. Viewers felt familiar with real estate without understanding its mechanics. Exposure replaced repetition. Recognition replaced readiness.

The result was not ignorance. It was misalignment. People felt closer to ownership while being less prepared for its demands.

Real estate became something to watch confidently rather than something to approach deliberately.

That gap between perception and reality widened quietly, setting the stage for frustration, hesitation, and missed opportunities once viewers encountered real markets without a script.

HGTV Lost Viewers While Netflix Gained Influence

Diverging Audience Trajectories

As streaming expanded, linear television contracted. The change was not gradual. It was structural.

Younger audiences stopped organizing their time around cable schedules, and once that habit broke, it did not return. Real estate programming did not vanish.

It migrated.

One platform scaled globally while the other remained tethered to domestic cable distribution. Reach and influence began to separate.

Fewer people watched traditional renovation programming, while far more people absorbed real estate narratives through streaming interfaces designed for volume and immersion.

Cost Structures Forced Strategic Retreat

Production economics accelerated the split. Renovation-heavy formats became harder to justify as material costs rose, timelines stretched, and margins narrowed.

Shows that once relied on predictable production cycles faced delays that clashed with fixed programming slots.

As risk tolerance declined, experimentation slowed. Proven formats were repeated. Reruns filled schedules.

The pipeline narrowed. What had once been a system for teaching process became a system for preserving familiarity.

Meanwhile, streaming favored formats that minimized operational complexity. Fewer variables meant faster turnaround. Faster turnaround meant scale.

Scale reinforced influence.

The Resulting Vacuum

When instructional real estate media receded, nothing replaced it at scale. Entertainment filled the space by default, not by design.

Viewers continued consuming real estate content, but the content no longer reinforced how ownership works.

This vacuum mattered. Without repeated exposure to process, understanding atrophied. Real estate remained visible, but its mechanics slipped out of the mainstream conversation.

The genre survived.

The operational frame did not.

How Real Estate Media Power Shifted (2015-2025)

| Metric | Netflix | HGTV |

|---|---|---|

| Primary Distribution Model | Global streaming | U.S. linear cable plus limited streaming |

| Audience Reach Trend | Rapid growth from ~70M to 315M+ subscribers | Decline from ~94M households to sub-75M |

| Core Demographic Strength | Ages 18-49, global, binge-oriented | Ages 55+, primarily U.S. domestic |

| Real Estate Content Strategy | Personality-driven, lifestyle-focused docusoaps | Process-driven, renovation and transaction formats |

| Average Cost per Episode | ~$100K-$800K depending on format | ~$40K-$500K depending on format |

| Real Estate Content Scale | 35-40 original series, globally distributed | 60-70 series, high-volume linear rotation |

| Viewer Learning Outcome | Emotional familiarity and aspiration | Operational familiarity and process repetition |

| Narrative Emphasis | Identity, status, lifestyle | Budgets, timelines, sequencing |

| Economic Context Shown | Rarely | Frequently |

| Long-Term Viewer Effect | Confidence without structure | Structure without scale |

This table shows how real estate media shifted from teaching process to selling perception, increasing visibility while reducing practical understanding of ownership.

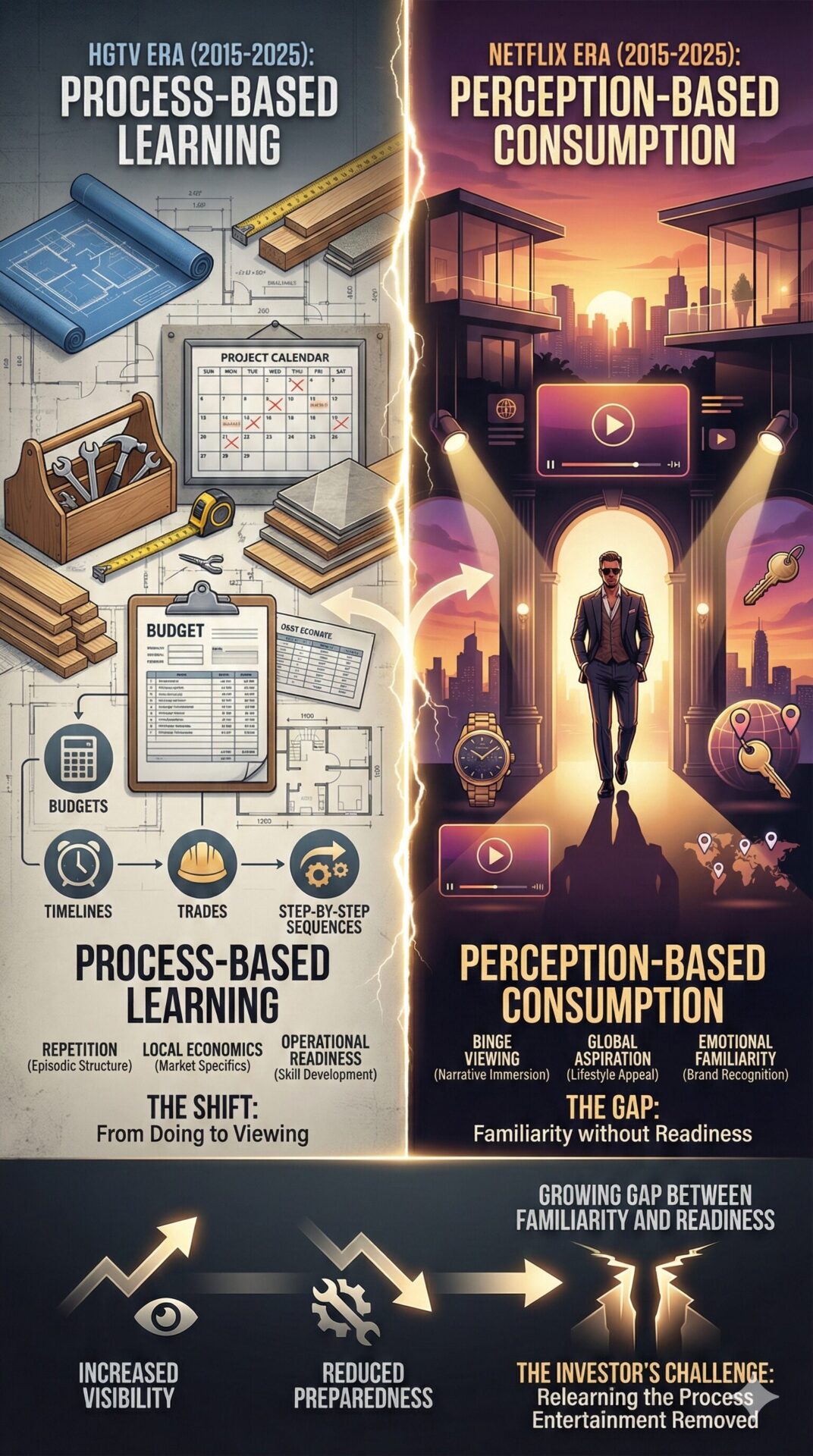

Process vs. Perception

A visual breakdown of how real estate media shifted from teaching process to shaping perception, and why ownership understanding fell behind.

How Media Shapes Ownership Beliefs

Entertainment Alters Risk Perception

When success dominates the screen, risk fades from view. Streaming real estate narratives favor clean outcomes, confident personalities, and upward momentum.

Losses, miscalculations, and long holding periods rarely receive sustained attention.

Over time, this conditions viewers to associate ownership with inevitability rather than probability.

Risk does not disappear. It becomes invisible. Without seeing downside play out repeatedly, audiences internalize a skewed version of reality where outcomes feel more certain than they are.

Visibility Does Not Equal Access

High-end markets and visually striking properties dominate modern real estate programming because they translate well on screen. The result is a steady diet of exceptional cases presented as familiar scenarios.

Viewers see inventory that feels abundant and transactions that appear attainable.

This visibility creates proximity without access. The properties feel close even when the financial path to ownership is not.

The gap between what is seen and what is reachable quietly widens.

Why This Matters for Investors

Media frames expectations before numbers ever enter the conversation. By the time spreadsheets appear, beliefs are already formed.

If ownership is understood primarily through entertainment, decision-making starts from an emotional baseline rather than a structural one.

Investors who recognize this dynamic operate differently. They understand that confidence shaped by media must be recalibrated by process.

In a market where perception often leads behavior, clarity becomes an advantage.

Where United States Real Estate Investor® Enters the Equation

Explaining What the Camera Never Shows

United States Real Estate Investor® exists in the space that modern real estate media no longer occupies. It focuses on what happens after the episode ends and after the excitement fades.

Ownership is presented as a system that unfolds over years, not minutes.

This includes realities that entertainment formats avoid:

- Post-closing expenses that reshape cash flow.

- Operational friction that compounds over time.

- Maintenance, management, and decision fatigue that rarely make good television.

By restoring these elements to the conversation, United States Real Estate Investor® re-frames real estate as a discipline rather than a spectacle.

Separating Awareness From Readiness

Exposure creates familiarity, but familiarity does not create readiness. Watching real estate content can make ownership feel close without making it achievable.

United States Real Estate Investor® draws a clear line between recognizing a process and being prepared to execute it.

Readiness is built through repetition, structure, and context.

It comes from understanding timelines, risk, and tradeoffs, not from identifying with personalities on screen.

Re-centering Real Estate as a Discipline

United States Real Estate Investor® approaches ownership as a long-term operating system.

The emphasis is placed on structure over excitement and outcomes over optics. By doing so, it restores balance to a media environment that has favored visibility at the expense of understanding.

This perspective does not compete with entertainment. It complements reality.

The Moment Entertainment Replaced Understanding and Ownership Lost Its Teacher

Netflix did not replace HGTV in the traditional sense. It replaced how Americans interpret what real estate represents.

The shift moved public understanding away from process and toward perception, reshaping expectations without strengthening capability.

As instructional media declined and entertainment scaled globally, a gap emerged between familiarity and preparedness.

United States Real Estate Investor® operates inside that gap, providing clarity where narratives stop short and restoring real estate to its proper role as a long-term system of ownership rather than a form of passive consumption.