Key Takeaways

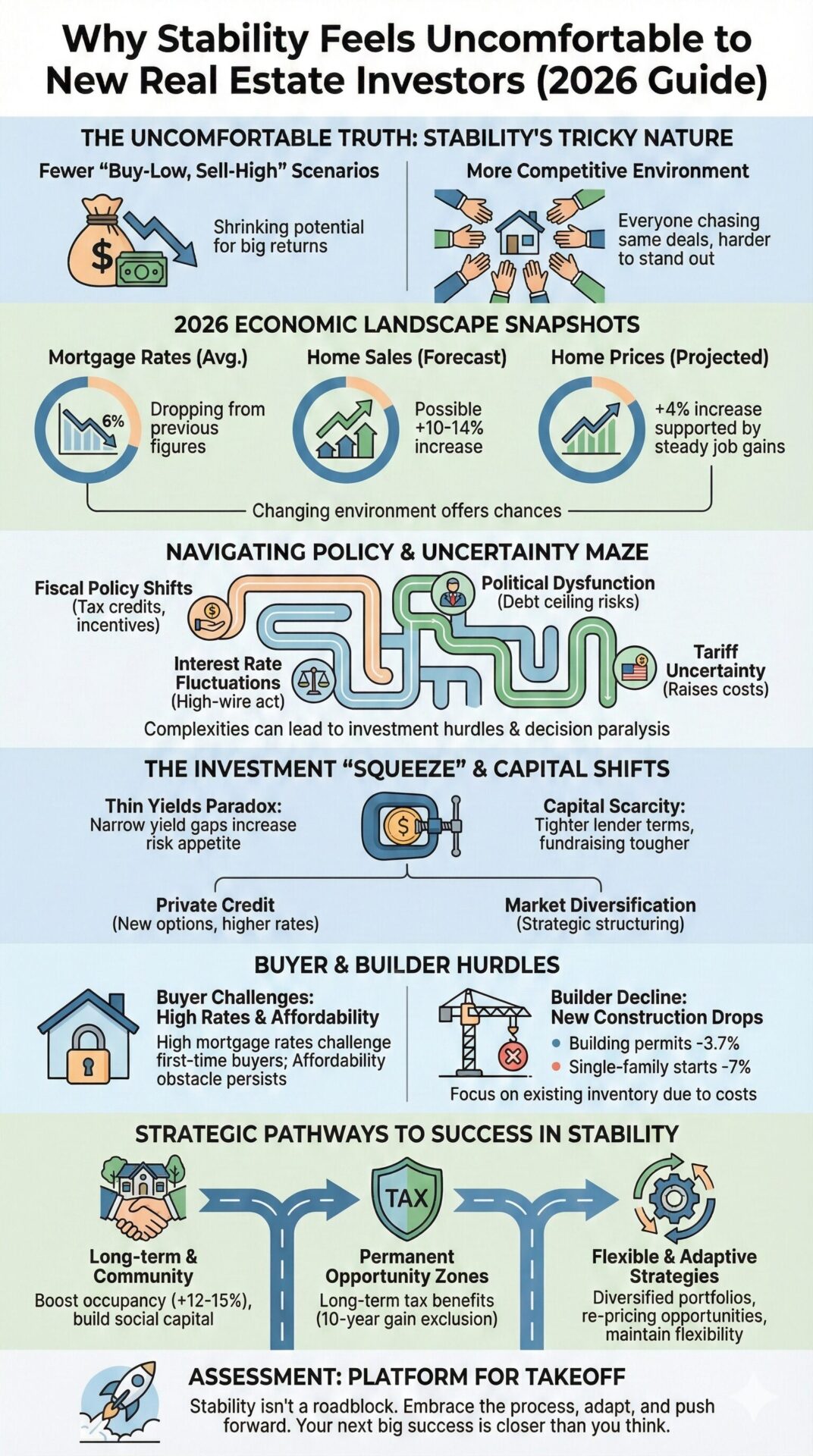

- Stable markets reduce opportunities for significant profit by limiting buy-low, sell-high scenarios.

- A more competitive environment in stable markets makes it challenging to find unique investments.

- Understanding the reasons behind the unease can help investors navigate these markets effectively.

Why Stability May Feel Tricky to Investor Beginners

You might think that stability in real estate is a good thing, but it can actually feel kind of tricky, especially for new investors in 2026. With stable markets, you may find fewer chances to buy low and sell high, shrinking the potential for big returns.

Not to mention, everybody’s chasing the same deals, making it tougher to stand out.

It might feel like a balancing act—but understanding why that feeling exists is the first step forward.

Navigating the Current Economic Landscape

While entering the real estate market might feel overwhelming, understanding the economic environment can make a big difference.

You’re stepping into a world brimming with emerging trends and fresh market opportunities. With the Federal Reserve cutting interest rates, borrowing costs decrease, spurring buyers.

Analysts suggest that this trend might ⓘ aid areas previously suffering from high foreclosures, as affordability improves. Expect mortgage rates to average 6% in 2026, dropping from this year’s figures. Forecasters remain optimistic about a possible 10–14 percent increase in home sales despite current interest rates.

Recognizing this trend allows you to seize potential property investments as affordability improves.

Steady job gains bolster these factors, supporting a projected 4% home price increase. Increased home sales and inventory expansion paint a promising picture for growth. Transaction volumes are set to climb steadily.

Stay informed and prepared; the changing economic environment is ready to offer you chances to succeed and grow in U.S. real estate.

Understanding Market Uncertainty in 2026

Navigating the complexities of fiscal policy changes and investment strategies in 2026 might seem like a high-wire act, but you’ve got this!

With interest rate fluctuations grabbing attention and international tensions looming, it’s all about staying agile and well-informed.

Now, let’s dive into the next section where we’ll explore these dynamics further.

Navigating Fiscal Policy Shifts

As you step into the world of real estate investing, understanding fiscal policy shifts can feel like trying to read a map without a compass—confusing but exciting. In 2026, policy adaptations like expanded Low-Income Housing Tax Credits and new middle-income housing credits affect the market.

These fiscal impacts create waves that ripple through the supply. Expect competitive conditions as you steer through streamlined permitting and infill development incentives. Rising home prices, despite affordability programs, demand your patience and strategy.

Mortgage rates slightly decline, yet the 6% mark stands as a pivotal shift. This reduced rate boosts confidence but doesn’t erase challenges.

As demand surges, aligning your investments with these policies opens opportunities to combat uncertainty and enhance your growth potential.

Investment Strategy Complexities

With the ever-changing fiscal policies in mind, you now stand at the threshold of understanding investment strategy complexities in the unpredictable real estate market of 2026.

Interest-rate volatility has grown, raising the cost of leverage, while mortgage-rate sensitivity dampens buyer demand.

You face high stakes in market analysis, as public-market signals and cross-asset competition shift capital flows, altering your investment strategy.

In multifamily properties, limited supply can be your ally, yet tenant preferences are evolving, complicating rent forecasts and occupancy growth.

Fundraising’s tougher too, with fewer options and stricter lender terms, making liquidity essential.

Predict pricing gaps between sellers and buyers using scenario stress tests with private data.

Despite rising costs, opportunities exist if you adapt quickly.

The Impact of Fiscal and Monetary Policies

You know, fiscal and monetary policies can really take new real estate investors on an emotional rollercoaster.

One moment you’re riding high, and the next you’re hit with the uncertainty of shifting interest rates and evolving fiscal measures.

It’s like you’re trying to play chess in a game where the rules keep changing.

But here’s the good stuff—embracing these complexities often uncovers investment opportunities that just might fit perfectly with your long-term goals, even when the ride feels a bit bumpy.

Curious about how to navigate these challenges strategically?

Let’s dive into the next section!

Policies Driving Uncertainty

When considering real estate investments in the U.S., fiscal and monetary policies are like the weather—powerful and sometimes unpredictable forces shaping the terrain. They have profound policy implications and can sway investment volatility, influencing your market sentiment and risk evaluation.

| Factors | Effects |

|---|---|

| Budget Deficits | Alters housing demand |

| Fiscal Programs | Shifts localized demand |

| Interest-Rate Paths | Impacts refinancing risk |

| Tax Incentives | Affects investor psychology |

Economic forecasts and regulatory impacts create financing challenges. In this uncertain climate, capital markets fluctuate, reflecting financing challenges and tax incentives shifts. Investor psychology changes as permanent fiscal changes dictate incentives and development economics. These elements blend unpredictably, nurturing caution but also opportunity. Keep evaluating risks while exploring possible rewards.

Capital Strategy Shifts

Although real estate investment might seem challenging in these times, understanding the capital strategy shifts can set you on a solid path.

You’ve got to grasp how fiscal and monetary policies affect capital allocation and risk assessment. Financing options now require careful navigation due to rising borrowing costs and credit availability.

The shift toward diverse capital sources like private credit offers new possibilities but at higher rates and tighter terms.

Market diversification and investor confidence rely on strategic deal structuring and pricing strategies. New tax reforms influence where and how you invest, changing your investment frameworks.

With an emphasis on stable-income assets, you can optimize your capital stack. By adjusting your approach, you’ll find a way forward amidst these changes.

Investment Decision Complexity

Given the twists and turns of fiscal and monetary policies, making investment decisions might feel like steering through a maze.

These factors can lead to investment hurdles and even decision paralysis.

Consider these complexities:

- Tariff uncertainty: It raises costs, dampening spending and affecting real estate demand.

- Interest rates: Though trending lower, they remain high, emphasizing cash flow but squeezing development viability.

- Tax policy shifts: Changes, such as increased estate tax exemptions, create uncertainty but opportunities too.

- Political dysfunction: It shrouds the market with risks, especially with the debt ceiling concerns.

You might find these factors overwhelming, impacting your decisions profoundly.

However, understanding these complexities can guide your path, transforming hurdles into opportunities over time.

Interest Rates and Investment Decisions

Despite the current uncertainty in the macro rate environment, understanding interest rates can empower your real estate investment decisions.

Higher-for-longer policies might seem intimidating, but by recognizing investment cues, you can identify market resilience opportunities.

Predicting future borrowing costs helps you traverse this terrain. Consider the projected 30-year fixed mortgage rates in the mid-to-high 5% range for 2026. These insights shape your residential deal expectations.

Beware of fluctuating Treasury yields and their impact on floating-rate CRE debt, which can keep borrowing costs high.

Adopt robust underwriting adjustments in response to rate volatility.

The Challenges of Raising Capital

Raising capital for real estate investments is quite a puzzle these days, isn’t it?

You’re faced with capital scarcity and increased fundraising difficulty due to market volatility and financing constraints. Investment hesitance reigns as investor confidence wavers.

Here’s what you’re maneuvering:

- Liquidity concerns bog down investment activity, making cash flow unpredictable.

- Risk aversion intensifies, causing cautious equity sources to hesitate.

- Competing sectors like energy and digital infrastructure vie for investor attention.

- Debt overhang from legacy loans persists, complicating new deals.

Finding the right funding is more complicated when financial conditions shift rapidly.

Yet, understanding these hurdles sharpens your strategy. By being persuasive and understanding liquidity concerns, you can bridge these gaps and emerge stronger in the competitive environment.

The Role of Foreign Investments

Have you ever noticed how much foreign investments shape the U.S. real estate markets?

It’s pretty fascinating.

Investors from around the globe navigate challenges like currency fluctuations and regulatory hurdles to strategically channel their capital into attractive sectors like logistics and senior housing.

This savvy approach ramps up competition in some areas, creating exciting opportunities for those ready to adapt and innovate.

Curious about what’s next?

Let’s dive into the following section!

Cautious Foreign Capital

Foreign investments in U.S. real estate play an important role in shaping the market’s terrain.

Investors bring cautious capital to American shores, maneuvering through the complexities of a giant market.

Why so cautious?

Uncertainty and high costs make them wary.

Still, there’s a world of opportunities awaiting you. Imagine what’s out there:

- Real estate transactions are booming, thanks to fierce bidding.

- Fiscal and monetary policies are breathing life into the capital markets.

- Inflation levels are finding balance, which attracts foreign interest.

- Digital tools make buying easier, faster, and more transparent.

Competing Global Investments

As you guide through the exciting world of U.S. real estate, you’re part of a larger global stage where investment opportunities compete fiercely for attention.

Given the flow of global capital, investors are seeking regions promising better returns and supporting global diversification. The U.S. has regained its appeal with many investors.

Tight competition within lucrative markets like New York and Los Angeles leads to yield compression, making investors explore secondary cities.

Currency shifts and geopolitical risks further challenge returns.

Investors must steer through these dynamics, including hedging strategies that impact net yields.

Risks of a Stable Market

Even though a stable real estate market might seem safe, it brings its own challenges for new investors. You’ll find liquidity concerns and operational risks lurking where you least expect them.

A market that doesn’t move much can mean:

- Fewer buying and selling opportunities, making quick exits tough when you need them.

- Longer hold periods, exposing you to risks like job losses or zoning changes.

- Compressed cash flow, meaning you’ll have to watch every dollar of income and expense.

- Increased competition for stable properties, driving prices up and yields down.

Stability might limit distressed buys and quick flips. A reduced chance for rapid appreciation shifts your focus to rental income. Your financial strategy needs to adopt patience and precision more than ever.

Long-term Deals and Community Involvement

A stable market might seem like the safest bet for new real estate investors, but long-term deals and community involvement offer avenues for real success. Engaging in community programming can boost occupancy by 12–15%, leading to greater tenant retention.

It’s like planting roots: your tenants are more likely to stay when they feel part of a community. Public support grows when neighbors see genuine investment in their well-being, reducing risk and encouraging loyalty. Developments with wellness programs report tenant retention rates 3–4 times higher than average.

People love feeling connected, and knowing their neighbors by name—67% in some communities—builds strong social capital.

Plus, word-of-mouth referrals lower marketing costs, leading to steady leasing and less vacancy risk.

Permanent Opportunity Zones

Imagine stepping into a world where Permanent Opportunity Zones not only offer you substantial long-term tax benefits but also a sense of community connection.

By simply holding onto your investments for a decade, you can completely exclude new gains from taxes. It’s like having a safety net for your financial future.

But hey, remember, getting the community on board is key because when your project succeeds, it’s not just your portfolio that’s growing—it’s the entire neighborhood thriving.

Now, let’s dive into what’s next!

Long-term Tax Benefits

How can permanent opportunity zones make real estate investing more appealing?

They offer long-term strategies with tax incentives that are just too good to pass up. With the new rules in place, you’ve got a clearer path to success.

Here’s how you can benefit:

- Deferral Benefits: You can defer capital gains by reinvesting in Qualified Opportunity Funds, giving you more room to plan.

- Gain Reduction: See a 10% gain reduction after 5 years, or a 30% reduction if your investment is rural.

- 10-Year Gain Exclusion: Hold for 10 years and exclude gains entirely from taxable income.

- Rural Enhancements: Special advantages for rural properties include a 30% step-up after 5 years.

These opportunities cater to a more predictable real estate journey, offering security alongside growth.

Community Buy-In Essential

Permanent opportunity zones aren’t just about taxes; they’re about community growth and resilience. For stability, community input and stakeholder engagement become essential. Including local voices guarantees developments fit real needs.

You need diverse input, from neighborhood reps to developers, creating balance. Strategic plans ask, “What’s needed here?”

Data-driven outreach helps vulnerable residents learn about investment opportunities and benefits.

Governors require communities to shape development strategies. Local plans now mirror resident visions. Banks and QOF managers prioritize investment that aligns with these needs, focusing on housing and inclusive growth.

Partnerships are key. Engaging with think tanks, law firms, and community experts guarantees benefits reach everyone. This collaborative approach builds trust and lays a strong foundation for long-term success in real estate investments.

The Thin Yields Paradox

Although investing in real estate seems promising, the thin yields paradox can puzzle new investors. With yield compression, your risk appetite increases as the narrow yield gaps make decisions tougher. Investor sentiment often shifts based on market timing, affecting return metrics.

Allocation strategies become vital when you face:

- Yield compression: Narrowing gaps reduce appeal versus rising bond yields.

- Risk appetite: Higher risks in real estate as bond yields fluctuate.

- Investor sentiment: Shifts with policy and economic changes.

- Market timing: Poorly timed investments can underperform.

Liquidity concerns arise, making it harder to adapt quickly.

Asset diversification becomes essential for balancing stability with higher yields. Understanding these dynamics helps create a robust strategy in the ever-evolving U.S. real estate market.

Barriers for First-Time Homebuyers

Steering through the real estate market can be tough, especially when you’ve got thin yields challenging your investment courage. First-time hurdles seem endless. Buyer demographics reveal fewer young people entering the market. Declining from 42% in 2007, only 21% were first-time buyers in 2025. The advanced median buyer age now sits at 40.

Rising down payments and tight inventory block younger families. Despite desires, many remain renters due to financial constraints.

| Metric | Value |

|---|---|

| First-time Buyer | 21% |

| Median Age | 40 years |

| Homeownership | 64.8% |

| Repeat Buyer Age | 62 years |

| Survey Response | 3.5% |

First-time buyers prioritize safety but often compromise due to high costs, opting for fixer-uppers instead. Stay focused: your moment will arrive.

Mortgage Rates and Housing Affordability

Hey there! So, you’re thinking about diving into the real estate market, huh?

Well, those high mortgage rates might seem like a mountain of their own, making the affordability factor just that much more challenging.

Even with predictions of rates getting close to 6%, it’s no secret that they can still stretch your budget thin. But don’t lose hope yet!

Even small rate decreases could give you a tad bit of relief with those monthly payments. So, hang in there because a little relief might be just around the corner.

Speaking of relief, let’s move on to the next section and see what other insights we can uncover.

High Rates Challenge Buyers

High mortgage rates can make buying a home feel like an uphill battle, especially for first-time buyers seeking stability.

You’re likely facing buyer hesitation due to affordability challenges. Here’s how you can envision the scenery and make sense of these obstacles:

- Projected Rates: Expect 5.9% to 6.4% by the end of 2026, according to Fannie Mae and others.

- Market Movements: Home sales are anticipated to rise modestly to 5.16 million by 2026.

- Economic Factors: Inflation remains above targets; this affects rate stability.

- Refinance Trends: A significant increase, moving from 26% to 35% by 2026.

Navigating these challenges involves understanding rates and market dynamics.

Stay informed and plan strategically to achieve your homeownership dreams despite the hurdles.

Affordability Obstacle Persists

Facing high mortgage rates, you might feel like you’re stuck in a storm. But understanding affordability trends eases your journey.

By late 2026, affordability could rise 3 percent, thanks to climbing incomes. Yet, this light at the end of the tunnel doesn’t eliminate all challenges.

Falling buyer numbers and persistent seller surplus create mixed buyer sentiment. Imagine this: 37.2 percent more sellers than buyers in November 2025.

But don’t lose hope—income growth outpaces house prices, boosting buying power.

In places like Miami and Atlanta, real buying power is improving, which might surprise you. As buyers gain ground, sellers lower prices and offer concessions.

U.S.-wide policy changes also strike a note of optimism, pointing to future affordability gains.

Supply and Demand Dynamics in 2026

Curiously, 2026 presents an exciting time for budding real estate investors like you to understand the evolving supply and demand dynamics.

You’ll notice supply fluctuations across markets. Renter preferences for smaller, affordable units remain due to lifestyle changes. Market segmentation makes regions unique—you should watch tech hubs for lower vacancies.

Expect stabilization challenges as increased investor appetite impacts lease-ups, especially for top-tier properties.

Here’s what shapes the environment:

- Tighter rental vacuums: National vacancy rates sit below long-term averages, making some areas competitive.

- Strong metro absorption: Sun Belt metros see growth, tightening space despite slow national completions.

- Short-term rental impact: More vacation rentals pressure long-term vacancies.

- Shift in tenant demand: Preferences lean towards affordability, influencing rent patterns.

Navigating these dynamics can guide your success.

The Decline of New Home Construction

The scenery of housing construction is changing, and you’re stepping into this scene at an interesting time. The decline in new home construction reflects a shift in homebuilder sentiment. Higher construction costs further dampen enthusiasm.

Here’s what the numbers look like:

| Metric | August 2025 |

|---|---|

| Building permits | 1,312,000 |

| Single-family authorizations | 856,000 |

| Single-family housing starts | 890,000 |

| Forecasted finish for 2025 | 909,000 |

This year, building permits dropped 3.7% since July. Single-family starts show a 7% dip. Builders are cautious, focusing on existing inventory due to costs and market challenges. You’re witnessing a unique period where stability still feels elusive in an evolving industry. Understanding these dynamics can guide your real estate journey with confidence.

Multifamily Housing Trends

Multifamily housing in the United States is entering a transformative era. As a new investor, you’re witnessing a dynamic shift where multifamily investment meets housing affordability challenges head-on. Fewer new units mean both opportunities and hurdles.

- Supply’s dipping: Completions drop to 300,000 units in 2026, a decline from 700,000 units in 2024.

- Rent is bouncing back: CoStar says rents will grow 1.9% by the end of 2026.

- Vacancy trends are shifting: Expected to fall below 10%, yet some properties face high vacancies.

- Populations are aging: Fewer young renters, but a rise in senior housing.

Embrace these changes as keys to revealing successful multifamily investments while guiding affordability concerns. You’re not just investing in properties; you’re shaping futures.

The Future of Rental Housing

Picture a world where rental housing is full of opportunity and fresh perspectives.

You’re standing at the brink of a transformative era in renter demographics and housing preferences. With seniors reaching over 80 million, expect a surge in demand for senior housing. Families renting have climbed to 37%, a reflection of changing needs and rising costs.

While immigration slows, 4.3 million more rental homes are essential by 2035. Expect rent growth to stabilize as construction falls, with apartment and single-family rents inching upward.

Regions like the Midwest and Northeast prepare for growth, while retention strategies strengthen market stability.

Future rental housing will adapt, offering amenities like homework pods and imagination centers. Welcome these changes, staying ahead in a dynamic environment.

Psychological Factors Affecting Investors

Imagine maneuvering the world of real estate investment, where your mind becomes both your best friend and your biggest challenge.

Investor psychology and behavioral biases play significant roles in shaping your decisions.

You’re juggling:

- Risk Tolerance: How much uncertainty can you handle? It decides if you shy away from volatility or immerse yourself in high-return, riskier ventures.

- FOMO: This fear pushes you to make impulsive choices during market buzz, sometimes leading to overpayments.

- Loss Aversion: The dread of losses often keeps you clutching underperforming properties for too long.

- Overconfidence: Believing you’re more skilled than you’re can spur ill-considered, high-risk actions.

Re-pricing and Investment Opportunities

Diving into the world of re-pricing and investment opportunities, there’s a lot to be excited about in the U.S. housing market.

Understanding repricing strategies is your key to revealing investment potential. Quick price reductions—averaging 4.9% for homes on the market for just 0–14 days—can boost sales, while longer listed homes might need steeper cuts.

Sales are on the rise, with existing home sales expected to jump by 3% to 4.2 million.

With mortgage rates dropping to 6% from 2025’s 6.7%, you gain a competitive edge and enhance affordability.

Active listings are up 8.9%, presenting more choices.

Accepting these trends lets you traverse this dynamic environment, offering room for strategic growth and financial success.

Employee Retention Concerns

When it comes to keeping your real estate team intact, you’re facing some serious challenges.

You need to improve employee engagement and retention in a rapidly changing market. Turnover rates remain troublingly high, and workers seek alignment with organizational values.

To tackle this, consider:

- Retention strategies: Build clear career development paths to boost job satisfaction and reduce attrition drivers.

- Compensation fairness: Guarantee fairness in pay to prevent feelings of inequity affecting your retention.

- Workplace culture: Cultivate an inclusive and supportive environment for stronger team connections.

- Feedback mechanisms: Collect regular feedback to adapt swiftly and enhance organizational effectiveness.

Strategies for Maintaining Flexibility

Although the real estate market can be unpredictable, having a flexible strategy is essential for success. You can start by building diversified portfolios to protect against downturns. Mix residential and commercial assets, spreading investments across different geographies.

Use flexible financing like adjustable mortgages or creative lease-options to guarantee you stay adaptable. Modular renovations enable quick property turnarounds, meeting changing market demands efficiently. Adopt scalable systems to enhance operating agility, allowing you to pivot smoothly when needed.

Operate with operational resilience by standardizing processes and tracking KPIs for data-driven tactical responses. Employ adaptive strategies to handle shifts by maintaining cash reserves and applying cross-asset hedges.

Assessment

Navigating the real estate world can be like taming a lively GPS.

It might feel challenging, but trust your skills to stay on course.

This phase of stability isn’t a roadblock; it’s a platform for takeoff.

Embrace the process, rely on your instincts, and keep learning.

Adapt and push forward because the future is full of chances.

Your next big success is closer than you think.

Stay confident and let your passion be your guide.