LISTEN TO THIS ARTICLE

Key Takeaways

The pandemic has greatly changed how people shop and work, leading to a decline in demand and a change in trends. The growth of online shopping and remote work has negatively affected conventional physical businesses and office spaces.

The commercial real estate (CRE) market is grappling with various financial uncertainties and risks such as stringent lending environments, potential decrease in property prices, and income strain.

Flexibility and creativity: Successfully steering through the post-COVID commercial real estate market requires adaptability and uniqueness.

Commercial Real Estate Financial Crisis (Post Pandemic 2023 Market Statistics and Future Analysis): The Financial Crisis Impacting Commercial Real Estate in 2023

In the aftermath of the COVID-19 pandemic, is U.S. commercial real estate in severe danger of absolute collapse?

There are for sure many of you who are wondering similar questions when it comes to your CRE portfolio.

In the wake of the global pandemic. the business property market has encountered unparalleled obstacles.

As the world continues to gradually bounce back, it’s vital to comprehend the ongoing effects of the financial crisis following the pandemic on this industry.

Let’s jump into exploring this fascinating topic together.

Overview of the Commercial Real Estate Market and the Impact of the Post-Pandemic Financial Crisis

Let’s first examine the state of the commercial real estate sector before COVID-19 hit. It was flourishing, marked by consistent expansion and escalating income.

However, the widespread outbreak of the pandemic led to the mandatory closure of businesses.

This, in turn, resulted in a major drop in the need for office areas, retail outlets, and hospitality venues.

Let’s initially scrutinize the commercial real estate sector’s condition before the pre-pandemic era.

The sector was blooming with steady growth and soaring revenue.

The pandemic’s rampant outbreak, however, triggered mandatory business shutdowns.

The consequence was a significant decrease in the demand for office spaces, shopping outlets, and recreational venues.

During that time, an analyst looking at the vacancy rate in the office sector observed a significant rise since the pandemic began.

It was noted that the demand for commercial real estate decreased, reflecting higher rates of office vacancy.

Real Estate Investment Trusts (REITs) or REITs have also experienced changes, and various REITs, which primarily hinged on office spaces, have had to revise their business models to remain viable.

The escalation of real estate debt, specifically commercial real estate debt, has become a significant concern for real estate investment.

Recent months have shown a shift in the Federal Reserve’s approach, with expected rate hikes over the next two years.

This shift is predicted to increase the cost of borrowing, further affecting commercial real estate loans and the ability to refinance existing real estate debts.

As of the first quarter of 2022, the commercial real estate sector’s investment sentiment remains cautious.

The last quarter showed a slight recovery with a 3.8 percentage point increase, indicating a slow yet hopeful resurgence.

Still, the combined challenges of rising interest rates and a high office vacancy rate weigh on the sector’s overall outlook.

Moving further into 2023, it is clear that it is a significant year for the commercial property market.

Even still, the financial havoc caused by the pandemic has profoundly affected companies and their capacity to spend on physical premises.

Numerous businesses have transitioned to work-from-home arrangements, diminishing their requirement for office spaces.

Retail businesses have encountered difficulties due to shifting consumer habits and the e-commerce surge.

Global Data Points

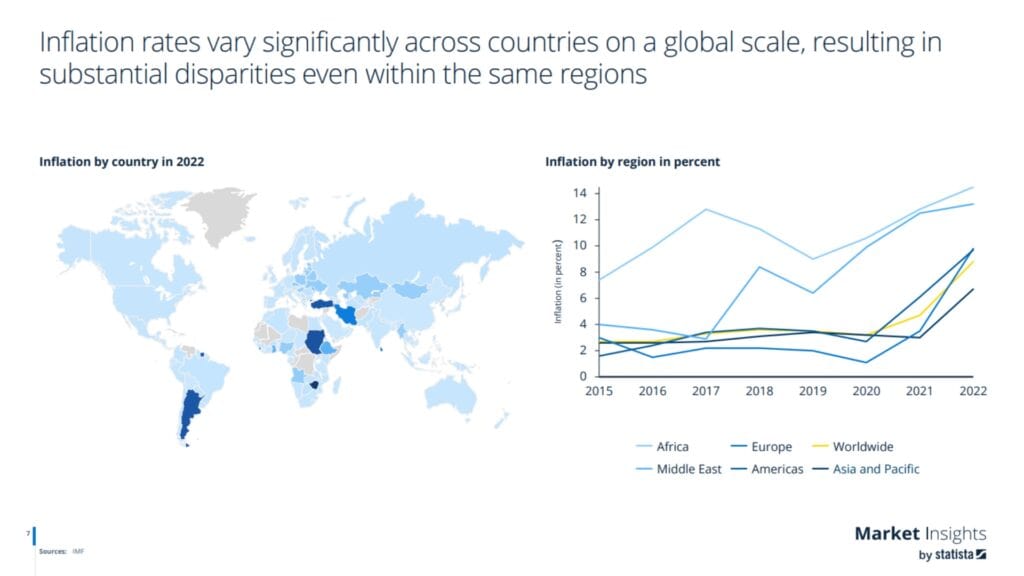

- Inflation by region in 2022: The inflation rates varied significantly across different regions, with Africa experiencing the highest inflation rate, followed by the Middle East, Europe, the Americas, and Asia-Pacific.

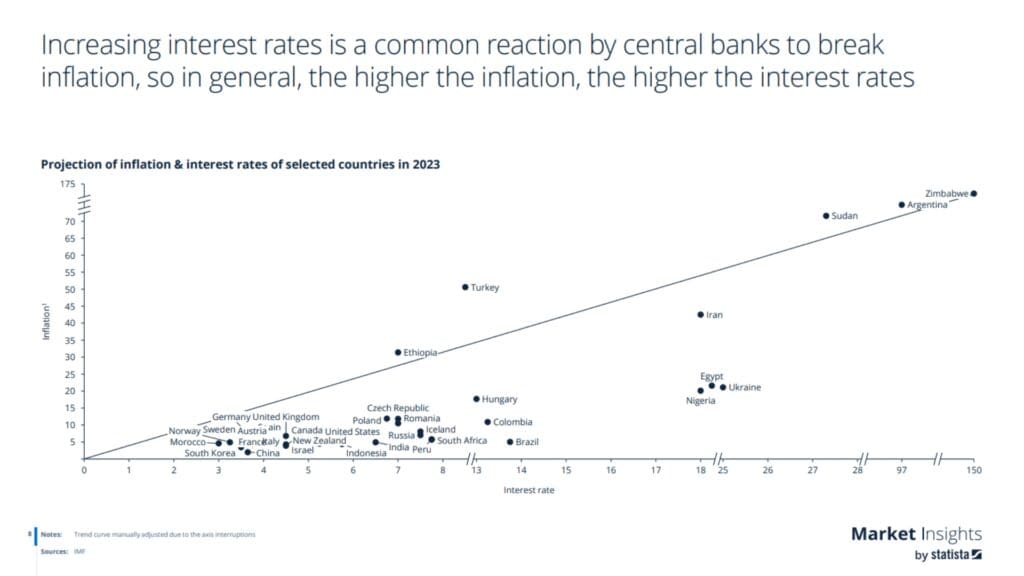

- Projection of inflation and interest rates of selected countries in 2023: Gathered documentation provides information showing the projected inflation and interest rates for various countries in 2023, highlighting the relationship between inflation and interest rates.

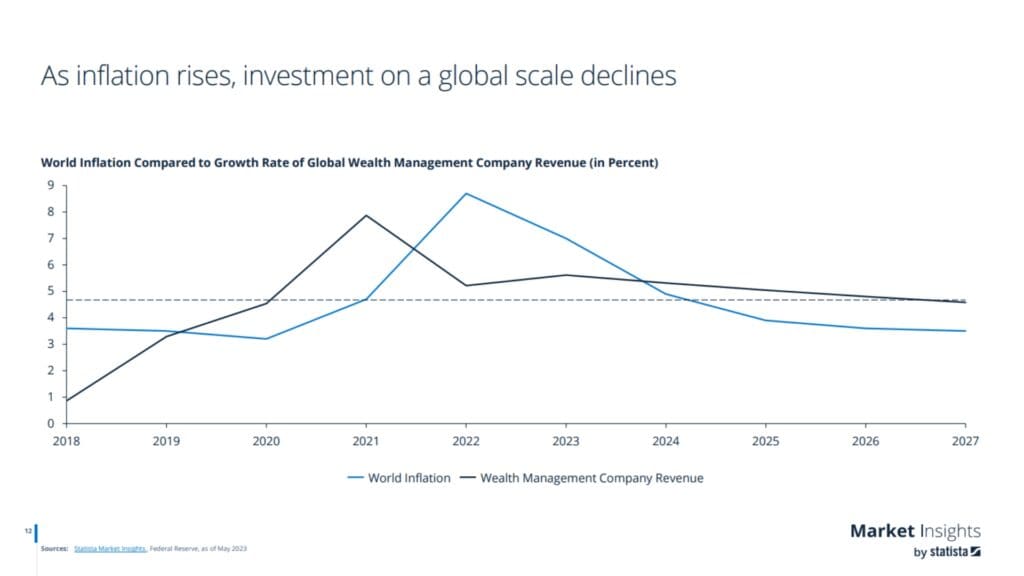

- Global inflation increase in the past years: The global inflation rate has significantly increased in recent years, mainly due to factors such as increased money supply, supply shortages, the Russia-Ukraine war, and demographic challenges leading to higher wages without a sufficient productivity increase.

Setting the Stage (Why 2023 is a Pivotal Year)

In 2023, various tendencies will likely influence the commercial real estate market.

These trends encompass the following:

Adaptation and Innovation: Companies must adjust to novel work methods and come up with creative solutions to cater to the changing needs of their customers.

Repurposing of Spaces: Given the abundance of unoccupied office buildings and retail outlets, there’s the necessity to reassign these spaces to other unique functions like shared workspaces, distribution centers, or multi-purpose developments.

Focus on Sustainability: The future of commercial real estate will be greatly influenced by environmental issues. Emphasis will be placed on sustainable methods and energy-saving constructions by both developers and investors.

Technology Integration: The use of technology, like smart building structures and virtual reality walkthroughs, will become critical in drawing in tenants and buyers.

The fiscal crisis resulting from the pandemic has greatly influenced the commercial property market.

Deeper into 2023, individuals in the industry need to adjust, innovate, and accept new trends to successfully navigate this changing terrain.

Goldman Sachs (The State of Commercial Real Estate Amid Economic Uncertainty)

As the globe begins to recover from the pandemic economies start to bounce back.

The business property market is confronting new trials and unpredictability.

Goldman Sachs, an international investment bank at the forefront of the industry, states it’s vital for both investors and those working in the industry to comprehend the present condition of the commercial real estate market.

Goldman Sachs’ Key Insights

Goldman Sachs offers several important perspectives on the present condition of the commercial property market:

Remote Work Impact: The surge in remote working has resulted in alterations in the demand for office areas. With businesses embracing blended work methods, the necessity for conventional office spaces might diminish, while the demand for pliable and cooperative working areas might increase.

Retail Transformation: The pandemic has hastened the transition to online shopping, affecting traditional physical stores. To cope with this change, retailers should adopt multi-channel approaches and create distinctive in-store experiences to draw in customers.

Industrial Boom: The expansion of online trade has sparked an increased need for industrial facilities, including warehouses and distribution hubs. As online shopping becomes even more popular, this trend is anticipated to persist.

The Economic Factors Affecting CRE

Multiple financial elements are impacting the commercial property market following the pandemic:

Interest Rates: Reduced interest rates have resulted in cheaper borrowing options, thereby promoting investment in the property market. Nevertheless, looming inflation could potentially elevate these interest rates in the future, consequently affecting the cost of financing.

Economic Recovery: The speed and intensity of the economic bounce-back greatly influence commercial real estate (CRE) outcomes. A vigorous recovery, characterized by a surge in consumer expenditure and business operations, could potentially spell good news for the market.

Supply and Demand Dynamics: Alterations in supply and demand can influence the worth of properties and the rates of rent. Comprehending the patterns in the market and recognizing regions with high demand but insufficient supply can result in profitable investment opportunities.

The commercial property sector is maneuvering through economic instability and changing market conditions.

Keeping up-to-date with important findings and economic variables is crucial for investors and professionals in the industry who aim to make knowledgeable choices in the post-pandemic commercial real estate market.

Capital Economics Weighs In: How CRE is Navigating the Financial Crisis

Capital Economics’ Perspective

Amid the financial turbulence brought about by the post-pandemic world, the commercial real estate (CRE) sector has encountered unparalleled obstacles.

Nonetheless, Capital Economics, a well-known economic research company, assures a glimmer of hope.

The firm anticipates that despite the uneven path toward recovery, the CRE arena holds the power to rebound with heightened strength and resilience.

Capital Economics emphasizes several crucial elements that lead to this positive forecast.

Primarily, they stress the significance of government aid and stimulation plans in balancing the market.

These strategies offer essential aid to floundering firms, aiding in the prevention of widespread bankruptcies and repossessions.

Capital Economics highlights that the shift towards teleworking and online commerce has opened up fresh prospects for commercial real estate.

With companies adopting a blended work approach, there is an anticipated growth in the need for adaptable office spaces and shared work environments.

The boost in e-commerce has escalated the need for distribution hubs and storage facilities.

Strategies for Navigating Crisis in CRE

To successfully overcome the financial crisis, professionals in commercial real estate must employ strategic methods.

Below are some crucial strategies to take into account:

Adaptability: In periods of ambiguity, adaptability is vital. Real estate professionals should be willing to delve into innovative business structures, as well as adjust their assets in response to fluctuating market needs.

Technology Integration: Adopting technology can optimize processes and improve the experience of tenants. The introduction of intelligent building systems, virtual tour options, and online leasing platforms can draw in technologically inclined tenants and boost productivity.

Diversification: Diversifying your investments among various property types and locations can help reduce potential risks. Putting money into sectors like healthcare facilities or industrial properties, which have demonstrated robustness amidst crises, can bring stability.

Collaboration: Establishing robust connections with renters, creditors, and professionals in the sector is imperative. Cooperative initiatives can give rise to creative resolutions and extend assistance in difficult times.

By applying tactics like these and keeping abreast of market trends, real estate professionals specializing in commercial properties can weather the financial storm and set themselves up for enduring success.

Although the financial crisis following the pandemic has created considerable obstacles for the CRE sector, there is still room for optimism.

Thanks to government aid, changing market needs, and tactical plans, the CRE industry has the opportunity for rejuvenation and prosperity moving forward.

United States Data Points

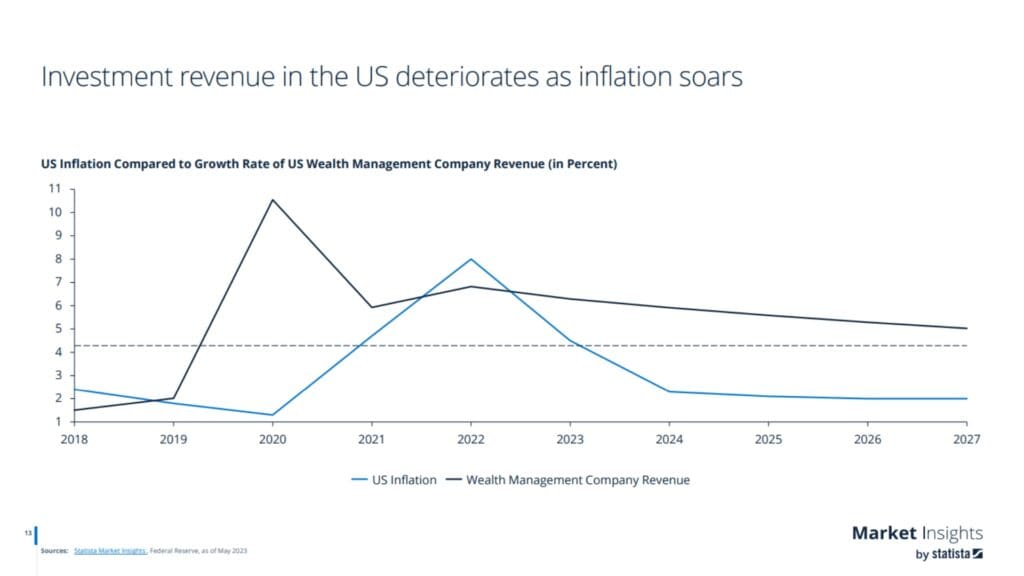

- US Inflation and Wealth Management Company Revenue: The growth rate of US wealth management company revenue has shown a decline as inflation in the country has increased. In 2023, the US inflation rate is around 6%, while the growth rate of wealth management company revenue is around 2%.

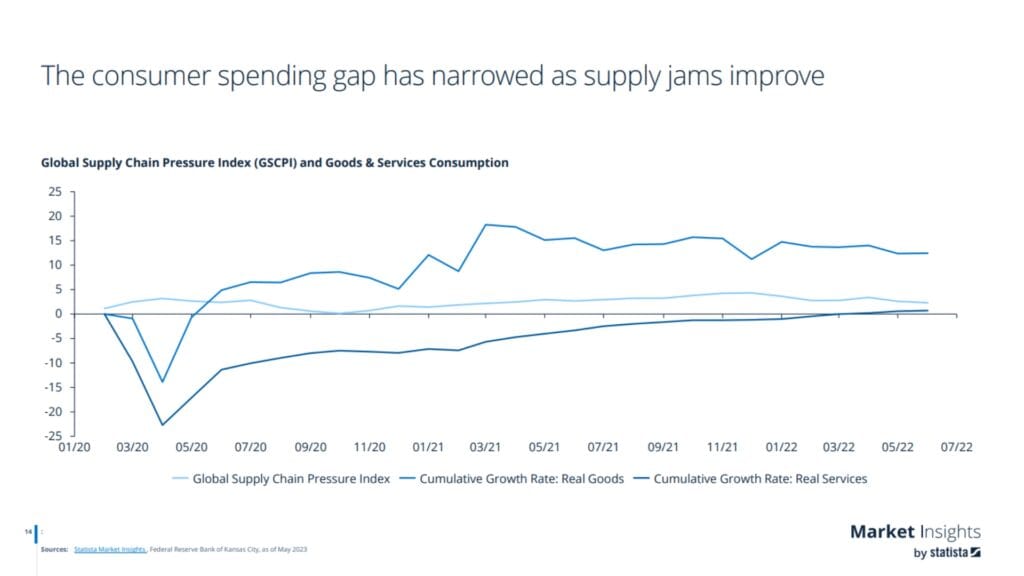

- Consumer Spending Gap: The Global Supply Chain Pressure Index (GSCPI) and Goods & Services Consumption chart show that the consumer spending gap has narrowed as supply chain pressures have improved. This indicates that as supply chain disruptions are resolved, consumer spending on goods and services is recovering.

- Impact of US Inflation on International Trade: High inflation in the US can fuel inflation abroad due to higher US export prices. This can lead to increased costs for countries importing goods from the US, which can contribute to inflationary pressures in those countries.

Inflation and Its Ripple Effect on Commercial Real Estate Valuations

Comprehending Inflation in Today’s Economic Climate

Inflation denotes the continual rise in the cost of goods and services over time.

As a crucial economic element, it can profoundly affect different sectors, particularly the commercial real estate business.

In the past few years, the worldwide economy underwent instances of inflation.

If you’re investing in the commercial real estate sector or owning a stake in it, comprehending the effects of inflation is vital.

Inflation signifies the persistent escalation of prices for goods and services with time.

Recognized as a critical aspect of economics, inflation can deeply impact various sectors, especially the commercial real estate industry.

Over recent years, occurrences of inflation have been experienced in the global economy.

Stakeholders and investors in the commercial real estate sector need to understand the implications of inflation.

Commercial property values are directly impacted by inflation, as well as the performance of commercial mortgage-backed securities.

As the chief investment officer would assert, the consistent rise in the prices of goods and services dramatically influences commercial real estate in the U.S., especially office and retail spaces.

It’s pivotal that potential increases in costs are considered, as investments are likely to default if not managed wisely.

Terms of current loans may need to be renegotiated in the coming years, particularly with regional banks and their respective loan-to-value ratios.

The economic environment faces the risk of higher interest rates, meaning borrowers would have to refinance at a higher rate.

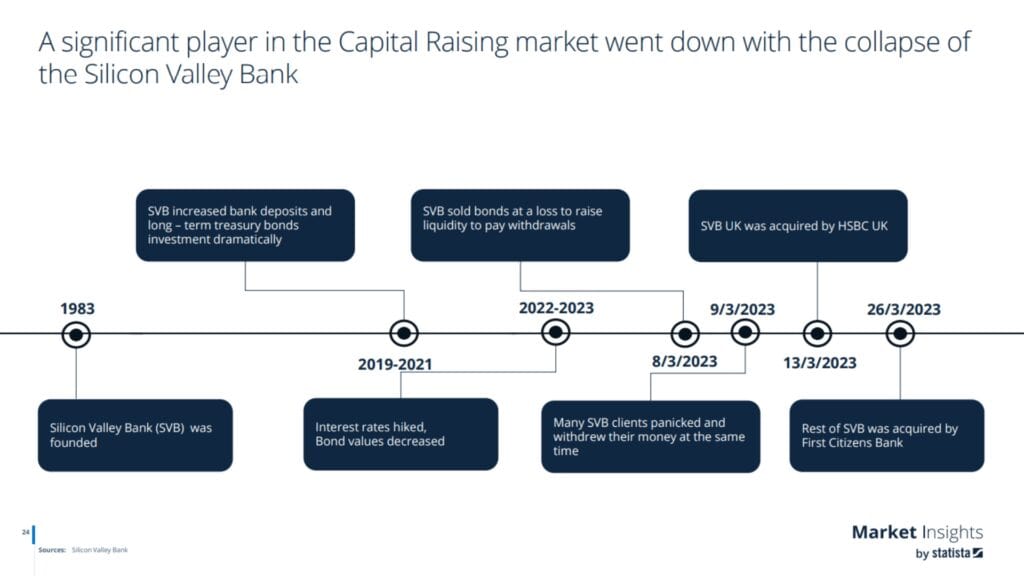

Silicon Valley Bank, and others alike, may enforce stricter lending criteria to offset this potential risk.

The residential real estate sector also faces the impact of inflation, as seen by a vacancy rate of 19%.

This is a higher rate compared to pre-pandemic levels, indicating rising vacancy rates within the industry.

This worrying trend extends to the multifamily and industrial sectors as well, as confirmed by a well-known research firm.

In the face of interest rate hikes and potential defaults, professional services advise caution and a comprehensive understanding of the economic landscape.

It necessitates persistent reassessments and renegotiations of current terms to mitigate risks and create a sustainable business model in this challenging economic environment.

How Inflation Impacts Asset Valuation

The effect of inflation on business property values can go either way, being beneficial or harmful.

Here are several crucial factors to ponder:

Increased Construction Costs: Inflation frequently results in increased building expenses owing to escalated costs of materials and labor. This could impact the profit margins of new projects and might necessitate higher rents to compensate for these elevated costs.

Rental Income Growth: Over time, inflation can potentially cause growth in rental income. As the prices increase, landlords can raise their rental rates. This could result in an increased cash flow and potentially enhance the value of their property.

Asset Depreciation: Conversely, inflation could diminish the value of fixed-rate loans that are employed to fund business properties. The decreasing buying power of money also reduces the actual worth of the debt. This situation can impact real estate proprietors who have taken out loans at fixed interest rates.

Market Demand: Inflation can affect the market’s demand for commercial real estate. As costs go up, companies might be more reluctant to grow or invest in new properties, causing a drop in demand and possible devaluation.

For those of you who are involved in commercial real estate, such as investors and stakeholders, it’s crucial to stay on top of inflation trends and comprehend their potential effects on your property values.

Keeping abreast of this information and adjusting your tactics accordingly can guide you through the market fluctuations following the pandemic and enable you to make educated investment choices.

The Rise of Hybrid Work (How It’s Changing the Way People Work in CRE Spaces)

The Shift to Hybrid and Fully Remote Work Models

The COVID-19 pandemic has fast-tracked the uptake of blended work patterns, in which employees divide their time between working from home and in commercial property spaces.

The transition has been spurred by the demand for adaptability, enhanced work-life equilibrium, and financial benefits for companies.

Hybrid work arrangements provide several advantages for both workers and businesses.

Employees benefit from the flexibility of remote work, yet still have the option to utilize shared spaces in commercial real estate settings.

Many studies have actually shown that this can lead to heightened creativity and productivity, as well as decreased travel time and costs.

On the flip side, employers have the opportunity to minimize costs related to office spaces, while still preserving a physical point for team alliance and client discussions.

Implications for Commercial Real Estate

The emergence of combined work patterns has crucial consequences for the commercial real estate sector.

As more firms embrace remote and adaptable work structures, the need for conventional office areas has declined.

This has prompted a change in the design and use of commercial real estate spaces.

Commercial property developers are now concentrating on designing versatile and adjustable areas that meet the evolving requirements of hybrid employees.

This entails integrating aspects like communal work areas, secluded conference rooms, and cutting-edge tech infrastructure to facilitate distant teamwork.

Even further, CRE operators are consistently investigating novel business models to appeal to tenants in this ever-changing environment.

This entails offering adaptable lease conditions, presenting amenities that improve the equilibrium between work and personal life, and allocating resources to technology solutions that facilitate uninterrupted remote work experiences.

As you can see, the emergence of hybrid work structures is revolutionizing commercial real estate spaces.

This work shift provides greater adaptability, enhanced efficiency, and economic benefits for companies, leading to modifications in the architecture and functionality of CRE spaces.

As this developing trend continues to gain traction, and as begrudging as the remote-work revolution seems to some large corporations, businesses, and CRE managers must adjust and welcome this evolving work style.

Market Conditions (A Deep Dive into Current CRE Trends and Forecasts)

As the world emerges from the pandemic, the CRE sector is confronting a novel blend of hurdles and prospects.

Comprehending the existing market scenarios and forthcoming forecasts is indispensable for investors, developers, and people working in the industry.

Current Market Snapshot

Despite economic instability, the commercial real estate market has demonstrated strength in the initial half of 2023.

Based on information from experts at CBRE Research, there has been a positive momentum observed in sectors like offices, industry, retail, multifamily dwellings, hotels, and data centers.

Workplace: The increase in remote work is leading to a growing need for versatile workspaces and team-oriented settings. Nevertheless, conventional work environments might struggle in the aftermath of the pandemic.

Industry: The surge in e-commerce has amplified the need for warehouses and distribution centers. The expansion of last-mile delivery services has moreover escalated the requirement for industrial properties situated in strategic locations.

Retail Sector: Although some traditional physical retail stores have faced challenges, there is a noticeable trend towards retailing that provides a unique experience and mixed-use facilities. It’s predicted that retail spaces that offer distinctive experiences and ease of use will see growth and success.

Multifamily: There is still a high demand for rental properties with elements such as cost-effectiveness and adaptability being the main contributors. Despite this, disturbances in supply chains have affected the building schedules and cost-efficiency in certain areas.

Hotels: The hotel sector has confronted considerable obstacles during the global health crisis. However, as travel bans start to lighten and customer assurance begins to enhance, it is anticipated that hotel capacity rates will slowly bounce back.

Data Centers: The growing dependence on cloud computing and data storage is driving up the need for data centers. With ongoing technological advancements, data centers are projected to take on an important role in backing numerous sectors.

Predicted Future Market Trends and Industry Insights

Experts within the commercial real estate sector have varying views on its future.

Some predict a firm resurgence and expansion, while others expect continuous difficulties and shifts in market trends.

Crucial aspects driving the future of the CRE market include inflation, interest rates, and government regulations.

Goldman Sachs’ Take on the Future of Malls and Office Buildings in CRE

Goldman Sachs’ Perspective on the Future of Shopping Centers

Goldman Sachs’ Global Investment Research has analyzed the present condition of commercial real estate and given future predictions regarding malls and office buildings.

Although office spaces have seen a significant drop in occupancy rates compared to other properties, the overall future scenario for CRE is not entirely gloomy.

Goldman Sachs has reported that regional malls, previously hampered by an oversaturation of ill-suited retail spaces, have now turned into some of the top-performing public real estate companies.

In their possession are robust balance sheets, the generation of a significant amount of surplus cash, and a continued display of solid operating outcomes.

Major players like pension plans and insurance companies – sophisticated entities with a long-term investment perspective – largely control the ownership of these regional malls.

Goldman Sachs Discusses the Progression of Office Environments

The Global Real Estate Financing Group of Goldman Sachs in Investment Banking recognizes the problem of outdatedness in the commercial real estate sector, notably concerning office spaces.

The market struggles with a considerable amount of antiquated stock. This has resulted in a decrease in occupancy rates for office structures.

Despite the obstacles, Goldman Sachs maintains that real estate may continue to provide an investment buffer.

While office properties are dealing with more significant problems, other types of properties within the CRE industry are looking more promising.

The downturn in occupancy rates for these properties is not as drastic.

To sum up, Goldman Sachs’ study indicates that despite the hurdles in the commercial real estate market, it is also packed with possibilities.

Regional shopping centers have evolved into high performers, and while office buildings may struggle with becoming outdated, other property categories present a brighter future.

How the Pandemic-fueled Financial Crisis Altered Investment Strategies in Commercial Real Estate

The commercial real estate industry’s current financial crisis caused by the pandemic presented never-before-seen challenges.

To survive these uncertainties and guarantee stability in the market over time, investors were required to modify their methods.

Investment Strategies Before and After a Crisis

Before the crisis, the primary focus of investors was high-risk, high-reward strategies, aimed at rapid profit turnovers.

However, the pandemic laid bare the inherent risks of these tactics. After the crisis, investors have pivoted towards investment strategies that are more conservative and robust.

Diversification: Investors are currently expanding their portfolios to include various asset classes and regions. This strategy lessens threats and decreases vulnerability to market changes.

Focus on Essential Sectors: The emergency has underscored the crucial significance of vital sectors like healthcare, logistics, and technology. Investors are currently focusing on properties in these sectors that have proved to be resilient during the global health crisis.

Adjusting Investment Plans for Robustness

Evaluating Risk Factors: Before making investing decisions, investors are carrying out in-depth evaluations of risks. They are contemplating various factors like terms of the lease, creditworthiness of tenants, and the market demand to secure long-term steadiness.

Embracing Technology: The health crisis hastened the uptake of technology in the business property sector. Investors are utilizing digital aids for managing properties, communicating with tenants, and analyzing data. This leads to more streamlined operations and knowledgeable decision-making.

Sustainable Investments: ESG (Environmental, Social, and Governance) elements have become more significant after crises.

Sustainable investments that observe ESG standards are now a priority for investors.

This approach not only promotes a more environmentally friendly future but also increases the value of properties and draws in tenants who are socially aware.

The financial crisis triggered by the pandemic has transformed investment approaches in the commercial real estate sector.

Currently, investors are emphasizing resilience, diversification, and sustainability to maneuver through uncertainties and guarantee sustained prosperity in the market.

Conforming to New Norms (How CRE is Responding to Changed Work Patterns)

In the aftermath of the pandemic, commercial real estate has had to significantly adjust due to changes in work patterns.

The trend of working from home and having flexible work schedules has led CRE firms to reassess their methods and adjust to the new reality.

Due to the shift in work habits, commercial sector firms are now concentrating on developing versatile spaces that address different work modalities.

Classic office configurations are being redesigned to incorporate flexible workspaces, cooperative zones, and technologically sophisticated facilities that enable offsite work.

These modifications are indicative of the increasing need for mixed work models that combine face-to-face and remote teamwork.

In addition, real estate companies dealing with commercial properties are adopting technology to improve tenant experience.

Techniques like virtual tours and 3D floor plans have become popular, enabling prospective tenants to view properties from a distance.

Sophisticated communication tools and intelligent building systems have also been incorporated for streamlined management and operations.

In addition, in the period following the pandemic, health and safety precautions have become critically important.

Companies in the commercial real estate sector are instituting strict cleaning procedures, enhancing air circulation systems, and integrating technology that requires no physical touch.

To attract tenants and adapt to evolving business requirements, they are also providing flexible renting conditions and competitive incentives.

Adhering to the new standards, companies in the Commercial Real Estate sector are acknowledging the significance of sustainability.

Structures are being constructed to fulfill energy-efficiency criteria, include renewable energy solutions, and encourage consciousness about the environment.

Commercial real estate is proactively adjusting to new work structures by developing flexible environments, endorsing technology, prioritizing health and safety, and advocating for sustainability.

These changes signify the industry’s dedication to fulfilling the changing requirements of companies and individuals in the aftermath of the pandemic.

Final Thoughts (Innovation and Potentially Resilient Outcomes)

As we focus on the future, we are quickly reminded of the vast potential and resilience inherent in innovation.

This is particularly true in the world of commercial real estate, an industry once perceived as rigid, traditional, and resistant to change.

Constantly on the move, commercial real estate investors have been driving progress and securing a potentially resilient outcome through continual adaptation and transformation.

They are significantly contributing to the economy with commercial real estate transactions reaching over $2.9 trillion in commercial mortgages in recent years.

Such profound numbers reflect the immense economic potential and opportunities held within this industry.

With the advent of financial innovation and increased featured technologies, commercial real estate transactions have evolved in significant ways.

An exciting evolution to watch is the rise of commercial mortgage-backed securities (CMBS), a type of mortgage-backed security backed by commercial mortgages rather than residential property.

This allows investors to invest in a broader range of property types, providing a greater level of diversification.

Think of it as distributing your eggs into different baskets – it’s allowing investors to distribute their risks while maintaining the potential for high returns.

Such an innovative tool in the industry is set to revolutionize its approach and sustain its continuous growth.

The road ahead for commercial real estate is laden with opportunities to explore, create, and innovate.

The industry’s future lies in the minds of those who dare to take on challenges and develop novel strategies to seize new opportunities.

As we usher in this era of property innovation and change, let’s continue to grow a culture of resilience and forward-thinking that moves the industry forward.

This kind of innovation mindset breeds resilience. It drives us to reimagine what’s possible, to strive for better, smarter ways of doing things, and to forge a path that’s not just about surviving but thriving.

So, let’s ride the wave of imagination and meet these challenges head-on.

For our commercial real estate investors, the journey of flexibility continues.

Innovation is not a destination, but a continuous journey of modernization unfolding right before our eyes.

As we reach toward the future, it’s not just about adapting to and overcoming obstacles; true resilience will come from the capability to establish and remake our new reality.

Let’s step forward into the unprecedented with the conviction that the commercial real estate industry will always find a way to reinvent and thrive.

Embrace the future armed with inventiveness, secure in the knowledge that we are building even more resilient outcomes.

Let innovation shape our tomorrow, and let’s take the reins to secure a resilient future in commercial real estate in a different way.

References

Reuters: Commercial real estate investors risk painful losses in post-COVID world

Goldman Sachs: Commercial Real Estate: Into the Headwinds

Goldman Sachs: US offices are under pressure, but real estate may still offer a hedge for investors

J.P. Morgan/Chase: 2023 midyear commercial real estate outlook

CBRE: Midyear Global Real Estate Market Outlook 2023

No related posts.