Key Takeaways

- Aggressive socialist housing laws historically trigger capital flight, reduced housing supply, and long-term market damage.

- New York City is showing early indicators that mirror prior housing policy failures in other U.S. cities.

- Both landlords and tenants face rising long-term risk when political ideology overrides market mechanics.

Socialist housing laws are no longer theoretical in New York City.

They are active, enforceable, and already reshaping the financial reality of ownership across the five boroughs.

What happens when housing policy stops balancing markets and starts correcting ideology?

What happens when rent freezes, enforcement-first governance, and administrative power converge inside the largest real estate market in the United States?

This article breaks it down clearly and methodically by examining:

- How New York City entered a new legal and enforcement phase

- Why historical rent control failures follow the same four-step collapse pattern

- What capital markets recognize before voters do

- How tenants become trapped inside decline while protection is normalized

- Why ownership erodes without formal abolition

The warning signs are not subtle. They are procedural, documented, and accelerating.

Let’s dive deep…

Ownership is the quiet promise of America. What you build is yours, and no authority stands between your work and your future.

This vital report is written for landlords, lenders, syndicators, developers, and every investor whose portfolio depends on New York City behaving like a functioning housing market.

A City Governed by Incoming Socialist Laws Driven Toward Potential Collapse

New York City has entered a phase where socialist laws, rather than market mechanics, increasingly determine housing outcomes that are no longer shaped primarily by supply, demand, or capital discipline, but by statute, enforcement, and administrative interpretation, creating conditions that many investors and housing operators now view as structurally destabilizing for the city’s real estate market.

How New York City Entered a New Legal Phase

The election of Zohran Mamdani marked a sharp pivot in how housing policy is framed and executed at the city level.

Affordability was elevated from a policy priority to a moral mandate, and that shift altered the balance between tenant protection and ownership viability.

Housing law is no longer positioned as a stabilizing framework but as a corrective instrument, designed to actively reshape outcomes rather than moderate them.

Under this approach, ownership stability has become secondary to enforcement velocity.

Rent regulation, eviction standards, and compliance requirements are increasingly treated as tools to force behavioral change from property owners, regardless of downstream effects on cash flow, maintenance capacity, or long-term asset performance.

For investors, this represents a fundamental change in how risk is created and applied within the city.

When Laws Become the Engine of Economic Destruction

The growing concern across landlord networks, lending desks, and syndication groups is not tied to a single statute, but to the cumulative force of socialist laws operating in sequence. Rent ceilings cap revenue.

Operating costs continue to rise. Enforcement intensifies. Legal exposure expands. Exit options narrow. Each step is lawful. Together, they form a closed system.

This dynamic is amplified by the role of administrative agencies, which can act faster than legislatures and without renewed voter input.

Enforcement decisions now carry market-level consequences, yet accountability is diffused across departments, boards, and offices.

Democratic legitimacy remains intact on paper, but the economic impact unfolds through process rather than debate.

What alarms both investors and housing analysts is the growing sense that collapse, if it occurs, will not arrive through a single shock.

It will arrive through compliance, one regulation at a time, until ownership in New York City no longer functions as an investable proposition.

I. The “Declaration of War” (Mayor Zohran Mamdani)

Source: Inauguration Speech & Executive Order Signing (Jan 1–2, 2026)

“I was elected as a democratic socialist, and I will govern as a democratic socialist. I will not abandon my principles for fear of being deemed radical.” — Zohran Mamdani, Inaugural Address (Cited by Washington Post, Jan 6, 2026)

“My friends, we have toppled a political dynasty.” — Zohran Mamdani, Victory Speech (Cited by BBC News)

“If your landlord does not responsibly steward your home, city government will step in… We will not wait to deliver action.” — Zohran Mamdani, Press Conference outside Brooklyn rent-stabilized building (Cited by CBS News, Jan 2, 2026)

“You cannot hold landlords who violate the law to account unless you have a proven, principled and tireless fighter at the helm. That is why I am proud today to announce my friend Cea Weaver as the director of the newly reinvigorated Mayor’s Office to Protect Tenants.” — Zohran Mamdani, Appointment Announcement (Cited by CBS News, Jan 2, 2026)

The Appointment That Turned Risk Into Certainty

What had been theoretical risk hardened into operational reality with the elevation of Cea Weaver into a position that directly influences how housing laws are enforced across New York City.

For investors, this moment marked the end of speculation and the beginning of recalibration.

The question stopped being whether the legal environment could deteriorate and became how fast.

Why the Rise of Cea Weaver Changed Investor Calculus

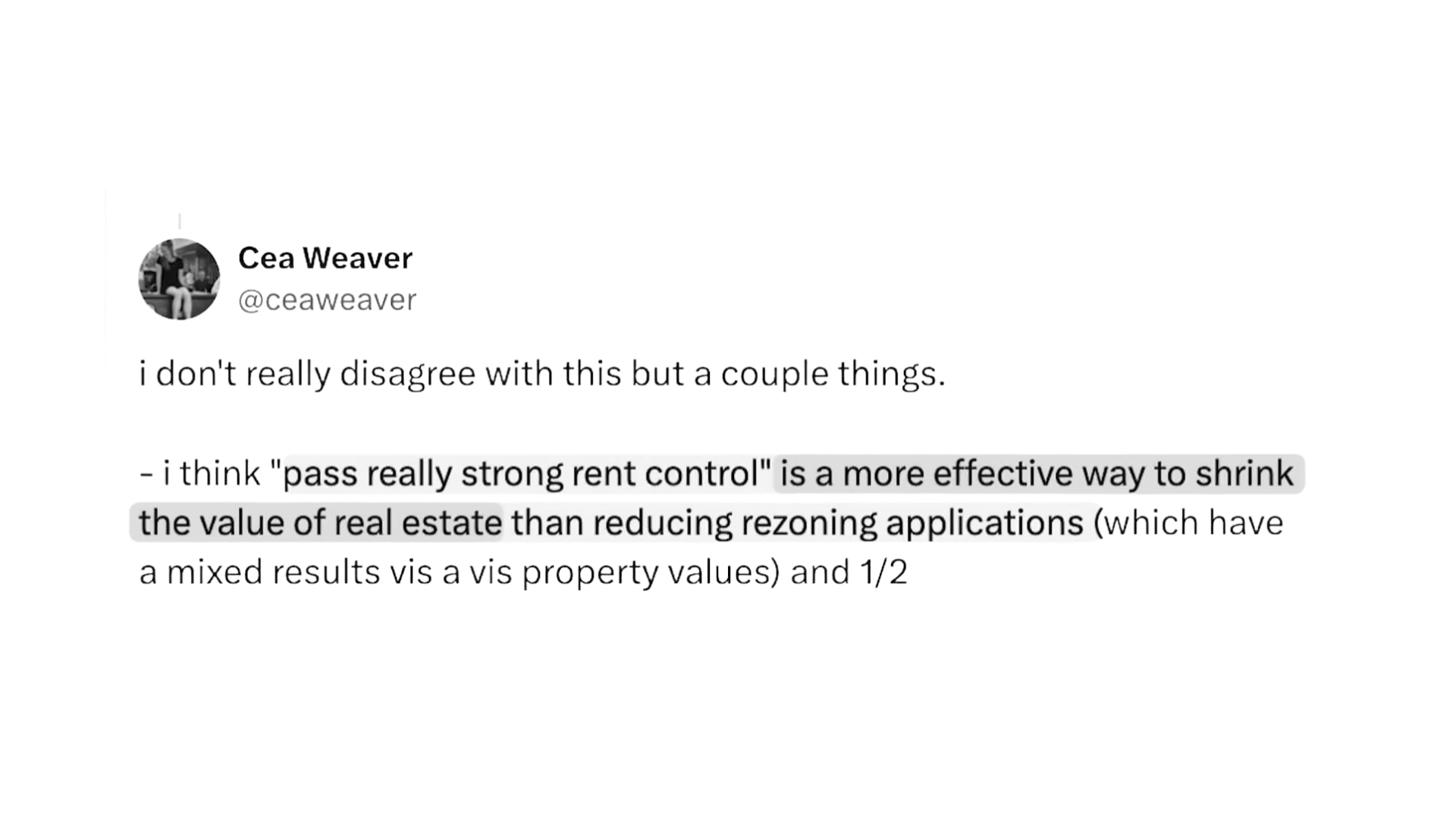

Weaver’s background is not rooted in property management, capital markets, or housing operations. It is rooted in activism, pressure campaigns, and policy design intended to constrain ownership outcomes.

That distinction matters because enforcement posture flows from worldview. When housing is framed as a moral battlefield rather than a system that must remain functional, enforcement ceases to be neutral.

Landlords and lenders interpreted this appointment as a signal that statutes would no longer be applied with balancing discretion. Instead, they would be applied with intent.

Compliance would not protect margins. Good faith would not insulate owners from scrutiny. Cash flow would be judged against ideology, not feasibility.

Within days, internal investor communications shifted tone. Language moved from monitoring to contingency planning. From patience to triage. From growth strategy to capital preservation.

From Legislative Debate to Administrative Execution

The most destabilizing aspect of the appointment is not public rhetoric. It is administrative velocity.

Laws already on the books gain new force when interpreted aggressively by empowered offices that operate without additional votes or public hearings.

Enforcement actions can be sequenced, stacked, and escalated quietly.

This is how democratic systems can produce outcomes that feel undemocratic to those bearing the cost.

Voters cast ballots once. Agencies act continuously. Each inspection, citation, or ruling is legal in isolation.

Together, they reshape the market without reopening the question of consent.

For real estate investors, this is the point where risk models break.

Traditional underwriting cannot price an environment where enforcement philosophy is itself a variable.

When administration replaces debate, certainty does not come from clarity. It comes from direction.

The direction signaled by this appointment is unmistakably signaling a red American past.

II. The “Enforcer” (Cea Weaver)

Source: Press Releases, City Limits Interview, and Resurfaced Viral Clips (Jan 2–5, 2026)

The New Mandate (Jan 2026):

“We are going to hold you accountable to operating [affordable housing] alongside the housing maintenance code. If you can’t do that, we are going to offer you money so that you can do it… And if you still don’t do it, we’re going to take it away from you.” — Cea Weaver, Interview on her enforcement strategy (Cited by City Limits, Jan 5, 2026)

“Through the Rental Ripoff hearings, City Hall will not only be listening, we will take action to ensure that the law is followed without exception…” — Cea Weaver, Official Statement on “Rental Ripoff” Hearings (Cited by NYC Mayor’s Office, Jan 4, 2026)

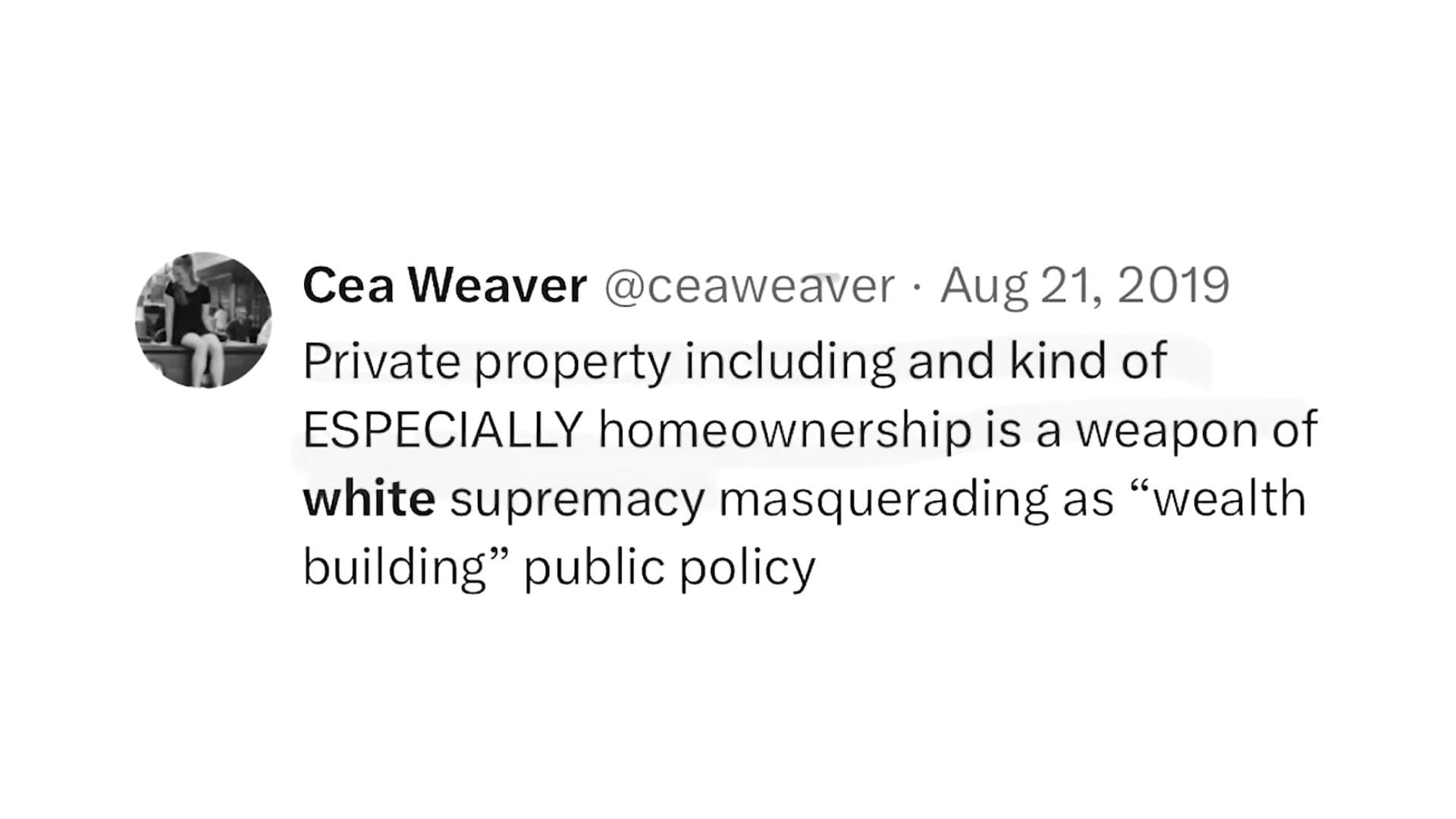

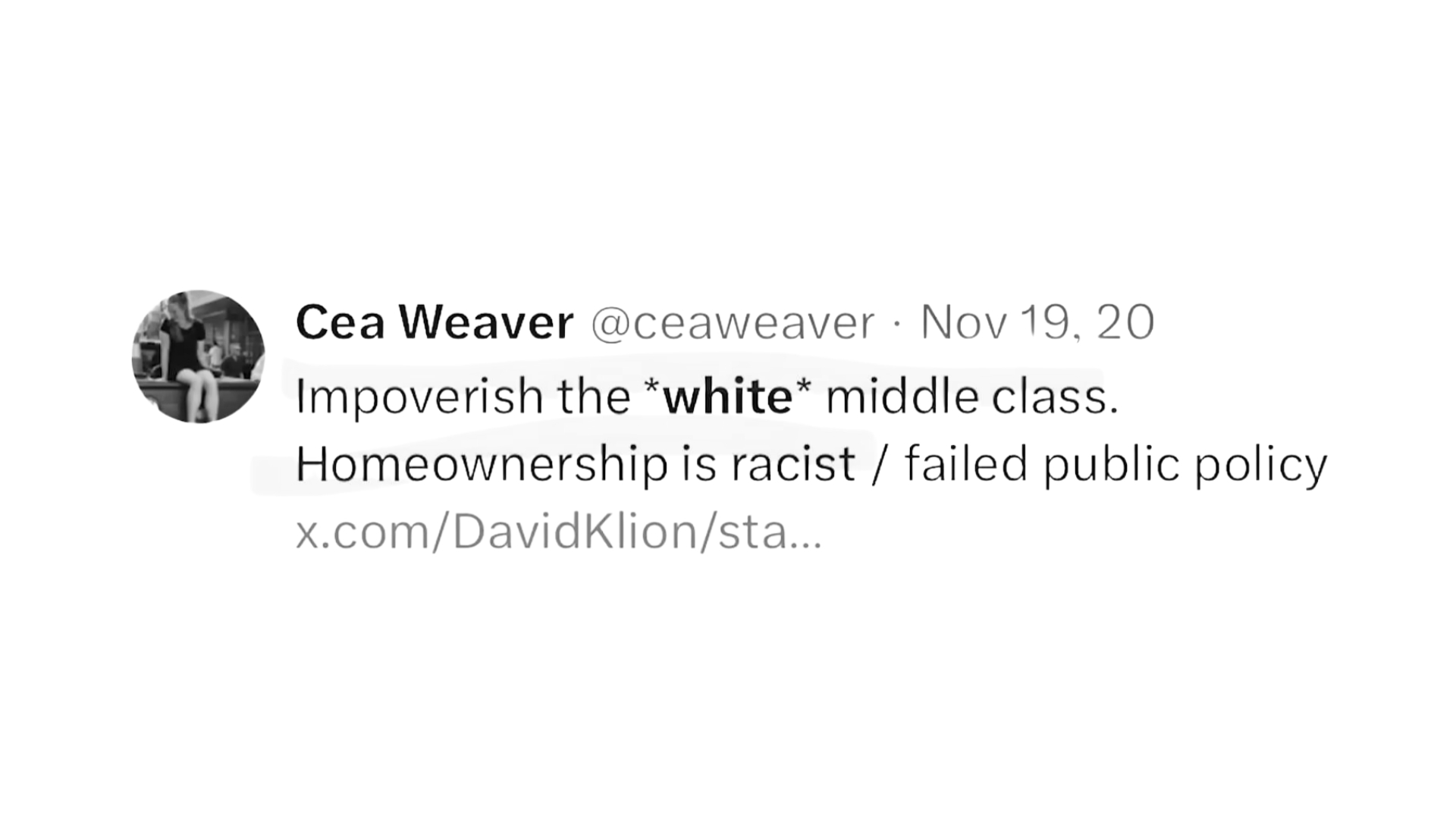

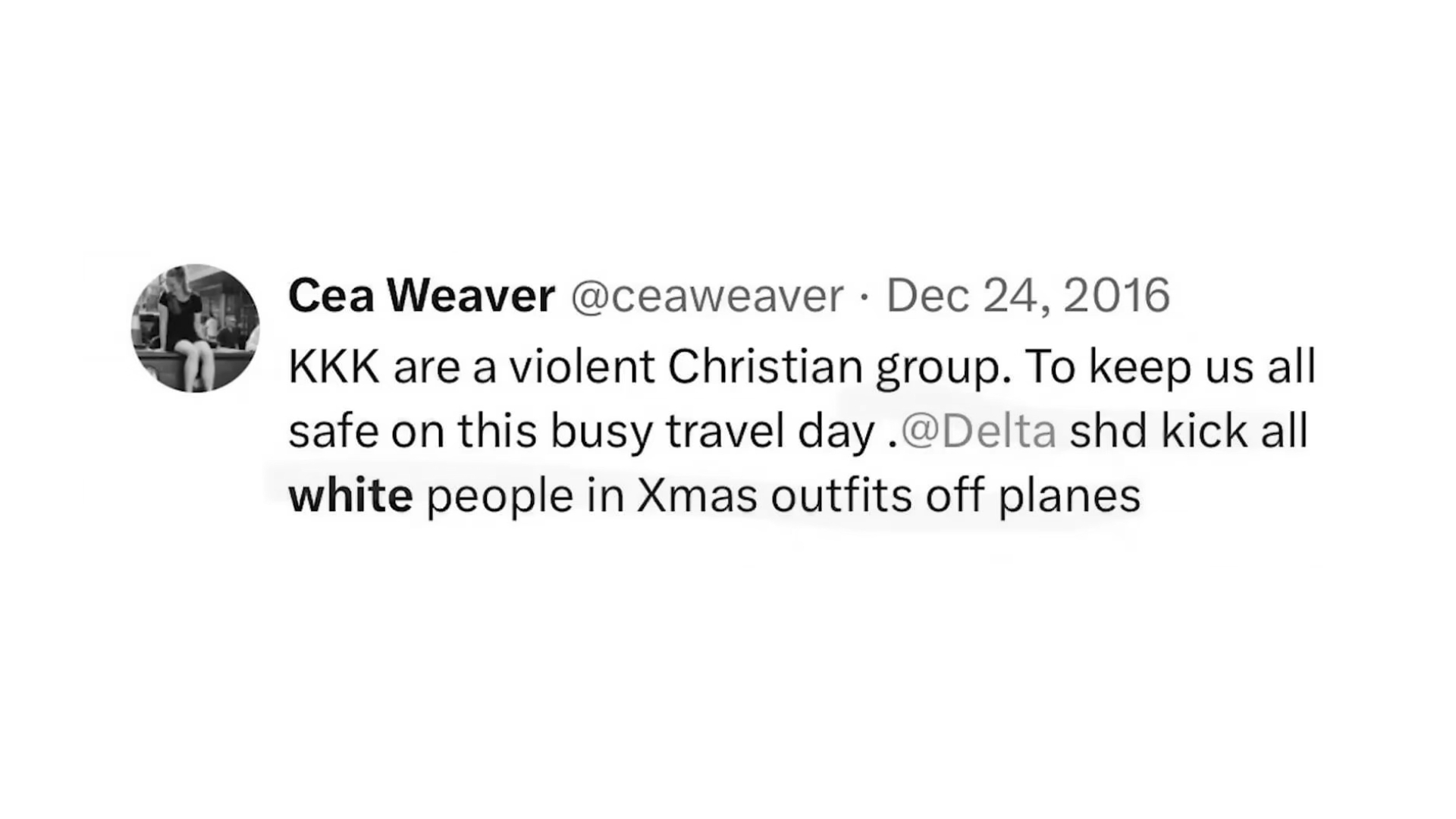

The “Resurfaced” Viral Quotes (Circulating Jan 3–6, 2026):

“Seize private property!” — Cea Weaver, Resurfaced Social Media Post (Cited by Washington Post, Jan 6, 2026)

“Families, especially White families, would have a different relationship to property.” — Cea Weaver, Resurfaced video clip on collective ownership (Cited by Times of India, Jan 5, 2026)

“Impoverish the white middle class. Homeownership is racist / failed public policy.” — Cea Weaver, Deleted 2018 Post (Cited by Washington Post, Jan 6, 2026)

III. The Resistance (Critics & Officials)

Source: Reactions to Weaver’s Appointment (Jan 5–6, 2026)

“Guess it’s easier to name a communist to a position that doesn’t require confirmation.” — Kalman Yeger, New York State Assemblyman (D) (Cited by Washington Post, Jan 6, 2026)

“The elevation of someone with such ugly and racialized views into a position of authority in America’s biggest city is fresh evidence that Mamdani wasn’t joking…” — Editorial Board, Washington Post (Jan 6, 2026)

“This administration will make sure every New Yorker knows their rights and knows they have a champion in city government who will not back down…” — Sam Levine, Commissioner of the Department of Consumer and Worker Protection (Cited by NYC Mayor’s Office, Jan 4, 2026)

What makes the current moment especially consequential is that the legal and procedural pathways enabling this shift were established long ago, quietly shaping how far ideology can move inside the system before resistance is triggered.

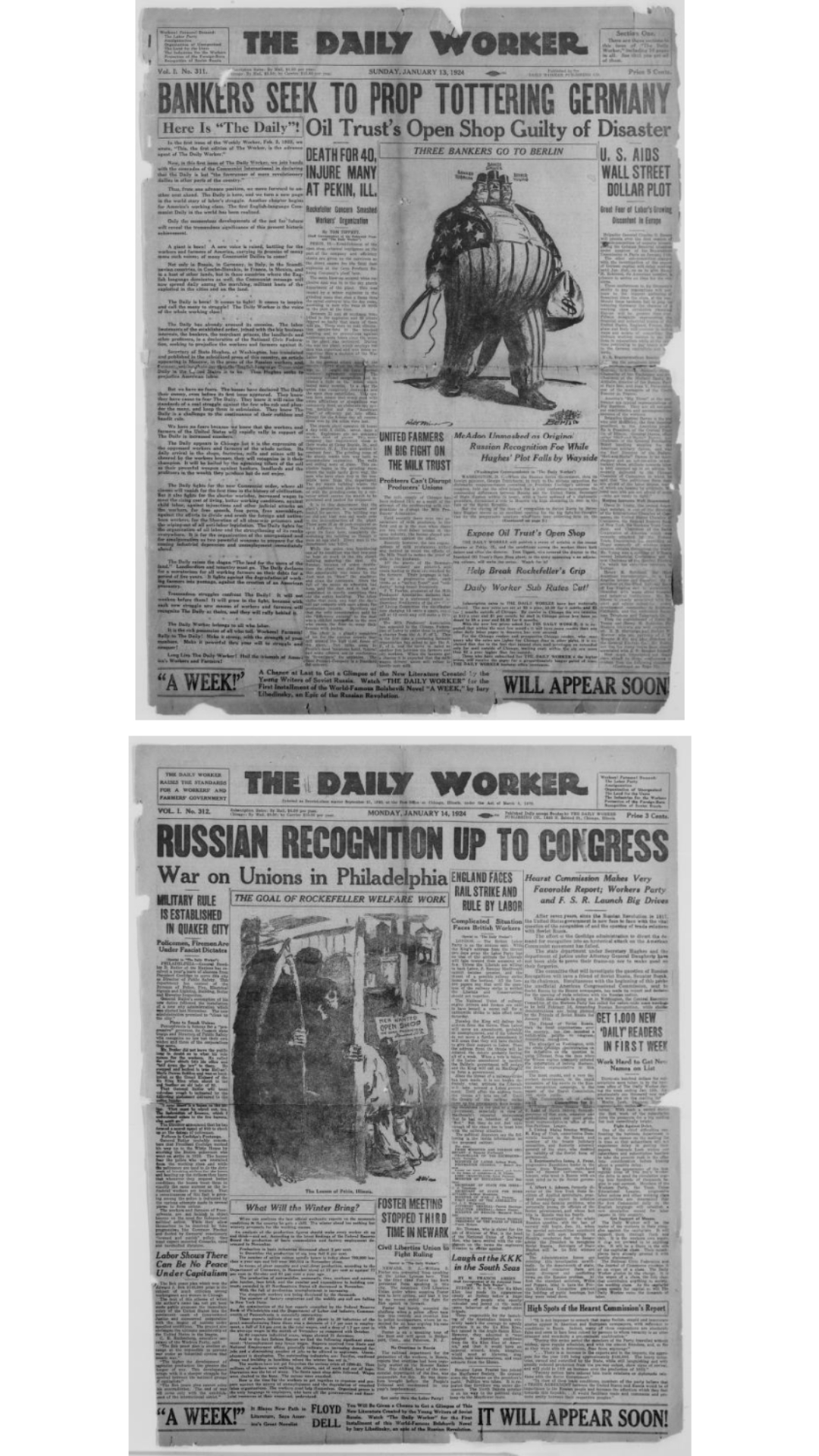

William Schneiderman and the Legal Precedent That Never Expired

Long before New York City’s current housing crisis took shape, the United States quietly set a legal boundary that still governs how far ideology can travel inside the system before it is stopped.

That boundary was defined by William Schneiderman, and its consequences now hang over New York real estate investing with renewed force.

Who William Schneiderman Was

Schneiderman was not a fringe voice.

He was a senior leader of the Communist Party USA, serving as a state secretary and national organizer at a time when the party openly rejected private property, market economics, and the American ownership model itself.

Born abroad and naturalized in the United States in 1927, he made no secret of his belief that capitalism was illegitimate and that property ownership was a structural source of inequality.

His ideology was not rhetorical. It was programmatic.

The Communist Party platform he supported called for the nationalization of industry and the dismantling of private ownership through collective systems.

Housing was central to that vision, not as an asset class, but as a mechanism of redistribution.

Why His Case Still Shapes Property Rights Today

When the federal government later attempted to revoke Schneiderman’s citizenship, it did so on the grounds that his beliefs were incompatible with constitutional principles.

The case culminated in the landmark Supreme Court decision Schneiderman v. United States, which ruled that political belief alone, absent clear evidence of violent intent, was insufficient to strip citizenship.

That ruling did more than protect one man. It established a durable legal shield around radical ideology, even when that ideology explicitly opposed private property.

The decision raised the standard of proof so high that belief, advocacy, and policy intent became legally survivable as long as they were executed through lawful process.

For decades, that precedent seemed academic. Today, it is operational.

It explains how deeply anti-ownership philosophies can exist inside democratic systems, move into administrative roles, and reshape markets without triggering constitutional intervention.

Schneiderman did not lose in court.

He lost later in history.

New York City is now confronting the consequences of that legal choice in real time.

Schneiderman v. United States and the Limits of Democratic Self-Defense

The Schneiderman ruling did not merely resolve a citizenship dispute.

It exposed a structural weakness in democratic systems when confronted with ideologies that reject the economic foundations of that system while operating fully inside its legal boundaries.

The Government’s Failed Argument

In its case against William Schneiderman, the federal government argued that communism was fundamentally incompatible with the principles of the United States Constitution.

The argument rested on a simple premise.

A political movement that seeks the abolition of private property and the restructuring of the economy cannot be meaningfully attached to a constitutional system built on individual rights and ownership.

Housing sat at the center of this conflict.

The government pointed to the Communist Party’s explicit goal of replacing private ownership with collective control as evidence that Schneiderman’s allegiance was incompatible with the constitutional order.

This was not speculation.

It was doctrine.

Yet the argument failed.

The Supreme Court Ruling That Changed Enforcement Forever

The Supreme Court ruled that the government had not met the required burden of proof.

Without clear, unequivocal, and convincing evidence that Schneiderman personally advocated the violent overthrow of the government, ideology alone was not enough.

Belief was separated from action. Intent was insulated by process.

That distinction reshaped the balance between democracy and self-preservation.

From that moment forward, democratic systems were constrained in their ability to respond to internal ideological threats unless violence was explicit and imminent.

Structural transformation pursued through law, regulation, and administration remained protected.

This ruling did not legalize communism.

It legalized patience. It created space for ideology to evolve, embed, and execute slowly, shielded by legality at every step.

For New York City real estate investors, this matters because it explains why today’s housing policies do not arrive as revolutions.

They arrive as rules. They do not seize property outright. They render it unusable.

Democracy, bound by its own precedents, struggles to intervene until the damage is complete.

How That Ruling Echoes Through New York City Today

The Schneiderman precedent did not stay confined to history books or law school case studies.

It quietly became a blueprint for how ideology can move through democratic systems without triggering constitutional resistance.

New York City is now testing the outer limits of that blueprint in real time.

Ideology No Longer Needs Revolution

What Schneiderman proved is that ideology does not need force to win. It needs time, process, and lawful execution.

Courts are bound by precedent. Legislatures move slowly. Administrative agencies act continuously.

When belief is translated into regulation rather than uprising, the system struggles to identify a stopping point.

In New York City, housing policy now reflects this evolution.

Laws that constrain ownership do not announce themselves as radical. They arrive as tenant protections, affordability measures, and enforcement updates.

Each step is defensible on its own. Together, they form a structure that steadily transfers control away from owners while preserving the appearance of legality.

This is why the current moment feels different to investors. There is no single vote to reverse. No dramatic seizure to challenge.

The transformation occurs through compliance, interpretation, and cumulative burden.

By the time the impact is visible in cash flow and asset values, the legal foundation is already set.

From Marxist Doctrine to Housing Law

Schneiderman argued that the abolition of private property could be achieved through democratic means rather than immediate violence.

That theory failed politically in his lifetime. It succeeded procedurally over decades.

Today, its modern expression is visible in housing frameworks that treat ownership as a tolerated condition rather than a protected right.

Under the enforcement posture signaled by Cea Weaver, housing law is no longer neutral infrastructure. It becomes an instrument of outcome.

Rent growth is framed as harm.

Control is framed as accountability.

Profit is framed as extraction.

None of these positions require constitutional confrontation.

They require only consistent application.

This is where Schneiderman’s legacy becomes unavoidable.

The legal system he tested now allows ideology to be implemented through administration, not insurrection.

New York City is not witnessing a sudden break with democracy. It is witnessing democracy’s rules being used to hollow out one of its core economic pillars from the inside.

Decommodification as a Legal Strategy

What once lived in academic theory and activist manifestos has now taken legal form.

Decommodification is no longer a concept debated in classrooms or rallies. It is emerging as an operating principle inside housing law, and its implications for New York City real estate investing are severe.

Housing Redefined Under Socialist Law

Under decommodification logic, housing is no longer treated as an asset that must function economically.

It is treated as an obligation imposed on owners in service of a broader social outcome.

Ownership is permitted, but only insofar as it submits to constraints that erode its economic purpose.

Rent growth is framed as exploitation.

Capital improvement returns are framed as excess.

Market pricing is reframed as exclusion. When these views are embedded into statute and enforcement guidance, the result is not reform. It is redesign.

For investors, this means the rules governing housing no longer aim to preserve a viable private market. They aim to manage decline in a way that advances redistribution goals.

The law does not abolish ownership. It redefines it until it no longer resembles investment at all.

What Happens When Markets Are Governed Morally

Markets require predictability. Moral governance produces volatility.

When laws are designed to correct perceived injustice rather than maintain system function, capital responds defensively.

Maintenance is deferred because revenue is capped. Financing dries up because returns are uncertain.

Long-term planning collapses because upside is politically suspect. The housing stock does not stabilize. It thins, ages, and decays.

This is the hidden danger of decommodification executed through law. It does not trigger immediate crisis. It triggers slow degradation. Buildings remain standing.

Ownership remains nominal. But the incentives that keep properties safe, maintained, and investable are quietly removed.

For New York City, the risk is not a dramatic crash. It is a managed unraveling, driven by laws that treat economic viability as secondary to ideological outcome.

Supporters of these laws argue that aggressive regulation is the only way to stop displacement and protect working New Yorkers.

The danger is that when policy is built to punish ownership rather than sustain housing systems, the result is not protection, it is a shrinking supply, decaying buildings, and a cost burden that eventually lands on tenants first.

The Historical Roadmap of Failure: This Has Happened Before

For real estate investors, failure is not abstract. It has a definition. Capital flight. Property value destruction. The halt of new supply.

History shows that when housing policy crosses certain lines, these outcomes arrive in a predictable sequence, regardless of intent.

The record is not theoretical. It is documented.

St. Paul, Minnesota: The Capital Strike That Froze a City

In 2021, voters in St. Paul approved one of the most aggressive rent control laws in modern American history.

Annual rent increases were capped at 3 percent with no inflation adjustment and no exemption for new construction.

The objective was immediate decommodification. Prices would be frozen. Markets would be overruled.

The response was instantaneous.

Within months, multifamily building permits collapsed by more than 80 percent. Development did not slow. It stopped.

Capital did not negotiate. It left.

Across the river, construction in Minneapolis continued, exposing the policy impact with brutal clarity.

The city reversed course almost immediately, carving out exemptions for new construction in a public admission that the law had effectively killed housing production overnight.

The lesson was simple. When returns are capped by ideology, capital strikes back by withdrawing entirely.

Cambridge, Massachusetts, The Two Billion Dollar Suppression

For twenty-five years, Cambridge enforced strict rent controls designed to keep housing affordable and restrain landlord profit.

The policy was celebrated politically. Economically, it hollowed out the city.

When the state forced repeal in 1994, researchers from MIT documented what happened next.

Property values surged across entire neighborhoods, not just previously controlled units.

The estimated damage inflicted by rent control exceeded two billion dollars in suppressed housing value.

The impact went beyond investors.

Deferred maintenance became the norm.

Capital improvements were postponed for decades.

The city looked stable on paper while quietly decaying.

When controls lifted, the rebound exposed how much value had been trapped and how long the housing stock had been starved.

Santa Monica and Berkeley: The Gentrification Paradox

In Santa Monica and Berkeley, rent stabilization and strict eviction rules were meant to protect the vulnerable.

Over time, they produced the opposite.

Controlled units became effectively inherited.

Long-term tenants stayed regardless of income.

Studies showed that many of these units were occupied by affluent professionals, often white, who never moved because the economic incentive to stay was overwhelming.

Landlords responded rationally. Rental units were converted to condominiums and sold to owner-occupants, permanently removing them from the rental pool.

Supply shrank.

Prices for non-controlled units soared.

A two-tier system emerged. Cheap rent for the lucky few who got in decades earlier.

Punishing prices for everyone else, including the poor, the laws were supposed to protect.

Pruitt Igoe and Cabrini Green: The State as Landlord

When private markets fail under regulation, the state often steps in. The historical evidence is catastrophic.

Pruitt-Igoe and Cabrini-Green were built as utopian answers to private ownership and profit.

The government would own, manage, and maintain housing at scale. Without private capital discipline or reinvestment incentives, the buildings deteriorated rapidly.

Elevators failed.

Heating systems broke.

Crime surged.

Conditions became unlivable.

Both complexes were ultimately demolished. Pruitt Igoe lasted barely twenty years.

They remain the clearest warning that removing profit does not remove decay. It accelerates it.

The Pattern Investors Cannot Ignore

Across every case, the sequence is the same.

Rents freeze.

Maintenance contracts.

Supply disappears.

Housing quality collapses.

Governments panic and either repeal the laws or assume control of failing assets.

This is not ideology.

It is pattern recognition.

Cea Weaver’s appointment signals that New York City may be entering the first phase of this cycle.

The city has not reached collapse.

It has reached ignition.

How Capital and Operators Are Responding in Real Time

The following statements come directly from real estate investors, developers, legal professionals, and market analysts actively operating in or reallocating capital away from New York City. Their perspectives reflect how housing policy shifts are being interpreted in real time by those underwriting risk, managing assets, and making capital allocation decisions today.

Shawn Zar

Real Estate Investor

“It’s way too early to call it. I’ve seen this same script in other cities with socialist mayors. Stricter laws didn’t kill the market in San Francisco or Los Angeles, but they definitely slowed things down and pushed out small landlords. Big money gets scared, and everything just takes way longer to get done.

For me, it just means expecting more expensive paperwork and slower approvals, but you don’t just quit. NYC demand isn’t going anywhere. You just have to be way more picky with your deals now. The ‘meh’ projects won’t work, but if you’re a pro with a good location, you’ll still find a way. The market always adapts, even if it’s a total pain in the ass at first.”

—

https://sell-my-house-fast.com/

https://featured.com/p/shawn-zar

Sergii Starostin

Co-Founder, Outpost | CEO, OJH Holdings

“We’re optimistic that Mayor Mamdani will champion reforms to shared housing regulations that would enable the development of new Single Room Occupancy buildings. Such policy changes could unlock tens of thousands of critically needed housing units across New York City in the near term.

We do anticipate increased operational costs, as enhanced tenant protections will likely require more robust legal and regulatory compliance infrastructure.

Looking ahead, we expect declining interest rates, combined with City of Yes initiatives and the corporate push for five-day office returns, to catalyze significant new development activity across both commercial office and residential sectors.”

—

Adriana Montes, JD, MBA

Real Estate Investor, Broker, & Property Operator

“Since the election, there has been a clear acceleration in inquiries and relocations from New York to South Florida, particularly from owners, operators, and professionals concerned about expanding rent regulation and enforcement uncertainty in NYC.

Miami continues to attract both individual buyers and institutional capital as a market where housing policy feels more predictable and growth-oriented, especially when compared to the increasing regulatory friction in New York. Remote work normalization, Florida’s tax structure, and a pro-business regulatory climate are reinforcing this migration, making Miami not just a lifestyle move but a strategic one.

For many investors, the conversation has shifted from ‘how do we adjust in New York?’ to ‘where does capital work hardest with the least policy friction?’ Capital that once targeted NYC multifamily or mixed-use assets is being redeployed into Miami rental housing, workforce housing, and value-add opportunities.

Policy uncertainty in New York has led to more conservative underwriting assumptions, wider expense buffers, longer hold periods, and higher required returns. Lenders are tightening credit standards on NYC assets, particularly rent-regulated properties, while Miami benefits from stronger lender confidence and clearer exit assumptions.

Over time, this migration could materially reshape both markets, influencing development patterns, capital flows, and how investors think about policy risk as a core underwriting factor rather than a background consideration.”

—

https://www.seahorsebeachbungalows.com/

https://www.floridadreamsrealty.com/adriana-montes/

Barry Nussbaum

Owner & Senior Lawyer

Nussbaum Law

“I witnessed the move toward stiffer enforcement and expanded rent control after Zohran Mamdani was elected. I now include the risk of delayed permits, stricter inspections, and stronger tenant rights as direct costs.

A small building that once had a net yield of seven percent now appears closer to four percent after legal expenses, staffing costs, and vacancies tied to approval delays. That difference translates to roughly one hundred fifty thousand dollars less in annual distributable cash on a five million dollar asset.

Underwriting has changed. I increase hold periods to seven years, decrease exit assumptions by twenty percent, and add approximately sixty thousand dollars per year per property for legal liability. Lenders are modeling rent caps rising at two percent while taxes and insurance rise at six percent. I advise clients not to rely on fast rent resets and to demand aggressive loan-to-value ratios of fifty-five percent with increased reserves.

My editorial opinion is that policies designed to protect tenants can reduce the housing supply they aim to stabilize. Predictable rules bring builders. Unpredictable rules bring lawyers. Long-term ownership stability must be offered by cities that want homes, not merely compliance.”

—

John Boyd

Principal

The Boyd Company, Inc.

“Under the Mamdani administration, we have doubled down on evaluating legislative risk, not just market risk. The mayor’s commitment to de-commodifying the housing market has introduced high-friction variables, including the appointment of activist regulators like tenant rights advocate Cea Weaver to key housing roles.

Mamdani’s inaugural emphasis on the ‘warmth of the collective’ over ‘individualist coldness’ sent an early signal to capital providers that market-driven development may be giving way to state-managed equity. His rent freeze goals and property seizure rhetoric are creating anxiety across the investment community.

On a brighter note, some developers see opportunity in expedited permitting near transit hubs through the SPEED task force. Best case, this period resembles a third term of De Blasio where the city’s inertia absorbs inefficiency. Worst case, it accelerates the relocation of wealth, taxable income, and business to South Florida and other regional alternatives.

Between 2014 and 2024, New York State lost approximately one hundred eleven billion dollars in income to other states, with Florida absorbing nearly two hundred billion dollars. The hardest cost to measure is opportunity cost, when companies never consider New York at all.”

—

Jeff Lichtenstein

CEO & Broker

Echo Fine Properties

“We saw lots of movement to Florida during the pandemic, but mostly noise during and after the election. Many businesses want to escape New York. Financial players have been the most successful setting up in Miami and downtown West Palm Beach, now nicknamed Wall Street South.

Other industries are harder to move because of brick-and-mortar commitments, families, and employees. While we’ve had inquiries, a mass exodus is unlikely unless things go over the top.

Investors from New York are on edge. There is potential for a straw that breaks the camel’s back, which would accelerate relocations significantly.”

—

Alex Horn

Managing Partner

BridgeInvest

“I am seeing firsthand how recent housing policy signals and the enforcement posture in New York are affecting how lenders assess risk, adjust underwriting assumptions, and think about capital deployment and market exposure. From my position, it is clear that political and regulatory shifts are translating directly into real changes in financing decisions on the ground.

At BridgeInvest, we have surpassed $1 billion in assets under management, launched our first-ever green fund with $250 million raised, and are tracking toward approximately $890 million in origination volume, with select transactions expected to close in early 2026. That scale gives me a broad vantage point into how New York City compares to other major markets as conditions continue to evolve.”

—

The Phase 1 to Phase 4 Timeline: How New York City Follows the Failure Script

This four-phase model shows how socialist laws repeatedly drive housing markets toward the same failure points.

This is not a prediction built on fear. It is a projection built on pattern.

When the same legal tools appear in the same sequence, outcomes tend to repeat.

New York City now shows clear alignment with the early stages of every major housing collapse driven by aggressive rent regulation and enforcement-first governance.

Phase 1: Rent Freeze and Revenue Arrest

What It Looks Like in New York City Now

- Political pressure for rent freezes across stabilized units.

- Framing rent increases as moral harm rather than economic necessity.

- Data narratives shaped to justify zero percent outcomes.

Historical Match

- St. Paul Minnesota locked rents at 3 percent and triggered an immediate capital strike.

- Cambridge Massachusetts capped rents for decades and suppressed billions in value.

Why This Phase Matters

Once revenue is capped by law, every downstream decision is constrained. Owners do not adjust strategy. They retreat. Maintenance becomes triage. Financing becomes fragile. The system stops responding to reality.

Phase 2: Maintenance Retrenchment and Compliance Stress

What It Looks Like in New York City Next

- Deferred capital improvements as cash flow compresses.

- OPEX cuts to survive fixed-income conditions.

- Increased inspection activity and violation accumulation.

Historical Match

- Cambridge saw decades of deferred maintenance under rent control.

- Santa Monica and Berkeley experienced long-term housing stock deterioration masked by tenant stability.

Why This Phase Matters

This is where conditions begin to degrade quietly. Buildings remain occupied.

Ownership remains intact. But the economic engine that sustains habitability weakens. Enforcement accelerates precisely as owners lose capacity to comply.

Phase 3: Supply Collapse and Market Exit

What It Looks Like in New York City After That

- New development stalls due to capped returns and political risk.

- Owners convert rentals to condos where possible, removing units from the market.

- Lenders tighten terms or withdraw entirely.

Historical Match

- St. Paul lost more than 80 percent of multifamily permits within months.

- Santa Monica and Berkeley saw rental supply shrink as conversions accelerated.

Why This Phase Matters

This is where failure becomes systemic.

The city stops adding housing. Scarcity deepens.

Prices for uncontrolled units surge. The very groups the laws aim to protect are pushed further out.

Phase 4: Municipalization or Forced Reversal

What It Looks Like in New York City If the Cycle Completes

- Distressed assets steered toward nonprofit or city-backed acquisition.

- Owners exit at depressed values after prolonged losses.

- Public sector assumes control of aging, underfunded housing stock, or laws are partially repealed under crisis pressure.

Historical Match

- Pruitt-Igoe and Cabrini-Green collapsed under public ownership and were demolished.

- Cambridge repealed rent control only after decades of damage were undeniable.

Why This Phase Matters

At this stage, there are no clean exits. Either the government absorbs the failure at enormous cost, or it retreats after permanent damage has been done. Tenants suffer through decline. Investors are already gone.

Where New York City Sits Right Now

New York City shows strong indicators of Phase 1 with visible drift toward Phase 2. Revenue suppression is being normalized. Enforcement posture is hardening. Capital is beginning to hesitate.

History suggests that once a city passes Phase 1 without course correction, progression is not linear. It accelerates.

The danger is not that New York City does something unprecedented.

The danger is that it does something extremely familiar and believes it will end differently this time.

Documented Housing Policy Failures That Follow the Same Pattern

| City | Policy Implemented | Year Enacted | Regulation Severity | Housing Supply Impact | Property Value Impact | Documented Outcome |

|---|---|---|---|---|---|---|

| St. Paul, Minnesota | Hard rent increase cap with no new construction exemption | 2021 | Extreme | Multifamily permits fell over 80 percent within months | Immediate investor pullback | Developers halted projects, city amended law under pressure |

| Cambridge, Massachusetts | Long-term rent control | 1970 | High | New rental supply stagnated for decades | Housing stock undervalued by approximately $2 billion | Deferred maintenance and citywide value suppression |

| Santa Monica, California | Rent stabilization and strict eviction limits | 1979 | High | Rental units steadily removed via condo conversion | Dual pricing system emerged | Supply reduction harmed low-income renters |

| Berkeley, California | Rent control with tenancy lock-in | 1980 | High | Reduced rental turnover and new supply | Concentrated benefits among long-term tenants | Market rigidity and access inequality |

| St. Louis, Missouri | Government-owned public housing model | 1954 | Total state control | No private reinvestment | Rapid asset deterioration | Pruitt-Igoe demolished after 20 years |

| Chicago, Illinois | Large-scale public housing ownership | 1957 | Total state control | Maintenance collapse | Severe habitability decline | Cabrini-Green dismantled |

This table visually anchors the article’s core claim: when rent control escalates into enforcement-first governance, the sequence of failure is not theoretical. It is repeatable, measurable, and historically documented.

The Office to Protect Tenants as a Structural Override

The most underestimated force in New York City’s housing transformation is not a statute or a court ruling.

It is the administrative machinery now positioned to execute policy continuously, quietly, and without renewed public consent.

Why Enforcement Now Outpaces Voting

The Office to Protect Tenants operates in the space where democracy slows down, and administration accelerates.

Elections happen on a schedule.

Enforcement happens every day.

Inspections, notices, penalties, interpretations, and referrals stack faster than voters can respond.

Under leadership aligned with activist housing ideology, enforcement ceases to be reactive. It becomes directional.

The office does not need new laws to change outcomes. It only needs to apply existing ones aggressively and consistently. Each action is legal. Each step is defensible.

The cumulative effect is transformational.

This is how markets are reshaped without another ballot.

Owners comply or fall behind.

Compliance raises costs.

Falling behind triggers penalties.

Penalties trigger leverage.

Leverage narrows options.

At no point does the process require public debate to restart.

Democracy Reduced to Compliance

When outcomes are produced through administration rather than legislation, accountability diffuses.

Responsibility fragments across agencies, boards, and procedures.

Voters cannot easily identify where to apply pressure. Investors cannot identify where to seek relief.

This is not a suspension of democracy. It is a procedural eclipse. The rules are followed. The forms are filed. The notices are served.

And yet the result is a housing environment where ownership is continuously constrained without a clear moment of consent.

For New York City real estate investing, this is the inflection point.

Once enforcement philosophy becomes the primary driver of outcomes, traditional safeguards fail. Markets cannot negotiate with agencies.

Capital cannot vote. Compliance becomes the only language the system recognizes, even as compliance itself accelerates decline.

Rent Freezes as the First Domino

If collapse arrives, it will not begin with seizure or legislation that announces itself as revolutionary.

It will begin with a number.

Zero.

One Million Units Locked Into Decline

A rent freeze across New York City’s stabilized housing stock would immediately sever the relationship between revenue and reality.

Operating costs continue to rise. Insurance premiums climb. Labor expenses increase. Utilities inflate. Capital improvements age. Revenue remains fixed.

For owners, this is not a temporary inconvenience. It is a structural trap.

Cash flow compression reduces maintenance capacity.

Deferred repairs accumulate.

Financing covenants tighten.

Reinvestment becomes impossible.

Buildings do not fail all at once. They slip, one expense cycle at a time.

What makes this especially destabilizing is scale.

Nearly one million units would be locked into the same financial posture simultaneously.

The city would not be managing isolated distress. It would be normalizing it.

Speculation of Permanent Return Elimination

The deeper fear among investors is that a rent freeze is not a pause. It is a ceiling. Once imposed, political pressure makes reversal unlikely.

Any attempt to restore growth is framed as harm. Any return to market logic is framed as betrayal.

This is where real estate investing breaks as a discipline. Without a recovery path, underwriting becomes fiction. Without upside, capital has no reason to stay.

Exit optionality disappears not because buyers vanish, but because the asset no longer produces a rational return.

In this scenario, ownership persists only in name. The building remains. The deed exists.

But the economic engine that justifies private ownership has been shut down by law.

This is the first domino, and once it falls, the rest do not need to be pushed.

Good Cause Eviction and the End of Owner Control

Once revenue is capped, control becomes the next target.

This is where Good Cause Eviction transforms from a tenant protection into a structural override of ownership itself, representing one of the most consequential socialist laws affecting owner authority.

Under Article 6-A of New York’s Real Property Law, known as the Good Cause Eviction Law, the state now requires that landlords demonstrate legally sufficient “good cause” to remove tenants or refuse lease renewals, and it limits rent increases beyond certain thresholds, making eviction and pricing decisions subject to judicial scrutiny rather than unilateral landlord discretion.

Ownership Without Authority

Good Cause Eviction rewrites the relationship between owner and property by shifting control away from the deed holder and into procedural limbo.

Removal of non-performing tenants becomes an extended legal ordeal.

Timelines stretch. Burdens of proof multiply. Even clear non-payment cases move slowly through a system designed to delay resolution.

For owners, this is not about compassion or fairness. It is about functionality.

When an asset cannot be stabilized, repositioned, or even protected from sustained loss, ownership becomes a liability rather than a right.

Expenses continue. Revenue does not. Responsibility remains. Authority vanishes.

This is the point where investors realize they no longer control outcomes inside their own buildings. They carry the risk without the power.

They absorb the cost without the remedy.

Confiscation Without Transfer

Good Cause Eviction does not seize property in the traditional sense. It does something more destabilizing.

It removes the ability to manage risk while preserving every obligation associated with ownership.

Taxes must still be paid. Repairs must still be made.

Compliance must still be maintained. But the fundamental tool that allows owners to enforce basic economic order is neutralized.

Control is stripped quietly, legally, and incrementally.

In practice, this mimics confiscation without a title change.

The building remains privately owned on paper, but operational authority is functionally transferred to a system that prioritizes delay and endurance over resolution.

Value drains out slowly. Stress compounds. Failure becomes predictable.

This is not a side effect. It is a design feature. When combined with rent freezes, Good Cause Eviction completes the loop.

Revenue is capped. Control is removed.

The owner is left holding an asset that cannot respond, cannot recover, and cannot escape.

Municipalization as the Logical End State

When revenue is capped and control is removed, failure is no longer a risk. It is a timetable.

Municipalization emerges not as a policy announcement, but as the default resolution for assets engineered into distress.

Distress Manufactured Through Law

The pathway is procedural and repeatable. Rent ceilings starve income. Good Cause Eviction extends losses.

Compliance costs rise. Deferred maintenance becomes inevitable. Inspections intensify.

Violations accumulate. Penalties stack. Each step is lawful. Each step narrows options.

Owners are not accused of neglect in theory. They are documented into it.

The system creates conditions where maintaining standards becomes financially impossible, then enforces those standards aggressively.

Distress is framed as owner failure rather than policy outcome.

This is how buildings are prepared for removal from private hands without ever declaring intent to do so.

How Assets Leave Private Hands Quietly

Once distress is established, transfer becomes administrative.

Properties are steered toward nonprofit acquisition, city-backed entities, or forced dispositions under the banner of preservation.

Prices collapse because cash flow is broken and risk is permanent. Owners face a choice between prolonged losses or exit at distressed values.

No vote is required. No seizure is declared. The transaction looks voluntary on paper, even as the circumstances make alternatives unrealistic.

Municipalization is achieved through exhaustion rather than force.

For investors, this represents the endgame scenario. Ownership does not end with a headline. It ends with paperwork.

Buildings change hands not because the market demands it, but because the law made every other outcome unsustainable.

Tenants Inside the Collapse

Tenant Risk Summary

- Rent freezes can stabilize monthly payments while maintenance quality declines as building revenue is capped.

- Housing supply can shrink as new development stalls and rentals are converted to condos, pushing market rents higher for everyone outside protected units.

- Enforcement-heavy systems can increase paperwork and conflict without increasing repairs, leaving tenants trapped in deteriorating buildings with fewer places to go.

The collapse of New York City real estate investing does not stop at owners. It moves inward, unit by unit, reshaping daily life for the very tenants these laws claim to protect.

Protection That Becomes Entrapment

When revenue is capped and enforcement escalates, maintenance becomes the first casualty.

Owners defer repairs not out of neglect, but because cash no longer exists to fund them.

Elevators age.

Boilers fail.

Facades crack.

Hallways dim.

The building does not fall apart overnight.

It degrades quietly, steadily, and permanently.

Tenants are protected from rent increases, but trapped inside deteriorating housing with limited alternatives.

Mobility collapses because moving means entering an even tighter market with fewer viable units. Stability becomes stagnation. Protection becomes confinement.

In this environment, tenants do not gain power. They inherit risk. Safety declines.

Quality erodes. Complaints rise.

Enforcement intensifies further, feeding the same loop that caused the decline in the first place.

The Slum Risk of Socialist Law

History has already shown what happens when capital is removed from housing systems without a functional replacement.

Buildings age faster than public funding arrives.

Deferred maintenance becomes structural damage.

Neighborhoods hollow out slowly, not dramatically.

The danger is not that New York City suddenly becomes unlivable. The danger is that it becomes quietly worse every year, normalized by law and defended by ideology.

Tenants remain housed, but in buildings that no longer attract investment, improvement, or long-term care.

In this scenario, both landlords and tenants lose, but at different speeds. Investors exit early if they can.

Tenants remain behind, living inside the consequences of a system that removed economic incentives without installing a sustainable alternative.

Capital Markets Are Voting First

Capital does not wait to see whether socialist laws will soften. It prices permanence immediately.

Long before laws reach their full effect on the street, capital reacts. It does not protest. It does not debate. It leaves.

Investors Voting With Their Feet

Across lending desks, syndication platforms, and private equity committees, New York City is being quietly reclassified.

What was once viewed as a cornerstone market is now treated as an exposure problem. Risk memos are being rewritten.

Assumptions are being stripped. Return thresholds are being raised beyond feasibility.

This is not panic. It is arithmetic. When revenue is capped, control is constrained, and enforcement risk is open-ended, capital has no incentive to stay.

New deals stall first. Refinancings tighten next. Existing assets are held defensively or prepared for exit.

Liquidity thins. Transaction volume dries up. Price discovery disappears.

Markets do not collapse loudly. They go silent.

Speculation That NYC Is Becoming Structurally Uninvestable

The most damaging shift is not short-term withdrawal. It is long-term doubt. Once capital begins to view a market as structurally hostile, recovery becomes nearly impossible.

Even policy reversals fail to restore confidence because permanence risk has already been priced in.

Investors begin to ask a different question. Not when returns recover, but whether they are allowed to recover at all.

When the answer depends on political cycles rather than economic fundamentals, the market is no longer investable. It is conditional.

This is the moment when New York City risks crossing a threshold.

Capital does not wait for confirmation. It moves ahead of outcomes.

If the perception hardens that ownership itself is being discouraged by law, then the collapse is no longer speculative. It is simply delayed.

Behind the scenes, the market response is already forming.

Underwriters are stress-testing rent freezes as permanent.

Sponsors are shelving acquisitions that require stabilized rent growth to make returns pencil.

Refinance conversations are tightening around cash reserves and covenant risk.

Buyers are demanding deeper discounts or refusing to bid at all.

Owners with the option to convert are exploring it, not because they want to, but because the rental model is being made politically unlivable.

This is how exit behavior starts before the public realizes the exits exist.

The Democratic Paradox at the Core

At the center of New York City’s housing unraveling sits a contradiction that democratic systems rarely confront directly.

The same mechanisms designed to reflect the will of the people are now being used to constrain rights, hollow out ownership, and limit future choice without reopening the question of consent.

When Lawful Votes Enable Unlawful Outcomes

Elections provide legitimacy at a moment in time. Laws and agencies operate continuously.

Once authority is granted, it does not renew itself with every consequence. This is how outcomes emerge that no single vote explicitly authorized.

Voters may choose affordability.

They do not vote to eliminate maintenance incentives. They may support tenant protections. They do not vote to collapse financing structures.

They may reject speculation. They do not vote to freeze entire asset classes into decline.

Yet each of these outcomes can flow from statutes applied aggressively over time.

This is not the suspension of democracy. It is its procedural blind spot.

The system remains lawful while producing results that undermine economic mobility, ownership stability, and long-term housing quality.

The Schneiderman Warning Realized

The legal architecture that made this possible was laid decades ago.

The Supreme Court decision in Schneiderman v. United States insulated ideology from intervention as long as it moved through lawful process.

Belief could not be stopped.

Only violence could.

That precedent now echoes through housing policy. Ideological goals hostile to private property no longer need to announce themselves. They only need to be enforced patiently.

Administration replaces revolution. Compliance replaces coercion. The outcome arrives without ever triggering the alarms democracy was built to sound.

New York City is not witnessing the overthrow of democratic order. It is witnessing something more unsettling.

A system where democracy, bound by its own rules, enables the steady erosion of the very structures that made broad participation and stability possible in the first place.

This is not a call to panic or protest. It is a warning about sequence.

When laws, enforcement posture, and ideology align, markets do not argue.

They quietly reprice, quietly retreat, and quietly leave behind a housing system that no longer works for anyone except the people who promised it would.

Taken together, the sequence is clear and repeatable.

Ideology reshapes housing law.

Law caps revenue and removes control.

Enforcement accelerates as compliance capacity shrinks.

Capital withdraws in response to permanent risk.

Maintenance declines, supply contracts, and exit paths narrow.

What begins as protection evolves into entrapment, and what is framed as reform matures into structural breakdown.

This is not a single policy failure, but a system of outcomes moving in one direction, reinforced by legality, administration, and time.

Structural Verdict: When Lawful Process Makes Ownership Unworkable

New York City now stands at the edge of a structural experiment with no modern precedent inside a major American housing market.

The convergence of socialist laws, enforcement escalation, and administrative authority has created a housing environment where private ownership can exist legally while becoming economically unviable in practice.

The convergence of socialist housing laws, aggressive administrative enforcement, and legal protections for ideology has created a system where private real estate investing may no longer function as a viable institution.

This is not a forecast of a single crash or a short-term downturn. It is a projection of sustained degradation driven by lawful process.

Revenue limitations, control constraints, and enforcement escalation are aligning in ways that undermine cash flow stability, asset maintenance, financing viability, and exit optionality at the same time.

When these forces operate together, recovery does not hinge on market cycles. It hinges on political reversal.

At the same time, democratic safeguards appear ill-equipped to intervene. Elections confer authority broadly, while administrative systems execute policy continuously.

By the time consequences are visible to voters, they are already embedded in regulation, precedent, and capital behavior.

Ownership erodes without formal abolition.

Markets freeze without official declaration.

Housing quality declines without a single triggering event.

For investors, this represents an existential risk.

For tenants, it signals long-term deterioration masked as protection.

For the city itself, it raises a deeper question about whether democratic systems can preserve economic foundations when ideology is executed through law rather than force.

New York City may not be collapsing loudly.

It may be complying its way into a future where real estate investing, as it has been known for generations, no longer exists.

Frequently Asked Questions

Is this article predicting an immediate crash in New York City housing?

No. The article does not argue that prices will suddenly collapse or that buildings will fail overnight. It outlines a structural degradation process driven by law, enforcement, and capital response that unfolds over time, not a single shock event.

What does “systematic collapse” mean in this context?

For investors, collapse is defined as capital flight, destruction of property values, and the halt of new housing supply. Markets do not need to crash to fail. They can become uninvestable, illiquid, and unable to sustain maintenance or reinvestment.

Are these outcomes based on ideology or historical evidence?

They are based on documented historical case studies, including St. Paul, Cambridge, Santa Monica, Berkeley, and large-scale public housing experiments. The same policy sequence produced the same outcomes across different decades and political climates.

Why does enforcement matter more than legislation alone?

Because administrative agencies act continuously, while elections and legislatures operate episodically. Laws gain real force through interpretation, inspections, penalties, and compliance pressure. This is where market outcomes are shaped day to day.

How does the appointment of Cea Weaver change the risk profile?

It signals a shift from discretionary balance toward ideology-aligned enforcement. When enforcement philosophy changes, existing laws take on new economic consequences without requiring additional votes or public debate.

Does this mean all landlords are bad actors?

No. The article does not frame landlords as villains. It explains how lawful constraints can make responsible ownership economically unviable, regardless of intent or good faith.

How are tenants affected if these policies continue?

Tenants may see short-term rent stability, but face long-term risks including deferred maintenance, declining building quality, reduced mobility, and shrinking housing options as supply contracts.

Why doesn’t democracy stop this if voters disagree?

Because outcomes are produced through process, not referendums. Once authority is granted, agencies execute continuously. By the time consequences are visible to voters, they are already embedded in regulation and capital behavior.

Is this unique to New York City?

No. The article argues that New York City is following a familiar and well-documented pattern, not inventing a new one. The risk comes from assuming the city will somehow defy outcomes that repeated elsewhere.

Can the process be reversed?

Only through explicit political reversal that restores revenue viability, owner control, and capital confidence. Once a market is perceived as structurally hostile, recovery becomes exponentially harder even if policies later soften.

What is the core warning of this article?

That ownership can be hollowed out without being abolished, markets can freeze without a crash, and democracy can comply its way into long-term damage when ideology is executed patiently through law rather than force.

Related Content:

- INVESTORS UNDER SIEGE! America’s Affordability Meltdown Fueling Squatter Vigilance

- Trump Declares War on Wall Street Housing

- Top 20 Terrifying Reasons Agents Will Never Be Investors (And How to Fix It)

- The Death and Resurrection of the American Dream (How Real Estate Remains America’s Only Escape Route in 2025)