LISTEN TO THIS ARTICLE

Takeaways:

- Rampant theft in key U.S. cities is causing a significant number of store closures, impacting major retailers such as Walgreens, CVS, Target, Walmart, Macy’s, and Kroger.

- This surge in theft, tallying up to a whopping $112 billion loss in 2022 alone, presents both challenges and opportunities for the urban real estate market.

- While retailers are amplifying their theft prevention measures, the real estate investing landscape is poised for a potential recalibration, especially in the affected urban centers.

Target Rampant Retail Theft (Real Estate Investing Fallout Imminent): Retail Reality Setting In

In a world where every dollar counts, there’s a storm brewing in America’s major urban centers, and it’s not one you might expect.

Our bustling cities, known for their glittering storefronts and retail giants, now echo with a distressing sound: the rattle of locked doors.

Rampant theft, escalating at an alarming rate, is hollowing out the heart of our commercial hubs, shaking not just the world of retail but also some of the very foundations of real estate investing.

As the aisles of retail behemoths like Walgreens and CVS grow eerier, the questions emerge:

What’s next?

And how will the landscape of American real estate transform?

Continue on as we submerge ourselves deeply into this pressing and increasingly dire situation.

Rampant Theft’s Shocking Impact on U.S. Cities (The Real Estate Perspective)

As 2021 unfolded, a disturbing trend began to emerge in cities like San Francisco, Portland, Seattle, and New York City. Shoplifting incidents soared to alarming rates, painting a bleak picture for many retail stores.

CNN Business reports reveal that petty theft had evolved into organized theft, as professional thieves, armed with knowledge of how far they could go before being prosecuted, took advantage of lenient laws.

Some would blatantly loot, with the value of stolen goods often surpassing $950, a threshold in many areas that delineates between petty and grand theft.

This wasn’t just about the occasional shoplifter pocketing toothpaste from a drug store. These were brazen shoplifting incidents, organized shoplifting rings reselling stolen merchandise on platforms like Amazon and other online sellers.

According to the National Retail Federation, the spike in theft and fraud was causing shrinkage—a term denoting inventory loss—to levels that retailers had never seen before.

While some might casually attribute the rise to the pandemic, with stores across the country having limited security measures, the reality dives into something more organized and sinister. Loss prevention professionals cried too much last year, citing an increase in organized retail crime incidents.

Bay Area Damage Among Worst Hit

San Francisco stores were hit especially hard. Walgreens, a major drug store chain, announced that it’s set to close hundreds of stores, with five San Francisco stores being the first. Many stores reported loss rates at five times the national average.

As one Walgreens in San Francisco became a viral sensation for its brazen shoplifting incidents, a sense of despair permeated among store employees. “Shoplifting is done in broad daylight, almost as if it’s a sort of a joke,” one employee shared off the record.

Retail store chains weren’t the only entities feeling the crunch. As stores closed, a ripple effect was felt in the real estate market.

Property crime, especially shoplifting, had retailers rethinking their footprints in urban centers.

This had profound implications for real estate investors who’d previously banked on the presence of big chains like Walgreens and Target to attract tenants and foot traffic.

Walgreens, Rite Aid, and other retail giants had to make the painful decision to close stores, receding from areas of the country where theft across their establishments was rampant.

“Stores like ours can’t continue to operate in such conditions,” a spokesperson from Rite Aid lamented.

This sentiment echoed among many, as shoplifting often turned violent, endangering both employees and customers. With theft on the rise, many pondered if local stores were going to do anything proactive about it, or if it would become the new norm.

This introduction offers a lens into the mounting crisis that isn’t just a retailer’s nightmare but an alarm bell for real estate investors, city planners, and community stakeholders.

As we delve deeper into this unfolding saga, it’s clear that addressing rampant shoplifting isn’t just about securing retail profit margins—it’s about ensuring the very fabric of our urban landscapes doesn’t unravel.

Brick-and-Mortar Retailers in Crisis (Walgreens, CVS, and the Fallout from Rising Shoplifting)

It’s no secret that brick-and-mortar retailers have been weathering an unparalleled storm. The combination of the COVID pandemic’s impacts, a shifting consumer landscape favoring online shopping, and now an overwhelming surge in shoplifting has dealt a considerable blow.

Dive into anything related to the current retail market, and it will quickly become evident that rampant theft is putting significant stress on these physical retailers, including giants like Walgreens and CVS.

Data reveals a worrying trend: The National Retail Federation reported that in 2022, theft contributed to a whopping $112 billion in retail losses, a number that mirrors the alarming rate of rising theft incidents across the US.

With a staggering $94.5 billion reported due to rampant theft, there’s little wonder that some stores have felt the pressure to shut their doors.

Increased Security Efforts Questionable

Despite the additional security guard personnel, theft-deterrent tools, and even self-checkout modifications, retailers struggle to combat the rising wave of shoplifting cases.

This isn’t just about petty crime or a few stolen items; the numbers reflect a much more profound issue. Inventory loss, termed ‘shrinkage’ in the retail industry, has been spiraling upwards.

Personal care items have vanished from the shelves, and in some startling cases, employee theft has contributed to this shrinkage.

The situation is particularly dire in cities like San Francisco.

Sources say that it’s not just the rampant theft, but also violent crime that has been on the rise.

With every new report of a Target store facing unprecedented levels of theft or the news that Walgreens will close several stores in the US, there’s a renewed urgency to address this issue.

To put it in perspective, Walgreens closed several locations, and Rite Aid stores have also been significantly affected.

The latest blow was Target announcing the closure of nine stores across four states due to theft.

While the word on the street might say shoplifting has become a common occurrence with even the “crazies in San Francisco” getting in on the action, it’s essential to understand the broader implications.

The crime rate, including both petty and violent incidents, is undoubtedly influencing retailers’ decisions.

From the outside, it might look like it’s just about the worth of stuff being pocketed, but the situation’s depth is much more complex.

Further, the digital age has presented its challenges. With platforms like Amazon and others booming, brick-and-mortar retailers were already grappling to win customers back.

Add the rising theft issue, and many are questioning if these stores would fare better in the digital realm instead of the real world.

After all, when stores like CVS have to consider their privacy policy concerning increased surveillance measures or whether shoplifted goods are still prosecuted, it’s clear the landscape has shifted.

While many might shrug off the occasional news of people shoplifting or a store facing inventory loss, it’s a reflection of a much deeper crisis.

The balance between security, customer experience, and profitability is becoming increasingly challenging to maintain.

As the toll reaches numbers close to $100 billion, it’s time to acknowledge the full extent of the crisis faced by our brick-and-mortar retailers.

| Topic | Details |

|---|---|

| Retail Crisis Overview | – Brick-and-mortar retailers facing multiple challenges |

| Rising Theft & Financial Impact | – $112 billion in retail losses in 2022 – $94.5 billion due to rampant theft |

| Retail Giants Affected | – Walgreens facing store closures – Target closing nine stores in four states |

| Security Measures & Their Effectiveness | – Increased security guard personnel – Theft-deterrent tools – Self-checkout modifications – Persistent issues despite measures |

| Inventory ‘Shrinkage’ & Causes | – Personal care items vanishing – Employee theft contributing |

| Specific City Issues | – San Francisco facing dire situations – Rise in both petty and violent crimes |

| Digital Age Challenges | – Competition from platforms like Amazon – Debate on physical vs. digital presence |

| Deeper Implications & Reflection | – Balance between security, customer experience, and profitability – Reflecting deeper societal and industry crisis |

Is retail theft a felony?

Based on the information from California Penal Code 459.5, retail theft, commonly known as shoplifting, is generally considered a misdemeanor if the value of the stolen merchandise is $950 or less.

The penalty for this misdemeanor can include up to six months in a county jail and a fine of up to $1,000.

However, if someone is accused of stealing items valued at more than $950, they can be charged with grand theft, which can be a felony carrying up to three years in state prison.

There are specific situations where felony charges may apply, such as if the defendant has a prior conviction for certain serious crimes like sex offenses or violent felonies.

Additional Insights

- Intent Matters: The law emphasizes the “intent to steal” as a crucial element for a shoplifting charge.

- Civil Demands: Business owners can send a civil demand letter requiring the shoplifter to pay restitution.

- Proposition 47: This proposition changed the landscape, making it more likely for shoplifting to be charged as a misdemeanor rather than a felony, provided the value is under $950.

—

Source: Nolo’s Legal Encyclopedia

Investment Red Flags (How the Theft Surge Influences Real Estate Decisions in Major Cities)

The rise in theft across major U.S. cities is more than just a retail crisis; it’s sending waves of caution across the real estate investing landscape.

As organized retail crime balloons, bringing with it store closures and staggering financial repercussions, investors are compelled to reevaluate their strategies and forecasts for prime real estate in key metropolitan areas.

The National Retail Federation has spotlighted this alarming trend, reporting mind-boggling losses in 2022 alone.

While brick-and-mortar giants like Walgreens, CVS, and Target have been at the frontline of this theft surge, the aftermath is reshaping the fabric of urban commercial real estate.

Closures Are Immanent

San Francisco, Portland, Seattle, and New York City stand out as particularly hard-hit areas. In a dramatic response to this epidemic, Target recently declared the closure of nine stores across these states, specifically attributing their decision to theft and crime.

The move spells out a concerning pattern: when retail anchors shutter their doors, the vibrancy and appeal of shopping districts can decline. This, in turn, might push potential investors to pull back, seeking more stable opportunities elsewhere.

The aftermath of such closures goes beyond empty storefronts.

The surrounding businesses, often reliant on the foot traffic generated by major retailers, could also feel the pinch, leading to a potential cascade of further closures or reduced operations.

While the primary loss figure stands at $94.5 billion, when calculated with secondary impacts and the potential drop in property values, the total financial implications could far exceed this amount.

On the flip side, as brick-and-mortar retailers grapple with this crisis, the e-commerce sector, led by giants like Amazon and other platforms, sees a strengthened position.

The shift from physical stores to online shopping, already catalyzed by previous global events, may accelerate further. Investors eyeing the real estate scene might start to pivot, focusing more on warehousing and logistics spaces to capitalize on the e-commerce boom.

Closed due to theft — this phrase, now a common sight in several metropolitan areas, stands as a stark warning sign for investors.

It’s not just about tracking which stores shut their doors but understanding the ripple effects on the larger real estate ecosystem.

As theft continues its upward trajectory, wise investors will be those who adapt, recalibrating their strategies in light of these significant market disruptions.

Is retail theft increasing?

The National Retail Federation (NRF) conducted a comprehensive survey that found retail theft to be largely in line with historical norms.

While total retail shrink (which includes various types of inventory loss like theft, damage, and vendor error) did grow to $112 billion in 2022, up from $93.9 billion in 2019, the increase is generally proportional to the rise in retail sales.

The survey revealed that external theft, including organized retail crime, accounted for 36.15% of total shrink, slightly down from 37% in 2021.

Internal theft by employees rose a bit to 28.85% from 28.5% in 2021.

The NRF also noted that while the financial impact of these crimes is significant, the increased violence associated with them is of greater concern to the industry.

Thought-Provoking Insights

Underreporting of Theft: The NRF report mentioned that 78% of retailers do not include e-commerce goods in their shrink calculations, and 57% don’t include supply chain losses. This suggests that the actual dollar loss associated with theft is likely heavily underreported.

Violence and Safety: 67% of respondents reported more violence associated with organized retail crime than a year ago. This indicates that while the financial impact is a concern, the safety of employees and customers is becoming a priority.

Legislation and Policy: Nearly all respondents, 93%, support some type of federal organized retail crime legislation. This shows a collective industry push for stricter laws to deter theft and associated violence.

—

Source: CNBC

| Metrics | 2022 | 2021 | 2019 |

|---|---|---|---|

| Total Retail Shrink ($) | $112 billion | N/A | $93.9 billion |

| External Theft (incl. organized retail crime) | 36.15% | 37% | N/A |

| Internal Theft by Employees | 28.85% | 28.5% | N/A |

Retailer Resilience Tested (How Target, Walmart, Macy’s, and Others Respond to Shoplift Challenges)

In a shifting landscape marked by increasing theft, major retailers are finding themselves under unexpected pressure.

With cities such as San Francisco (state officials continually being labeled as failures and enablers), Portland, Seattle, and New York City becoming hotspots for organized retail crime, iconic names in the industry like Target, Walmart, and Macy’s are facing challenges they could hardly have foreseen a decade ago.

Target’s recent announcement paints a somber picture of the current retail climate.

The company has revealed plans to close nine stores across these four states, with theft and organized retail crime cited as significant reasons behind this decision.

The list includes locations in bustling urban areas, from East Harlem in New York City to Folsom Street in San Francisco.

Despite extensive investments in strategies to combat theft—including the hiring of additional security personnel, engagement of third-party guard services, and deployment of theft-deterrent tools—Target’s efforts have been met with overwhelming challenges.

The numbers are telling: by May 2023, Target disclosed that theft-related losses were projected to be $500 million more than the previous year.

Walmart, Macy’s, and other major players haven’t been immune to this trend either.

Several of their stores have also been forced to shut their doors in various locations due to the rise in theft.

And it’s not just about the immediate financial impact; the safety of workers and customers has emerged as a paramount concern, threatening the very ethos of the traditional brick-and-mortar shopping experience.

The National Retail Federation’s report from 2022 bolsters these individual accounts, revealing that theft played a role in staggering billion-dollar retail losses.

The average theft has seen an alarming increase, climbing from $937 in 2020 to $1,180 in 2021.

To counter these losses and mitigate future risks, retailers have had to adapt—cutting store hours, tightening return policies, and even introducing charges for returns.

Retailers are not merely reacting; they’re adapting and innovating.

Collaborative efforts between retailers and local leadership are in motion to strategize against organized retail crime.

While some regions see intensified focus from law enforcement, other retailers like Costco, Lowe’s, Best Buy, and Tractor Supply are managing to hold the fort by implementing rigorous strategies focused on ensuring both employee and customer safety.

The resilience of these retailers is on full display.

While the challenges are formidable, their adaptive strategies and collaborative efforts underscore an industry determined to navigate and thrive amidst adversity.

| Retailer Resilience Tested | |

|---|---|

| Overview | In a shifting landscape marked by increasing theft, major retailers are under unexpected pressure. |

| Hotspots for Crime | San Francisco, Portland, Seattle, New York City |

| Challenges for Big Names | Target, Walmart, Macy’s facing unforeseen challenges from organized retail crime. |

| Target’s Actions | Closing nine stores across four states due to theft, with losses projected to be $500 million more by May 2023. |

| Other Major Retailers | Walmart, Macy’s facing similar theft issues leading to store closures. |

| Adaptive Measures | Reducing store hours, tighter return policies, charging for returns. |

| Retail Innovations | Collaborative efforts with local leadership and strategies ensuring safety. |

| Resilience Displayed | Despite challenges, retailers adapt and strategize to thrive amidst adversity. |

The Dire Consequences of Rampant Theft (Store Closures and Their Ripple Effect on Property Investments)

As Target announced the closure of nine stores across affected states, the outlook of this situation looks nationally grim, to say the least.

Target’s decision wasn’t a mere business recalibration.

It was a direct consequence of theft and organized retail crime, posing threats to the safety of their workers and customers.

Set to take effect on October 21, 2023, these closures will leave empty storefronts in once-thriving locations.

Target isn’t alone in this battle.

Other retail giants, such as Walgreens, Walmart, Macy’s, and Kroger, are also grappling with the decision to close stores in various metropolitan hotspots, all due to the rising tide of theft noted by the National Retail Federation in 2022.

Retail Real Estate (Unknown Journey to Prosperity in Question)

For real estate investors, these closures spell uncertainty.

Prime retail spaces, often considered secure and lucrative investments, now come with increased risk.

The ripple effect extends beyond the direct property value.

Surrounding businesses, dependent on the foot traffic generated by these retail anchors, may also face decreased patronage.

Areas once seen as retail havens may see property values decline, and potential investors might start to reconsider their strategies, therefore resulting in an epidemic of property blight.

This shift is not just about the loss of retail profits; it’s a profound alteration of the urban commercial landscape.

As stores close, what becomes of those prime real estate spaces?

Will they be repurposed, or will they remain vacant, serving as stark reminders of the challenges retailers face?

While it’s evident that the retail industry is feeling the pinch, the intertwined world of real estate investment is also reckoning with this new reality.

As blatant theft continues its upward trajectory, both sectors are bracing for the long-term impacts, which may redefine the foundations of urban property investment.

Is there a connection between homelessness, drug addiction, and retail theft?

There is evidence to suggest a connection between homelessness, drug addiction, and retail theft.

Homelessness and drug addiction are often linked, with injection drug use indicating a dependence on “hard” drugs such as heroin, crystal methamphetamine, and cocaine.

Homeless individuals have been known to create encampments and take shelter in parking lots, alleyways, and dumpster areas, presenting a heartbreaking sight for retailers.

In addition, drug addiction can be expensive, and some homeless individuals may turn to professional shoplifting or “boosting” to support their habits.

Retail theft has become a significant problem in the United States, with rampant, often organized, and seemingly consequenceless shoplifting costing retailers nearly $100 billion in 2021.

Cities like San Francisco, Portland, Seattle, and New York City have been significantly affected by organized retail crime, leading to store closures and significant financial losses for retailers.

In some cases, homeless individuals struggling with addiction have been charged with organized retail crime for their involvement in theft.

Efforts are being made to combat retail theft, including the creation of task forces and the implementation of new programs and resources for retailers.

The issue remains complex and multifaceted, with homelessness and drug addiction being just two of the many factors contributing to the problem.

—

Sources: National Library of Medicine, Loss Prevention Magazine, New York Post, Publicola, New York State Government

Closing Time: Closed Due to Theft (The Growing List of Brick-and-Mortar Retailers Shutting Doors in Top U.S. Cities)

As the saying goes at close-of-shop hours, “You don’t have to go home, but you can’t stay here.” The saying doesn’t mention anything about taking things home with you that you did not pay for.

In a concerning trend for both consumers and investors, several major U.S. cities are witnessing a surge in brick-and-mortar retailers shutting their doors.

The catalyst?

An unprecedented spike in theft and organized retail crime.

Closing Store Locations

- New York City: East Harlem – 517 E 117th Street

- San Francisco: 1690 Folsom Street

- Oakland: 2650 Broadway

- Pittsburg: 4301 Century Boulevard

- Portland, Oregon: (3 stores)

- Seattle (2 stores)

At the moment, San Francisco, Portland, Seattle, and New York City are the epicenters of this alarming phenomenon.

Such cities, typically seen as bustling hubs of commerce, retail, and investment, are now grappling with the repercussions of unchecked retail crime, which begs to question the efforts and cares of government officials to enforce the law to create environments of potential prosperity.

Target, a retail giant in the industry, has sounded the alarm, announcing the imminent closure of nine stores across these cities, directly attributing it to the unrelenting wave of theft and organized crime.

Specifically, Target’s stores in locations like East Harlem in New York City, Folsom Street in San Francisco, Broadway in Oakland, Century Boulevard in Pittsburg, three outlets in Portland, and two in Seattle, are all slated to shut down by October 21, 2023.

But Target is far from the only retailer facing this challenge the sheer volume of theft incidents.

Such closures are more than mere statistical blips; they’re harbingers of a deepening crisis in the retail industry and possibly in our society.

Investor’s Pivotal Standpoint

From a real estate investment perspective, these closures are cause for concern. Brick-and-mortar retail locations, particularly those in prime city spots, are significant assets in any investment portfolio.

Their closure or underperformance can have a cascading effect on property values, rental yields, and overall investor sentiment in the affected areas.

While retailers like Target have pulled out all stops to combat this issue, from bolstering security to deploying advanced theft-deterrent tools, the challenges persist.

The rampant theft in U.S. cities is not just a retailer’s nightmare; it’s casting a shadow over the real estate landscape, prompting investors to reconsider their strategies and assumptions in these prime urban markets.

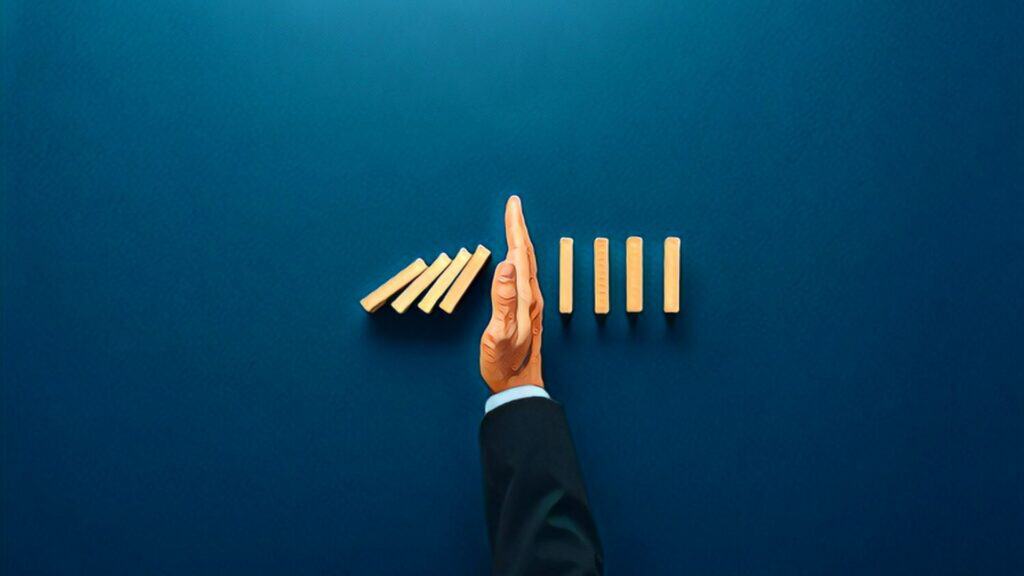

Rise in Theft Statistics (A Deep Dive into the $112 Billion Loss and Its Bearing on Retail Real Estate)

Theft in brick-and-mortar establishments, once considered the backbone of U.S. cities, has reached unprecedented levels.

As a result, the National Retail Federation reported staggering losses, pegging the figure at $112 billion in 2022 due to theft alone.

Such alarming figures aren’t just numbers on a page.

They signify a tangible downturn in the retail sector, which has a domino effect on retail real estate.

As retailers face these challenges, the implications for the property market become all too apparent.

With major brands announcing store closures across affected cities, prime retail spaces are left vacant, and the local real estate markets are feeling the repercussions.

Target, for instance, encapsulates the scale of this issue.

The Truth of Urban Flight

Despite implementing a slew of anti-theft strategies, from ramping up security staff to utilizing third-party guard services and theft-deterrent tools, they’ve faced an uphill battle.

For real estate investors and stakeholders, these closures and the underlying reasons for them paint a grim picture.

A vacant store isn’t just a missed retail opportunity; it can depress the value of surrounding properties, deter potential new businesses from moving in, and shift the very character of commercial districts.

The ongoing rise in theft and its ensuing challenges pose a question every real estate investor is now forced to consider: How will this reshape the future of urban real estate markets?

With theft becoming an increasingly pressing concern, the intertwined destinies of retail and real estate will be crucial to watch as cities and businesses navigate this evolving challenge.

Proactive Measures (How Retailers and Real Estate Investors are Navigating the Shoplift Epidemic)

The shoplift epidemic sweeping through major U.S. cities is a pressing concern not just for retailers, but also for real estate investors closely monitoring the health and viability of brick-and-mortar establishments.

As theft continues its devastating march, prompting continually staggering losses, businesses and property owners alike are innovating and implementing countermeasures.

Retail giants are at the forefront of this fight.

Beyond the simple addition of more security workers, they are contracting third-party guard services and investing in sophisticated theft-deterrent tools across their operations.

These efforts, while substantial, underscore the gravity of the challenge, as the company still grapples with organized retail crime and theft, even prompting the closure of nine key stores across New York and California.

Savvy Out-of-the-box Investor Thinking

Real estate investors, on the other hand, are recalibrating their strategies.

Given the correlation between retailer health and property values, they are exploring opportunities outside the hardest-hit metropolitan areas, and considering adaptive reuse of spaces, especially in cities like San Francisco and New York, where the threat of shoplifting is most acute.

Investors are also collaborating with retailers to enhance on-site security measures, ensuring that tenants and their customers feel safe, thereby maintaining property desirability and value.

In parallel, state initiatives, such as California Governor Gavin Newsom’s plan to bolster the budget of the California Highway Patrol’s Organized Retail Theft task force, aim to support retailers and indirectly stabilize the real estate market in affected areas.

Other retailers, like Costco and Lowe’s, are drawing inspiration from this holistic approach, combining state support with in-house measures to ensure both employee and customer safety, which, in turn, safeguards their property’s appeal to potential investors.

In essence, as the shoplifting epidemic evolves, a multi-pronged, collaborative approach from retailers, investors, and the state seems to be the emerging formula for resilience and recovery in this challenging landscape.

Organized Retail Crime (More Than Just a Retailer Issue, A Real Estate Investment Concern)

The surge in organized retail crime, particularly in metropolitan hubs like San Francisco, Portland, Seattle, and New York City, has caught the nation’s attention, especially with many video-recorded thefts being widely circulated on social media.

But while the immediate image that comes to mind is that of frantic retailers grappling with lost revenues and safety threats, there’s another significant player in this saga: the real estate investor.

Brick-and-mortar locations such as Walgreens and CVS have borne the brunt of this theft onslaught.

Their response, in many cases, has been to shutter stores, leaving valuable urban real estate vacant.

It’s not just about the immediate loss of rental income for property owners; the broader impact on real estate is multi-fold.

The ripple effect of such closures can lead to declining property values in neighborhoods, reduced foot traffic, and consequently, diminished appeal for other businesses and potential tenants.

As more stores, from big names like Walmart and Macy’s to smaller local businesses, close their doors due to theft, the desirability of owning retail property in these affected areas dwindles.

The staggering figure of $112 billion in reported retail losses, isn’t confined to the balance sheets of retailers.

It’s a clarion call for real estate investors and developers to reassess the viability of retail-centric properties in high-risk cities.

In essence, organized retail crime isn’t merely a challenge for store owners and their bottom lines.

It’s a looming shadow over the urban real estate market, prompting investors to tread with caution and reevaluate strategies for a landscape irrevocably altered by theft.

Conclusion and Future Predictions

How the Continued Rise in Theft May Shape Urban Real Estate Markets

As we reflect on the seismic shifts in the retail landscape, driven predominantly by flagrant theft in major U.S. cities, there’s a pressing need to evaluate its cascading impact on urban real estate markets.

Organized retail crime has not only precipitated a financial hemorrhage but has also triggered a wave of store closures that feed and supply nearby neighborhoods.

Such closures, especially in prime urban locales, can leave gaping vacancies that disrupt the commercial fabric of communities and potentially devalue surrounding properties.

While retailers are bolstering their defenses, with Target’s hefty investment in theft prevention as a prime example, the implications for real estate investors are twofold.

On the one hand, the vacancies offer a potential for adaptive reuse or redevelopment, turning these spaces into new ventures, from residential units to innovative commercial hubs.

But a warning, Investors need to be wary of the changing dynamics and potential decline in foot traffic, which can affect rental incomes and property valuations in a miles-wide radius.

Looking ahead, as cities grapple with this retail theft epidemic, urban real estate strategies may need strategic recalibration.

Investors might prioritize areas with stronger retail security measures or diversify their portfolios to mitigate risks.

One thing is certain: as theft trends evolve, so too will the strategies of savvy real estate investors who are keen to adapt and thrive in these challenging times.

References

- ABC7 News [1] [2]

- Business Insider [1]

- CNBC [1] [2]

- CNN [1]

- Corporate Target [1]

- Deseret [1]

- Finance Yahoo [1]

- Footwear News [1]

- Fox Business [1]

- Investopedia [1]

- KCRA [1]

- King5 [1] [2]

- KGW [1]

- KRON4 [1] [2] [3]

- KTLA [1]

- Loss Prevention Media [1]

- National Retail Federation (NRF) [1]

- NCBI [1] [2]

- NOLO [1]

- NY Post [1]

- NYC Gov [1]

- Publicola [1]

- Progressive Grocer [1]

- SF Standard [1]

- SF Chronicle [1]

- The Street [1]

- USA Today [1] [2]

- WHO [1]

- Wikipedia [1] [2]

- YouTube [1]

No related posts.