Ultimate Guide to California Real Estate Investing: Property Gold In Those Golden State Hills

Real estate investing has been one of the most popular investment strategies for building wealth.

Almost 90% of millionaires accumulate their riches through real estate. Although some people call real estate investing a “slow return investment,” but there is no quick route to success.

It may take years of experience to understand various property investments for most real estate investors to generate wealth significantly, diversify their portfolio, and other benefits.

A good reason to finish this comprehensive guide on investing specifically in California is to determine which type of property and appropriate investing strategy suits you in this enigmatic state

Understanding how much money you want to invest, the effort you want to exert, and the monthly income target will determine what real estate deals to pursue to achieve the financial independence you want.

As beginner investors, take into consideration different factors that influence the real estate market. That’s why getting to know yourself, your goals, and your purpose is best.

There are many investments to grow your money, and you can hire asset management professionals like financial advisors to help you. Therefore, it is essential to determine what you want and be clear about why you are interested in beginning your real estate investing journey.

A step-by-step guide could help a self-starter investor execute a business plan well. It will be stimulating and not always smooth sailing, but if you are up for the challenge, buckle up because you are here for the ride, and you may see why California is a great state for real estate investing.

Let’s get into the Ultimate Guide to California Real Estate Investing.

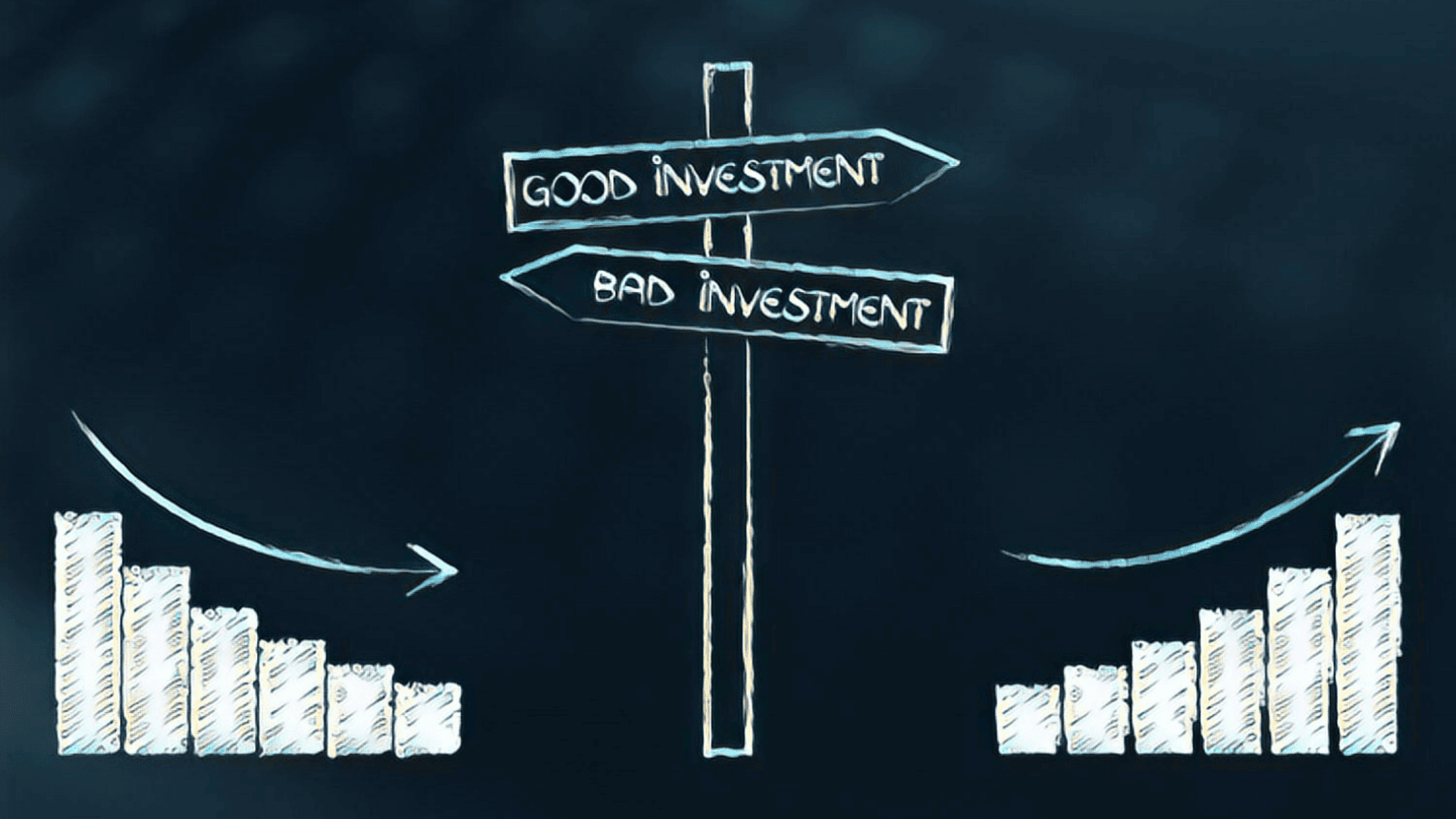

Is real estate investing a good idea?

The Ultimate Guide to California Real Estate Investing would not be complete without mentioning several advantages of investing in real estate. And yes, there can be serious setbacks that could heavily affect your financial portfolio.

- Real estate’s most common advantage is value appreciation. Property value tends to appreciate over time as places progress and improve.

- Real estate generally offers stable monthly cash flow through rental properties and passive income from real estate funds, including Real Estate Investment Trust (REITs). Real estate funds are some kind of mutual fund that invests in securities offered by real estate companies, which also include REITs. However, there is a slight difference in their gains because real estate funds grow your money through appreciation while REITs pay out regular dividends.

- Investing in real estate allows investors to avail of unique tax benefits such as depreciation and an income tax deduction on rental properties because of usage and decay. They also take advantage of these tax write-offs to deduct expenses directly associated with the operation, management, and maintenance, such as property insurance, mortgage interest, property taxes, etc.

- Real estate doesn’t give substantial returns overnight because it is a long grind. It is an illiquid asset that may take some time to convert to cash. It may require more time than other types of investments.

- Real estate is tangible with monetary value, unlike the stock market, where stocks are highly volatile. When the stock market crashes, your investment could be worthless, but with the real estate market, even if it hits bottom, land always has value. Therefore, even if your investment property may drop in market value, it will never be valueless.

- Real estate can act as an inflation hedge since it appreciates faster than inflation. Even in times of uncertainty, real estate prices continue to increase. Therefore, most investors consider it a safe investment.

- Real estate creates leverage benefits with the help of financing schemes. You can purchase real estate through loans, typically 70 to 80 percent of the purchase price. However, it may still require a lot of money because of expensive transaction costs such as title insurance, commissions, loan fees, and unforeseen closing costs.

Some avail of home equity loans to access ample cash with a fixed interest rate in buying investments. Though, you could lose your home to foreclosure if you fail to repay the loan.

A credit card loan is great for immediate cash requirements within your credit limit. Still, credit cards have steep interest charges and becomes more expensive when you delay paying the balance.

These loans are risky in financing real estate investments. Remember that the goal is to profit, and how you finance a property could make or break you.

These are just some of the pros and cons of real estate investing, but as long as you conduct research and are very cautious in the decision-making process, there is a greater chance to get good deals that can significantly pay off.

What are the factors that make California real estate desirable?

The next step is to focus on California. Many factors affect the real estate industry. Each state may have some differences in regulations in the United States of America, but overall, real estate investors are eyeing California, and let’s find out why.

Location

Property at a great price will be nothing if the location is undesirable. Aside from its features and amenities, what makes a valuable property is its location. The neighborhood, centrality, and accessibility to schools, hospitals, and the like are also significant.

Knowing future developments in the area could show the potential of the location because whatever expansion in the surrounding regions affects the desirability of your property. Please take note that when buying a house, you can remodel or renovate it, but you cannot change the spot of your lot.

Economy

According to Bloomberg, California outperforms the US and the rest of the world across many industries. It continues to outperform in gross domestic product growth, the market value of companies, and many more.

The economy in California has been promising, with international companies settled in. Google, Apple, Disney, Oracle, and other Fortune 500 companies known globally contribute to the thriving economy—local and global demands, whether products or services lead to a positive outlook of continuous growth.

The Golden State has been resilient and renewable energy has become its fastest-growing business. Job creation is strong, which causes a dip in unemployment. There is a strong demand for rental units with minimal space for building new accommodation, so rental spaces are at a premium, lessening the vacancy risk.

Demand

With numerous job opportunities, people are moving into the state. While some are looking for greener pastures, some are taking offers to elevate their current financial situation. As a result, landlords and property owners are confident with the high demand for property in the area.

Appreciation

With an increasing demand with a limited supply, property values tend to appreciate as long as it is an active market. It is best to invest in properties with desirable locations, and it is imperative to continuously improve and upgrade amenities and keep a schedule for maintenance and repairs.

Investors enjoy a steady stream of rental income if they have well-maintained properties and possibly sell at a higher price.

Tourism

California is a popular state for having a prosperous agricultural industry. It also has famous landmarks, such as the Golden Gate Bridge and the Hollywood sign, that always lure travelers worldwide.

California offers some of the best ways to enjoy unique outdoor activities, whether in the parks, mountains, or on the coastline.

Excellent year-round weather allows tourists to enjoy sceneries, shopping, exciting nightlife, and gourmet dining.

Los Angeles, California is considered the world’s entertainment capital, where multiple cultural, historical, and natural attractions such as the Sunset Strip, Venice Beach, world-famous theme parks, wineries, breweries, and many more.

With a flock of people coming for different reasons, accommodation is constantly needed. Although hotels are steady businesses, most tourists prefer to stay at short-term rental units to save extra money.

As technology advances, several mobile applications and websites allow property owners to lease out to short-term renters, such as Airbnb, Expedia, and Booking.com.

What California Real Estate Market Looks Like Today

Even though this is the Ultimate Guide to California Real Estate Investing, take note that not all California real estate investments become successful.

Since California offers many investment options, some investors still make wrong decisions, leading to massive losses. With some background in the real estate market, you can avoid making mistakes and better assess the current situation.

California is one of the country’s most competitive real estate markets, one of the most populated, and has a variety of industries ranging from technology to agriculture.

There are many real estate deals in California, the third largest state, making the state market full of various submarkets with little in common.

With a highly diverse population, the real estate market also varies in major cities and towns compared to other parts of the state. Being a vast state, let us divide them into groups.

Cities

Inland

Inland Cities have active real estate markets but are less crowded in population. Cities like San Bernardino, Sacramento, Ontario, Victorville, and Stockton are great places to start real estate investing, especially for beginners, compared to coastal regions that are more saturated. Moreover, the prices and rent of properties in inland cities are more affordable than on the coast.

Most neophyte real estate investors lean more toward flipping houses since there are many foreclosed properties, contractors are abundant, and the repair and renovation cost is inexpensive.

Although local economies are less robust, inland cities have diverse vital players. Even with fewer investment opportunities, they are more welcoming and require minimum financing. It is best to have the courage to find attractive deals and avoid limiting yourself.

Coastal

The property prices in the Coastal Cities, such as Bay Area, San Diego, and Los Angeles, have an upward trend, suggesting a booming market. They have new constructions, and more neighborhoods exist today.

As more developments continue to pour into these areas, many investment opportunities are sprouting, and more economic activities in these regions. Therefore, more people are coming over who could become prospective renters or home buyers needing some place to live.

As these places already have well-established and highly capitalized businesses, it can be quite challenging for new domestic or foreign investors to penetrate the market.

The stiff competition ranges from finding a workforce or contractor to securing bidding for places and financing.

Valley

Valley cities are quite different from inland and coastal cities. They have a moderate dynamic market and fast-selling properties that are reasonably priced. High-end and luxurious properties tend to linger longer in the market.

Rental properties are less attractive even if rents are lower, mainly because people will likely buy properties with many options.

When a market declines, a few foreclosures are up for sale. These places have local regulations that can be annoying sometimes. Most communities like to preserve the lifestyle they are used to, so bringing in businesses they are not accustomed to can be interesting.

Seasoned investors equipped with experience can create investment strategies that work. It may require versatility and other skills to fully take advantage of the valley region’s wide range of real estate markets.

Towns

Inland

Unlike the cities, towns are a bit different, especially inland. Inland towns have less incoming movement because they have difficulty attracting new people. You can say that real estate markets in these areas are not quite vigorous.

Buyers are more conservative and sophisticated and prefer properties that tick all the boxes of their preferences. Likewise, sellers are becoming unsure and less likely to close deals instantly.

There are fewer foreclosure actions, and if you think about flipping, you might wonder if there are any buyers after renovations.

Overall, inland towns try to sustain a stable economy, but it can be unsuitable for inexperienced and new investors.

Coastal

Coastal towns can be considered pleasant places to begin a real estate investing journey. Although these towns have few real estate activities, there is some competition from various investors in finding or keeping leads and recruiting contractors.

Coastal towns still have good mid-market opportunities, but it is best to deliberate more as municipal ordinances are intense compared to valley cities.

Desert

Desert towns generally are not ideal for beginners since they have minimal turnover and fewer real estate activities. Rentals are not thriving because there are only a few people who visit. Flipping homes could also be grueling since old houses in these areas are usually neglected. It is arduous to find skilled contractors and construction materials are expensive and incomplete.

Understanding California’s Real Estate Market Trends

Californian homes are taking longer to sell even if they generally have become slightly less expensive than last year, but some areas have slight increases year-over-year. California’s housing market is coming back slowly, so let us find out the current market conditions and forecast for this year.

Sales

According to the California Association of Realtors (CAR), as of February 2023, the housing market showed a decline in sales and median home prices. Last year of the same month, only four out of 51 counties had a sales decline of less than 20%. Mono County ranked first with the most significant drop (-80%), followed by Lassen (-73.9%) and Glenn (-65%).

The Central Coast scored -38.3%, while San Francisco Bay Area had -32%. Sales plummeted by 30% in 34 counties and as low as 50% for eight counties year over year. The state’s housing market’s decline was initially attributed to severe weather conditions recently experienced throughout California.

Home Prices

According to CAR, their latest report shows that single-family house prices dropped year over year. San Francisco Bay Area topped the most with double digits decline. Other places where home prices plummeted are San Jose, Stockton, Los Angeles, San Diego, Sacramento, and Riverside.

CAR suggests that the reason behind the continuous drop is partly because of the effects of the atmospheric river events. The median number of days to sell single-family homes tripled, which means today’s market is struggling to find buyers and closing sales.

Inventory

The housing supply in California was down by 2.1%, and the newly listed homes were also down by 37.5%. On the other hand, the housing demand also shows a decline. 32.5% of California homes were sold below the list price.

The statewide unsold inventory index (UII) grew by 60% with 3.3 months in February 2023 compared to 2 months in February 2022. Today, homes sold above the list price have a shrinking percentage, which suggests that the market is becoming less competitive.

Interest Rates

Rising interest rates affect businesses that avail financing from institutions. When the cost of borrowing money increases, there is likely a drop in the number of deals that investors would grab.

As mortgage rates and commercial loan rates continue to surge, the size of homes and investments tend to get smaller for home buyers and investors to fit their price range.

There might be a decline in capable buyers and more foreclosures. Buyers who bought properties at lower rates can no longer afford the mortgage payments due to higher rates, which may force them to sell.

Forecast

The CAR forecasted that the ongoing struggle against inflation, continuing rise of interest rates, and lower purchasing power would contribute to the weakening of the housing market in 2023.

Single-family home sales and prices may continue to plunge and fall short of the projections. The supply would grow, and demand may become stable for a few months.

Advantages and Disadvantages of Owning Real Estate in California

Pros

Owning real estate in California is ideal because data shows a steady population increase. Being a prestigious state with many big and known cities, having a primary residence here could be beneficial.

Major cities have good infrastructure, residential properties, office buildings, and establishments necessary for dwellers. Property prices have increased significantly in the past years, and with the influx of people, housing has been a huge demand.

There are excellent universities that attract individuals who want to study their courses. It has become an attractive place to choose your lifestyle because of the high quality of life.

Rental units have fewer vacancy rates because prospective tenants look for properties where they can work nearby economic enters or enjoy leisure activities near nature.

California has an optimal climate which is mostly sunny but not too hot for most of the years.

There are also no worries concerning rent arrears because most tenant often pays their rent on time with sufficient salaries for various job opportunities like big tech companies.

Employees from the technology sector often have high disposable income, which they can easily set aside for rent.

Places like Silicon Valley are attractive places for highly qualified individuals from across the globe who are not only tourists but to be permanent residents.

Cons

Since the upward trend continues, property prices have become pretty high already. Investing in major cities may require a lot of money as prices and way of life have become quite expensive. As you can see from current trends, there is also a possibility of a temporary drop in the future.

With housing demands increasing, tenants may become more demanding and uneasy to please. Most laws are tenant-friendly, which may be an issue for property owners and landlords. Residential property prices increased faster than rents may have been because of numerous California rent control laws.

Tourists are starting to notice changes in the beautiful landscape and beach scenery. Beaches have become gradually polluted, and frequent leakages of tankers and pipelines contribute to the severity of the problems.

As climate change becomes evident in the world, California is not an exemption. Rising temperatures give residents a hard time because this may lead to rampant wildfires and more prolonged droughts.

Consequently, being too humid allow the atmosphere to hold more water vapor. As a result, California may experience more intense storms, leading to more flooding.

Owning real estate in a particular region is crucial because some areas may experience serious water scarcity in the future.

With many more factors to consider, let’s dig a little deeper into this real estate investing ultimate guide for California.

Top Real Estate Investing Strategies for Beginners

Throughout this Ultimate Guide to California Real Estate Investing, you’ll realize that there are many types of investments where you can invest in the state of California.

Choosing the right real estate strategies is essential to achieve your financial goals whether you are an active investor or a passive one.

Active investments require more work than passive where you only need money to earn passive income.

You can invest directly in physical real estate or indirectly by buying shares in a fund or companies that invest in real estate.

Single Family Homes

Single-family homes commonly have two to three bedrooms, ideal for a starting family. Most buyers who are looking for single-family homes are those who are newlyweds and families who want to transfer residency.

Investing in Single Family Homes in California (int) may be ideal for some investors because it requires a minimal initial investment, down payment, and renovations. SFH funding can be considered as easier because of its lower costs.

Property managers looking for tenants to stay in single-family homes are more straightforward than in multi-family homes. However, the vacancy risks can be higher since owning a single-family unit means you have a single source of income.

With a single-family home, when the renter is delayed or suddenly moves out, you have no monthly income, especially in the fierce competition of California rentals.

Multi Family Homes

Unlike single-family homes, multi-family property may require more effort to conduct due diligence when buying California real estate since it must be assessed holistically.

Before purchasing, multi-family properties require higher acquisition prices and substantial cash reserves for costly renovation, maintenance, and other fees.

Units spread across different locations may need excellent and reliable people to be part of the property management team. They carry more risk since they are larger, and unexpected situations may arise that could hinder securing tenants.

As a result, the possibility of huge losses and financial distress can occur.

On the bright side, owning multi-family homes in California (int) means you can generate more earnings if considering income per square foot.

For example, you can earn $5,000 a month for a single-family unit, but if you have a multi-apartment with five units in the same neighborhood at $3,000 monthly rent, you can accumulate up to $15,000 monthly, given that they are all occupied.

The surroundings greatly affect the appreciation of single-family homes, whereas upgrades, remodeling, and renovation significantly affect multi-family home value appreciation. It makes it easy for these property owners to maximize their property value.

Commercial Real Estate

Commercial real estate is among the profitable investments available where a property is exclusively used for business purposes than a living space.

Although most investments require huge capital that turns off beginners, syndication could be an option. Commercial real estate syndication allows newbies to be part of grander projects with experienced investors because it pools money from multiple investors to purchase a commercial property.

It can be a chance to learn from those in the real estate industry for their insights and hear stories about their failures and success. Being a coach and a player is quite different. Of course, it is, but the point here is to absorb knowledge imparted and to expand your connections.

Rental

When the pandemic hit the entire world, it weakened the interest in rental property investing practices in California and worldwide. But the residential real estate demand continues with the growing opportunities online for remote work.

The Federal Reserve rate hike and unprecedented rain and snowfall affected the agricultural and tourism industries. Furthermore, increasing home prices across the state could revive the demand for rentals.

Investors look at existing properties since some building regulations discourage new constructions. A good cap rate, which measures a property’s current annual return compared to its current value, is within the range of 4-12%, depending on the area and type of property. Rental income is included in the cap rate formula.

The Ultimate Guide to California Real Estate Investing: Disneyland

Vacation/Short-term Rental

Real estate investors consider investing in vacation rentals in California because of its perfect weather, ocean views, and diversity. In a highly sought-after location such as California, owning properties you can rent out is perfectly suitable for creating an influx of passive income.

California is known for its beautiful attractions that entice tourists from all over the world. Vacations or short-term rentals with access to tourist spots are almost always in high demand in peak seasons. Keep in mind that prices could also vary depending on the season and demand.

Raw Land

In the major cities, raw land may have less inventory than those in the coastal and inland towns. Most cities are already developed and have improvements such as buildings, houses, and commercial properties.

Investors likely gravitate towards common real estate structures, houses, and condominiums but overlook raw land. Many lands are for sale, with land prices differing in every state.

You can find most of the inventory in desert regions where the cost per acre is much cheaper.

Investing in land requires less capital than investing in a rental home or condo, and land appreciates by about 3 to 4 percent. Investing in California’s raw lands has less competition despite its affordability.

People miss the opportunity to buy land where they have more freedom and options on what to turn it to. It can be developed into farms, ranches, and many more.

But this type of investment is more complex than it sounds because it is crucial to work with a qualified land agent who understands topography and other aspects to determine its potential better based on its foundation.

Check the zoning rules before investing so you would know what to do with the land, whether you want to sell it at a higher price, lease it out, or build something yourself.

California’s Best Real Estate Investment Strategies

Buy and Rent (Landlording)

A potential investor would buy family homes, condominiums, apartment complexes, or townhomes to rent them out to tenants.

It can provide monthly rental income, give leverage with financing and avail tax benefits. It takes patience to manage tenants and keep up with the maintenance and repairs.

Some investors hire a property management company to lessen strenuous work and allow them to focus on other things, such as investing in more properties elsewhere.

Buy and Hold

Sometimes synonymous with Land Banking (int), Buy and Hold (int) is a long-term investment strategy to realize price appreciation despite real estate volatility.

An investor buys a property, rents it out, and holds on to it for an extended period because it generally creates a stable portfolio and generates higher returns over time.

The benefits of this kind of strategy include recurring rental income, long-term property appreciation, and a potential hedge against inflation.

Buy, Flip, and Sell (aka Fix and Flip)

It is a strategy where an investor buys undervalued property, fixes or renovates it to increase value then sell it at a higher price.

This strategy requires enough capital and resources to purchase the property and hire contractors to make necessary renovations.

It also takes a lot of physical and hard work if you are doing it yourself, from planning to executing. You may also need a network of real estate agents when you list on the market.

REITs

REITs (Real Estate Investment Trusts) can be a good and affordable alternative for anyone to become passive investors, to own and finance income-producing real estate since money is pooled from many investors.

It has lesser capital, time, and effort requirement since you don’t have to do any work but still earn monthly or quarterly dividends.

However, you are not included in the decision-making process, such as how the company manages the properties or which properties to invest in.

Crowdfunding and Syndications

It brings together investors with the same objective and ideas in real estate investing.

It sits between owning physical properties and not having a say in what the company is doing since you know what the investment is about, the potential risks, the timeline, and the exit strategy.

Long-distance Real Estate Investing (Virtual Investing)

Long-distance real estate investing is purchasing a property outside your local market, whether in a different state or another country.

With this investment strategy, you outsource local professionals in the area to manage your property.

It is common for those who can’t afford to enter their own market because of existing high property values.

Hard/Private Money Lending

You become a hard money lender by lending money to real estate investors. It allows you to set the financing terms, charge fees, and earn through interest.

This could be an option if you are in a good financial situation.

You are helping other real estate investors through the funds you let them borrow, but the risk is high because there is no guarantee these borrowers will pay back their hard money loans.

Conclusion

As I conclude the Ultimate Guide to California Real Estate Investing, I hope you can see that learning about California real estate investing does not stop after you invest in your first property.

You must be willing to continue studying and researching to familiarize yourself with the ins and outs of the industry, which is a great way to learn more about the topics you are interested in and passionate about.

Understand that knowledge is not the only component in achieving great success. It takes self-motivation and determination to thrive in the business.

Aside from enjoying the Ultimate Guide to California Real Estate Investing, you should consider following experts with real estate investing experience because they most likely have numerous investment properties and could give even more useful real estate investing advice.

Great REI podcasts like Real Estate Investing Success, hosted by Antonio Holman, founder of United States Real Estate Investor, and This Month In Real Estate Investing, hosted by real estate agent, real estate investor James A. Brown, are excellent starting points to dive into industry lifestyle and news.

Notable real estate coaches like Brandon Turner (author, podcaster, speaker, real estate investor), Ken McElroy (author of ABCs of Real Estate Investing, podcaster, YouTuber) are also great professionals who can help enhance your REI knowledge.

Industry experts share their first-hand experiences to help educate you and inspire more investors by having the right mindset and sharing tips and techniques about their expertise.

In addition, the best-selling and crowd favorite books like Long-Distance Real Estate Investing by David Greene and Millionaire Real Estate Investor by Gary Keller are also worth reading.

If you want to learn from the best real estate investing platform on the internet, subscribe to the United States Real Estate Investor newsletter and follow @unitedstatesrei on all social platforms!

I truly hope you enjoyed reading the Ultimate Guide to California Real Estate Investing. It was my absolute pleasure to provide you with such valuable industry information.

Let’s learn, share, and reach financial freedom together!

No related posts.